Akasa Air completes strategic investment transactions, welcomes new partners

Aug 19, 2025

New Delhi [India], August 19 : Akasa Air on Tuesday announced the completion of its strategic investment transactions announced on February 6, 2025, welcoming new investment partners to the airline, the company said in a release.

The closure follows the receipt of all requisite regulatory approvals, the release added.

The investors include Premji Invest - a leading global investment firm whose returns primarily support the work of Azim Premji Foundation, funds managed by 360 ONE Asset - a leading asset management firm and Claypond Capital - the investment office of Dr Ranjan Pai, alongside an additional capital infusion from the Jhunjhunwala family, who are existing investors in Akasa Air.

The funds will accelerate Akasa Air's strategic roadmap to rank among top 30 airlines in the world by the end of this decade, enabling the airline to further contribute to India's emergence as a global aviation hub.

These investments will be directed towards expanding operations, enhancing customer experience and investing in safety, reliability and advanced technology.

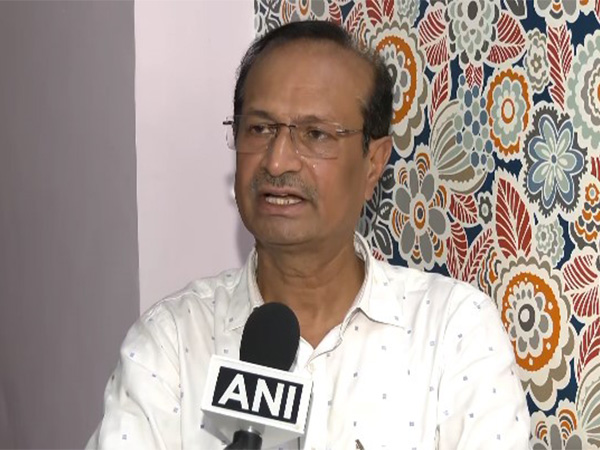

Commenting on the successful transaction closure, Vinay Dube, Founder and CEO, Akasa Air said, "We warmly welcome our new investors to the Akasian family and deeply appreciate their confidence in our team. Their support affirms our vision and strengthens our ability to scale sustainably while keeping customers and employees at the heart of our operations. We remain especially grateful to the Jhunjhunwala family for not just helping us take flight but for their continued belief in our dream to redefine air travel in India. We are also thankful for the support extended to us by the Ministry of Civil Aviation."

He added "In just three years, Akasa Air has demonstrated that rapid growth is possible with discipline, purpose and heart. With over 20 million passengers flown and a proven record of operational excellence, we are building an airline that India can be proud of and is poised to set new standards in global aviation."

Manoj Jaiswal, Partner - Industrials & Buyouts, Premji Invest commented "We are excited to partner with Akasa, India's fastest growing airline, in its next phase of growth. We believe Indian aviation industry has strong growth potential, domestically and beyond. Team Akasa is brilliantly positioned to execute on this opportunity."

Umesh Agrawal, Fund Manager, 360 ONE Asset commented, "We are elated to partner with Akasa Air at a time when India's aviation sector is poised for tremendous growth. This investment will support Akasa Air's mission to build a customer centric airline." Shyam Powar, Chief Investment Officer at Claypond Capital commented "What excites us is not just the scale of the opportunity, but the passion and purpose with which the team is building this airline. We are proud to back Akasa and look forward to supporting them in their journey to build a world class airline from India."

Marking three years since its inaugural flight on 7 August 2022, Akasa has achieved robust operational and financial momentum carrying over 20 million passengers, growing the fleet to 30 aircraft, and delivering industry-leading load factors and punctuality. In FY25 the airline recorded strong revenue growth and margin improvement driven by disciplined cost management, higher unit profitability and strategic network expansion.

Akasa Air recently announced accelerating its international network with a foray into Southeast Asia, with Phuket strengthening its presence in the region and laying the groundwork for further expansion across SAARC and ASEAN markets.

This combination of operational strength, financial resilience and targeted international growth positions Akasa to scale sustainably and advance its long-term ambition of becoming one of the top 30 airlines globally.