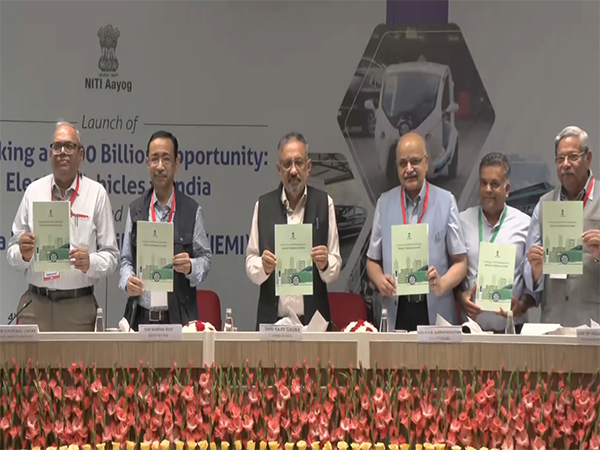

Adoption of EV in India slower than leading countries like US, EU, China: NITI Aayog report

Aug 04, 2025

New Delhi [India], August 4 : Electric Vehicles made up only 7.6 per cent of total vehicle sales in 2024, well short of the 30 per cent goal in 2030. While India has made notable progress in electric two- and three-wheelers, the adoption of electric buses, cars, and especially long-haul trucks remains sluggish, according to the NITI Aayog report titled "Electric Vehicles in India: Unlocking a USD 200 Billion Opportunity," outlining an ambitious roadmap to boost EV adoption in the country.

With a target of 30 per cent EV sales by 2030, the report identifies key challenges and proposes bold mandates, strategic investments, and regulatory reforms to accelerate the transition.

According to the report, India's EV sales grew from just 50,000 in 2016 to over 2.08 million in 2024, as against global EV sales having risen from 918,000 in 2016 to 18.78 million in 2024.

"Adoption of EV has been increasing in India but has been slower than the pace in some of the leading countries like the US, EU, and China," the report read.

"India is doing well with electric two-wheelers and electric-three wheelers. With regard to electric buses, it has made some progress but with electric cars it has been slow. Long haul electric trucks have virtually not taken off," it added.

India has progressed to only about 7.6 per cent of the sales in 2024 being electric, which is far behind its target of 30 per cent by 2030.

The report noted that India has taken nearly 10 years to reach a penetration level of 7.6 per cent and now needs to increase this share by over 22 per cent in the next 5 years alone.

The report outlines multiple policy shifts and calls for a transition from incentives to mandates for Zero Emission Vehicle (ZEV) adoption.

Focused electrification of urban fleets -- buses, para-transit, and freight vehicles -- in 5 cities to create a demonstrable impact.

Establishment of a pooled fund with multilateral support to reduce capital cost barriers for e-buses and e-trucks.

Development of a robust charging infrastructure along 20 high-density freight corridors.

A nationwide unified EV charging app for ease of access and payment.

NITI Aayog proposes a progressive plan that includes disincentives for internal combustion engine (ICE) vehicles, tighter Corporate Average Fuel Efficiency (CAFE) norms, and regulatory support for battery leasing and EV power lines (EVPL).

A special focus is placed on enabling small operators, who form the majority of bus and truck owners in India, through priority sector lending and risk-mitigation mechanisms.

The report notes India's vehicular landscape is dominated by two-wheelers (75 per cent) and small fleet owners, unlike the West, where private cars are the norm. The need for shorter travel distances and lower-cost mobility solutions makes India's EV trajectory distinct, warranting a saturation-based approach rather than nationwide distribution.

While India fares reasonably in charger availability (1 charger for 14 electric cars), utilisation remains low due to poor location planning, land access issues, and lack of consumer awareness.

The report recommends setting up a nodal agency in each state, akin to Singapore's EVe, to streamline charging infrastructure rollouts.

The report emphasised immediate action plan to kickstart momentum. NITI Aayog has recommended that there should be a national EV transition policy with clear timelines. Stricter regulations to mandate EV adoption across public fleets and the electrification of 100 per cent urban transport in 5 pilot cities.

There is also a need to operationalise a blended finance fund for affordable EV loans and form an inter-ministerial task force to resolve regulatory bottlenecks.

With an estimated USD 200 billion opportunity at stake, the report positions India not just as a consumer of green technology but as a global leader in electric mobility manufacturing, innovation, and sustainability.