A mature budget, Rs 20,000 crores for CCUS will benefit refineries: Union Minister Hardeep Singh Puri

Feb 01, 2026

New Delhi [India], February 1 : Union Minister for Petroleum and Natural Gas Hardeep Singh Puri on Sunday lauded the Union Budget 2026, calling it a "mature budget." He said that Rs 20,000 crores given for Carbon Capture, Utilisation, and Storage (CCUS) would benefit the refineries.

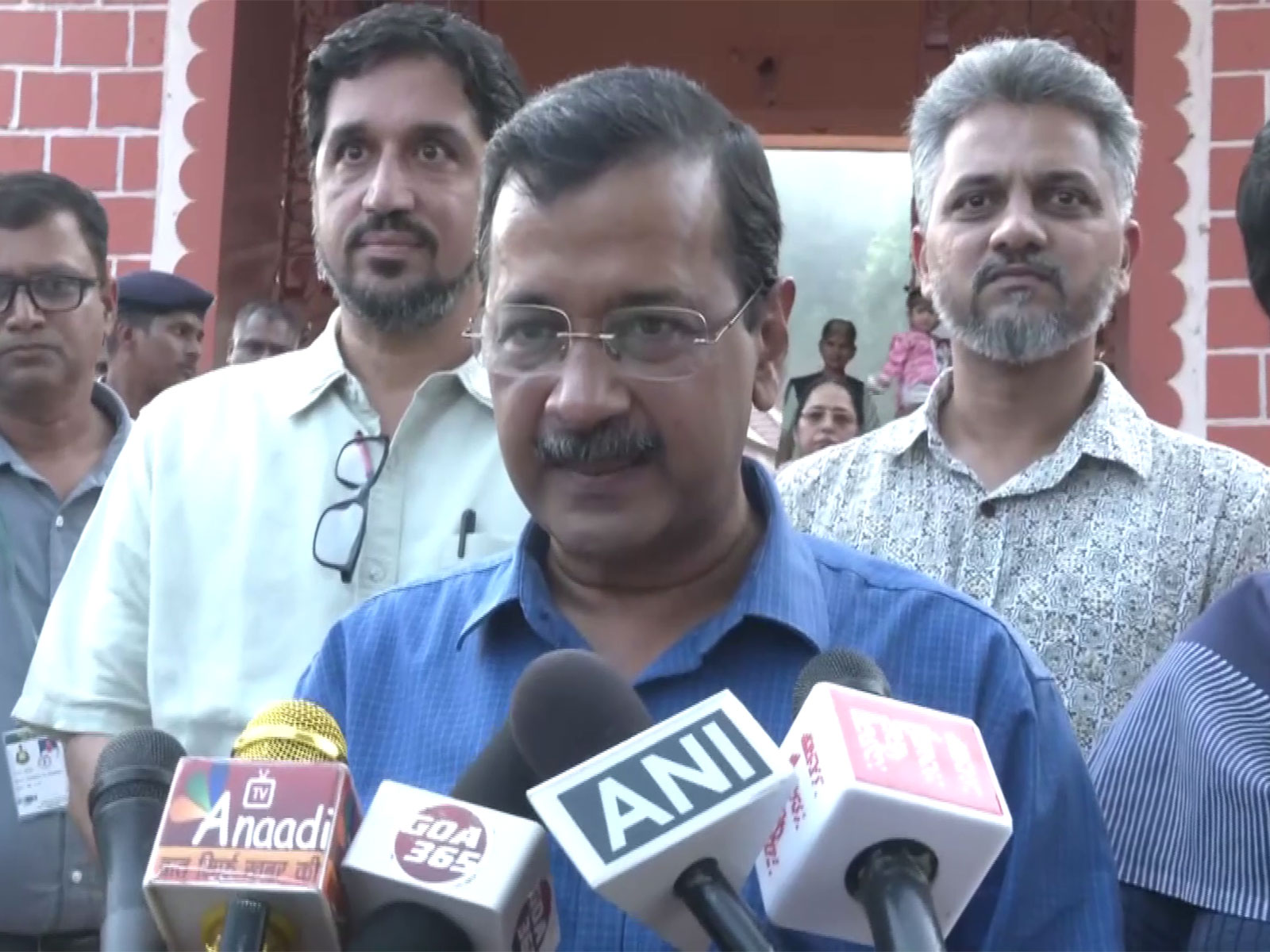

Speaking to ANI, Hardeep Singh Puri said, "The Union Budget is coming at a time when there is global turmoil, and India is an oasis of calm. This is Nirmala Sitharaman's 9th consecutive budget. Under the leadership of PM Modi, this is the 13th consecutive budget. This is a significant development. Whenever the budget is presented, the opposition criticises it. The economy of our country has reached the 4th position from the 10th position. Our GDP has reached 4.3 trillion from 2 trillion."

"Capital Expenditure was 2 lakh crore in 2014. When in last year's budget it crossed 11 lakh crores, we thought whether we would be able to sustain it or not. This year, it has become 12.2 lakh crores. In the energy sector, Rs 20,000 crores have been given on Carbon Capture, Utilisation, and Storage, which would benefit our refineries," he further said.

Puri said that in the bio-fuel sector, the blending of biogas in CBG will be kept out of the accessible value.

"A tax holiday for 20 years will cover the period of the vision of Viksit Bharat. This is a positive, purposeful and farsighted budget. It is a mature budget. There is no decision in this budget which will say that it is populist and not mature. Critical minerals and rare earth has been given huge priority in this budget," he added.

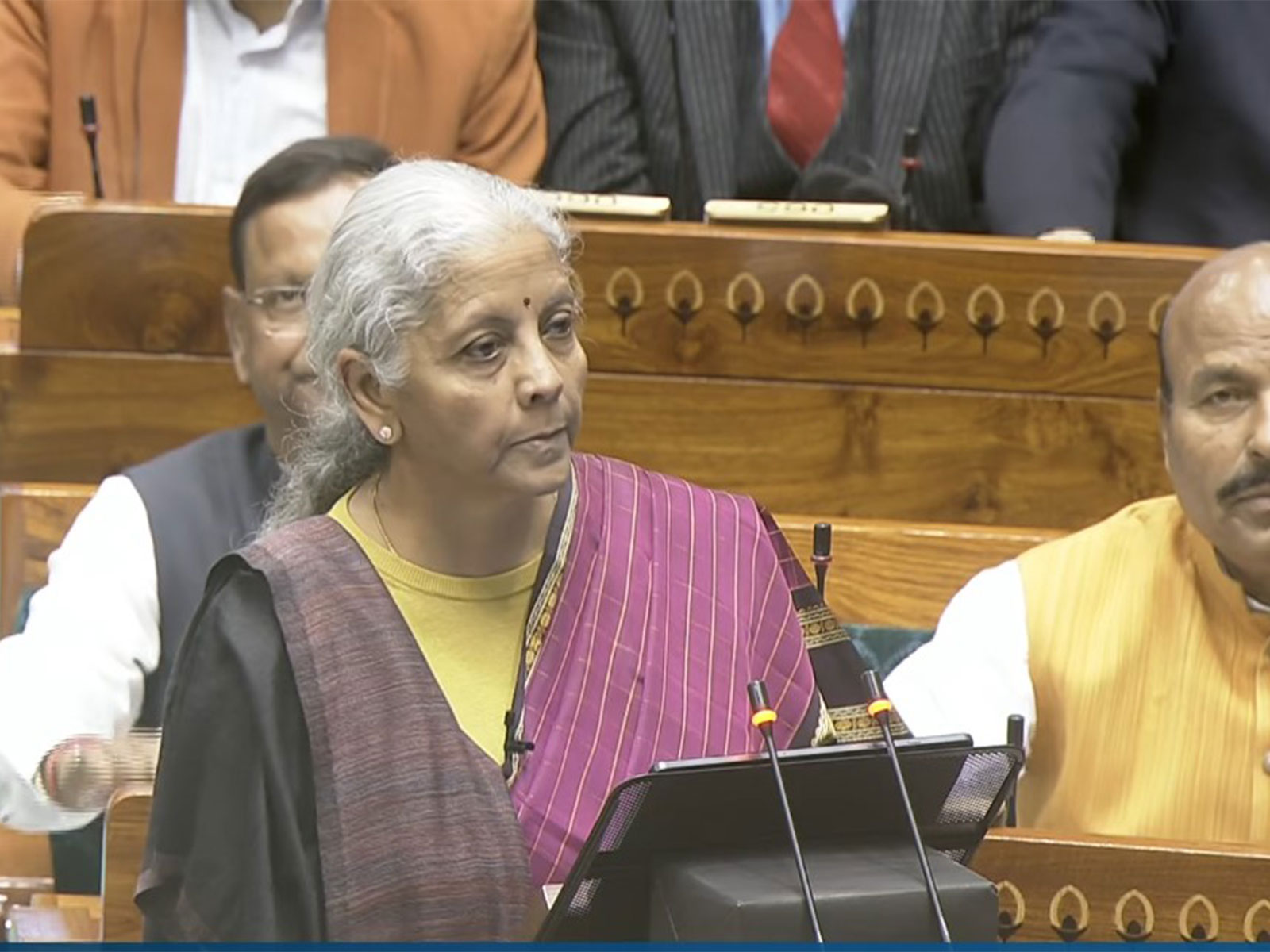

While presenting the Union Budget 2026-27, Finance Minister Nirmala Sitharaman proposed an outlay of Rs 20,000 crores over the next 5 years for Carbon Capture, Utilisation and Storage (CCUS) technologies to scale up and increase readiness in end-use applications.

Speaking in the Lok Sabha, Sitharaman also proposed a 'Coconut Promotion Scheme', aimed at increasing production and improving productivity to boost India's competitiveness in coconut cultivation.

In her Union Budget 2026-27 presentation in the Lok Sabha, Sitharaman said the scheme will focus on major coconut-growing states and include measures such as replacing nonproductive trees with high-yielding saplings."To further enhance competitiveness in coconut production, I propose a coconut promotion scheme to increase production and enhance productivity through various interventions, including replacing non-productive trees with new saplings or plants of varieties in major coconut-growing states," Sitharaman said.

India ranks among the world's leading coconut producers, accounting for roughly 31% of global production. An estimated over 90 per cent of India's coconut cultivation is done in the southern states of Kerala, Tamil Nadu, Karnataka, and Andhra Pradesh. Around 30 million people, including nearly 10 million farmers, depend on coconut cultivation for their livelihoods.

She also proposed a dedicated programme for Indian cashew and cocoa with the objective of making India self-reliant in raw cashew and coconut production and processing, while enhancing export competitiveness.

Recognising the need to enable critical infrastructure and boost investment in data centres, Nirmala Sitharaman has proposed to provide tax holiday till 2047 to any foreign company that provides cloud services to customers globally by using data centre services from India.

It will, however, need to provide services to Indian customers through an Indian reseller entity, according to the Finance Minister.

She also proposed to provide a safe harbour of 15 per cent on cost in case the company providing data centre services from India is a related entity.

To harness the efficiency of just-in-time logistics for electronic manufacturing, she proposed to provide safe harbour to non-residents for component warehousing in a bonded warehouse at a profit margin of 2 per cent of the invoice value.

"The resultant tax of about 0.7 per cent will be much lower than in competing jurisdictions," she asserted.

The Finance Minister has also proposed to provide an exemption from income tax for 5 years to any non-resident who provides capital goods, equipment or tooling to any toll manufacturer in a bonded zone.

She also announced a set of indirect tax measures in the Union Budget 2026-27, aimed at further simplifying the tariff structure, supporting domestic manufacturing, promoting export competitiveness, and correcting inversion in duty.

Finance Minister Sitharaman presented her record ninth consecutive Union budget today in the Parliament.