Adani Ports Q3 FY26 EBITDA rises 20% YoY to Rs 5,786 Crore

Feb 03, 2026

New Delhi, [India] February 3 : Adani Ports and Special Economic Zone Ltd (APSEZ) reported a strong financial performance for the third quarter of FY26, with consolidated EBITDA rising 20% year-on-year to Rs 5,786 crore, driven by robust growth across domestic ports, logistics, marine and international operations.

Revenue for the quarter increased 22% YoY to Rs 9,705 crore, while profit after tax grew 21% to Rs 3,043 crore.

For the nine months ended December 31, 2025, EBITDA stood at Rs 16,832 crore, up 20% YoY, supported by steady cargo growth and improving asset utilisation.

On the back of better-than-expected performance, the company raised its FY26 EBITDA guidance by Rs 800 crore to Rs 22,800 crore, exceeding the upper end of its earlier forecast. APSEZ said the upgrade reflects higher organic growth and the consolidation of NQXT Australia in the fourth quarter of FY26.

Logistics revenue surged 62% YoY to Rs 1,121 crore in Q3 FY26, led by the rapid expansion of asset-light services such as trucking and international freight networks. The marine business also posted strong growth, with revenue jumping 91% YoY to Rs 773 crore and EBITDA rising 135% to Rs 428 crore, supported by ongoing vessel acquisitions.

International ports crossed a key milestone during the quarter, with revenue exceeding Rs 1,000 crore for the first time at Rs 1,067 crore, up 20% YoY, while EBITDA from the segment more than doubled. Domestic ports continued to anchor performance, with EBITDA reaching a lifetime high of Rs 4,877 crore and APSEZ maintaining an all-India container market share of 45.8%.

During the quarter, APSEZ completed the acquisition of NQXT Australia, strengthening its international footprint along the East-West trade corridor. The company reiterated its long-term target of achieving 1 billion tonnes of cargo throughput by 2030.

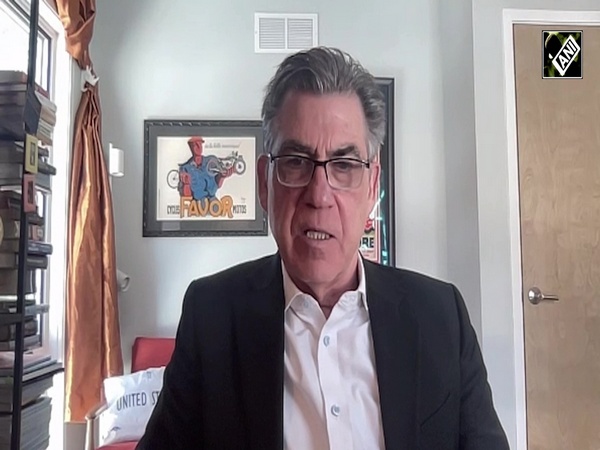

Ashwani Gupta, Whole-time Director & CEO of APSEZ, said, "As India's largest and the world's fastest-growing Integrated Transport Utility, APSEZ has once again delivered a strong and resilient performance. Sustained momentum across our four business pillars, combined with the consolidation of NQXT, has enabled us to raise the upper end of our FY26 EBITDA guidance by a robust Rs 800 Crore. Even after the NQXT acquisition, our leverage remains unchanged, underscoring the strength of our balance sheet and our disciplined approach to capital allocation."

APSEZ also saw multiple credit rating upgrades. Japan Credit Rating Agency assigned an "A-/Stable" rating, a notch above India's sovereign rating, while Moody's revised its outlook to "Stable" and reaffirmed its "Baa3" rating, citing the company's strong financial profile and governance standards.