AIIA signs MoU with General Insurance Council to launch cashless ayurveda treatment across 32 insurance companies

Feb 10, 2026

New Delhi [India], February 10 : In a move to bridge traditional medicine with modern financial security, the All India Institute of Ayurveda (AIIA), New Delhi, signed a landmark Common Empanelment Memorandum of Understanding (MoU) with the General Insurance Council (GIC) on Tuesday.

The primary benefit of this MoU is the establishment of a cashless treatment facility that spans all 32 insurance companies under the General Insurance Council. This initiative is designed to substantially enhance patient access and affordability, expand Ayurveda's outreach to a larger section of society, and reinforce the institutional credibility of Ayush treatments by placing them on par with conventional medical services.

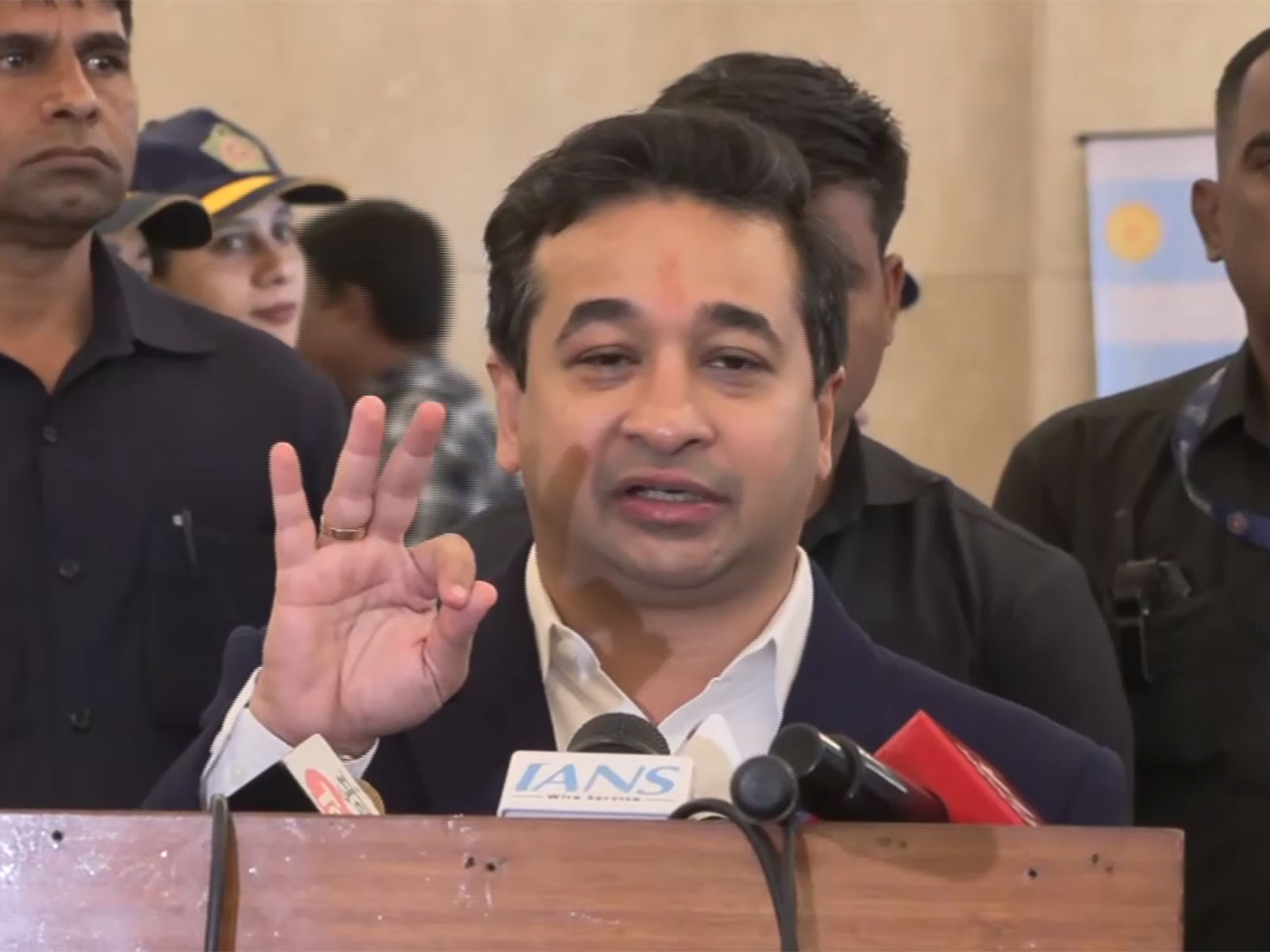

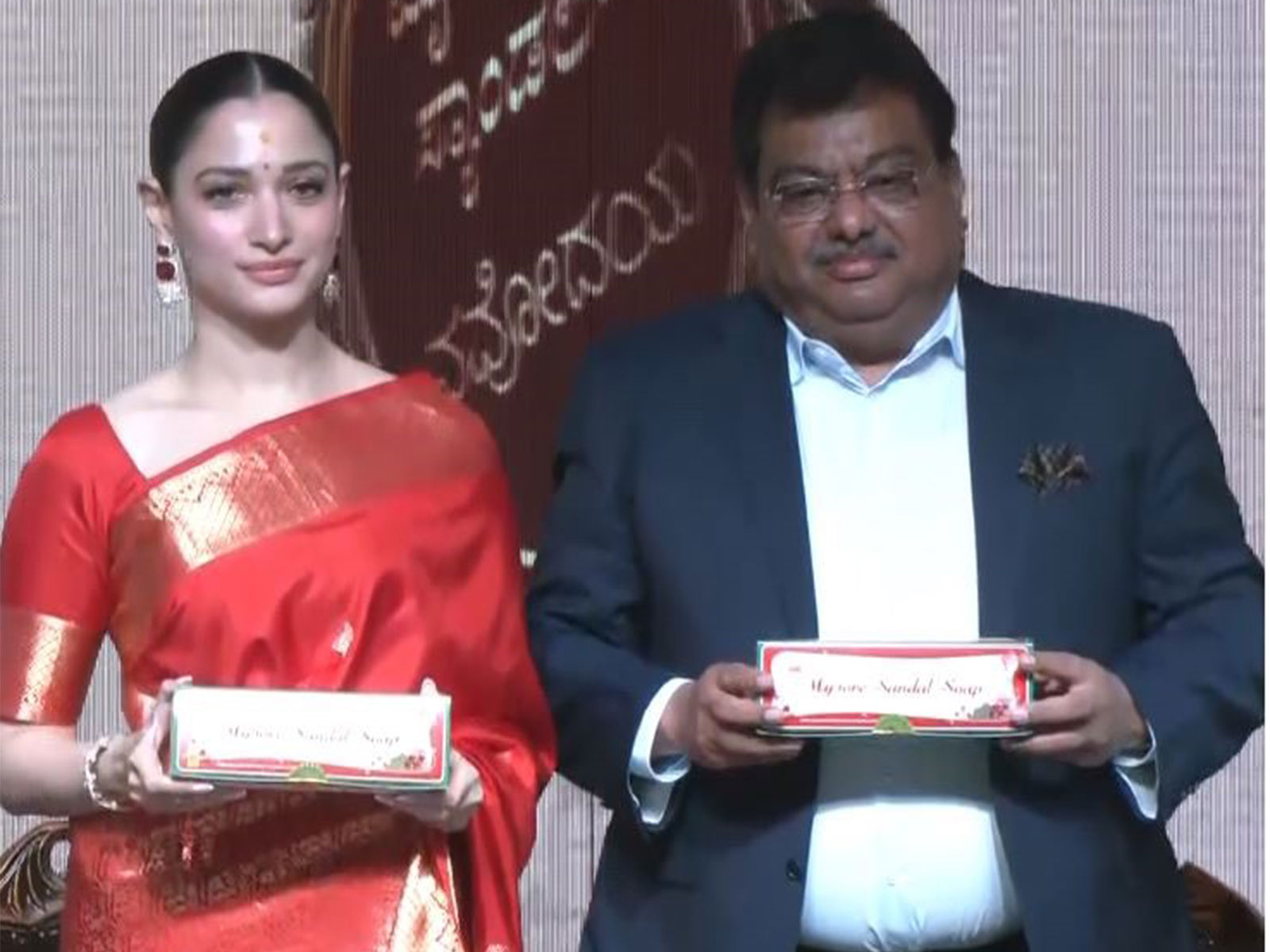

This agreement, signed between AIIA Director Prof (Vaidya) PK Prajapati and GIC Director Health Segar Sampathkumar, establishes a framework to integrate Ayurveda more deeply into the mainstream health insurance ecosystem.

According to a press release from the AIIA, the agreement marks the first time an Ayush institute in India has entered into such a comprehensive arrangement with the General Insurance Council. Prof (Vaidya) PK Prajapati emphasised the significance of the deal, stating, "With the signing of this agreement, AIIA has been empanelled with all 32 insurance companies under the General Insurance Council, enabling the provision of cashless treatment services to patients." He further expressed confidence that this step, supported by the Ministry of Ayush, will "help the patient at large."

Prof Bejon Kumar Misra, Chairman of the Core Group of Experts on Ayush Health Insurance, highlighted the transformative nature of the partnership during the event. He noted that the availability of cashless facilities would "strengthen patient confidence" and contribute to "sustainable institutional growth."

Beyond the empanelment, the release also announced the launch of a dedicated Ayush Health Insurance Helpline (1800-11-0008), which will operate from 9:30 AM to 5:00 PM on working days to resolve insurance-related queries and ensure beneficiaries can easily access their entitled benefits.