BHIM Payments App transactions rise over fourfold in 2025 to 165.1 million in December

Jan 21, 2026

By Vishu Adhana

New Delhi [India], January 21 : Monthly transactions on the BHIM Payments App rose more than fourfold in calendar year 2025 to 165.1 million in December from 38.97 million in January, reflecting higher adoption of digital payments across user segments following the launch of BHIM 3.0, according to data released on Tuesday.

Developed by NPCI BHIM Services Limited (NBSL), the app recorded an average month-on-month growth of around 14 per cent during the year.

The transaction value processed through the platform reached Rs 2,20,854 crore in December 2025, marking an increase of over 390 per cent in transaction volume and more than 120 per cent growth in value compared to the same period last year, the company said.

BHIM 3.0 was launched by the National Payments Corporation of India (NPCI) on March 25, 2025, bringing major updates like Split Expenses, Family Mode, Spending Analytics, and support for over 15 languages, while also working better in low-internet areas to make digital payments easier and more inclusive for everyone in India

Delhi emerged as one of the leading markets for the BHIM Payments App during the year, driven by strong traction in small-ticket, high-frequency transactions. Peer-to-peer payments accounted for 28 per cent of total transactions in the national capital, followed by grocery purchases at 18 per cent, fast food outlets at 7 per cent, eating places and restaurants at 6 per cent, telecommunication services at 4 per cent, service stations at 3 per cent and online marketplaces at 2 per cent.

The app also saw increased usage for IPO mandates, aided by its simplified interface and stable authentication processes. Continued use for high-value transactions highlighted user confidence in the platform's security and reliability, the company said.

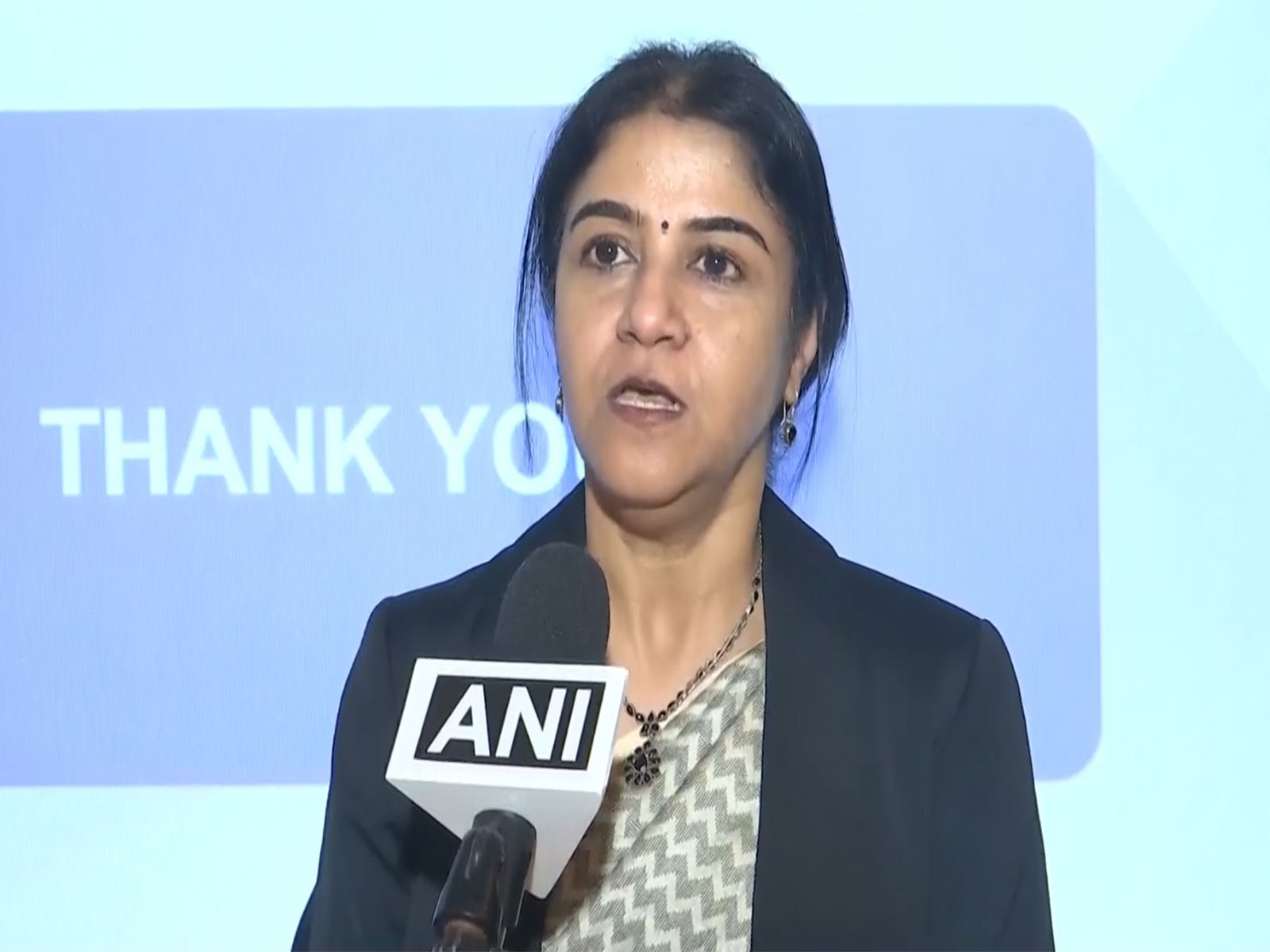

"Digital payments have become an integral part of daily life, and the BHIM Payments App is designed to address everyday user requirements," said Lalitha Nataraj, Managing Director and Chief Executive Officer, NPCI BHIM Services Limited. She said the app focuses on enabling safe, convenient and inclusive payments, supporting frequent low-value transactions and reliable usage even in low-connectivity environments.

She added that growth across northern markets, such as Delhi, Punjab, Haryana, Uttar Pradesh, and Rajasthan, reflected rising trust in the app's performance and user experience.

According to the company, the app supports more than 15 regional languages, including Hindi, Punjabi, Haryanvi and Marwari, and is optimised for low-connectivity environments to aid adoption in rural and semi-urban areas.

During the year, the platform expanded its feature offerings, including UPI Circle Full Delegation, which allows users to authorise trusted contacts to make UPI payments within a predefined monthly limit, as well as features such as split expense payments, family expense management, spending analytics, UPI Lite auto top-up, forex booking, prepaid mobile recharges and assured rewards.

NPCI BHIM Services Limited was incorporated in 2024 as a wholly owned subsidiary of the National Payments Corporation of India and focuses on expanding digital payments adoption through the Bharat Interface for Money platform, offering a secure, user-friendly payment experience.