"BJP should accept they had made mistake 8 years ago": AAP's Saurabh Bharadwaj on GST reforms

Sep 22, 2025

New Delhi [India], September 22 : Delhi Aam Aadmi Party (AAP) president Saurabh Bharadwaj on Monday criticised the ruling Bharatiya Janata Party (BJP) over the implementation of the next-gen GST reforms, saying the Centre should accept that it had made a mistake while implementing it eight years ago.

Bharadwaj further recalled that the opposition had raised strong objections at the time, warning that it would negatively impact small and medium-sized enterprises and slow down economic growth.

"When GST was implemented, the entire Opposition had pointed out that it would destroy the small and medium-scale industry and affect the growth rate, and there would be a rise in inflation. GST was imposed on the country for 8 years. Today, the BJP should accept that they had made a mistake then," the AAP leader said.

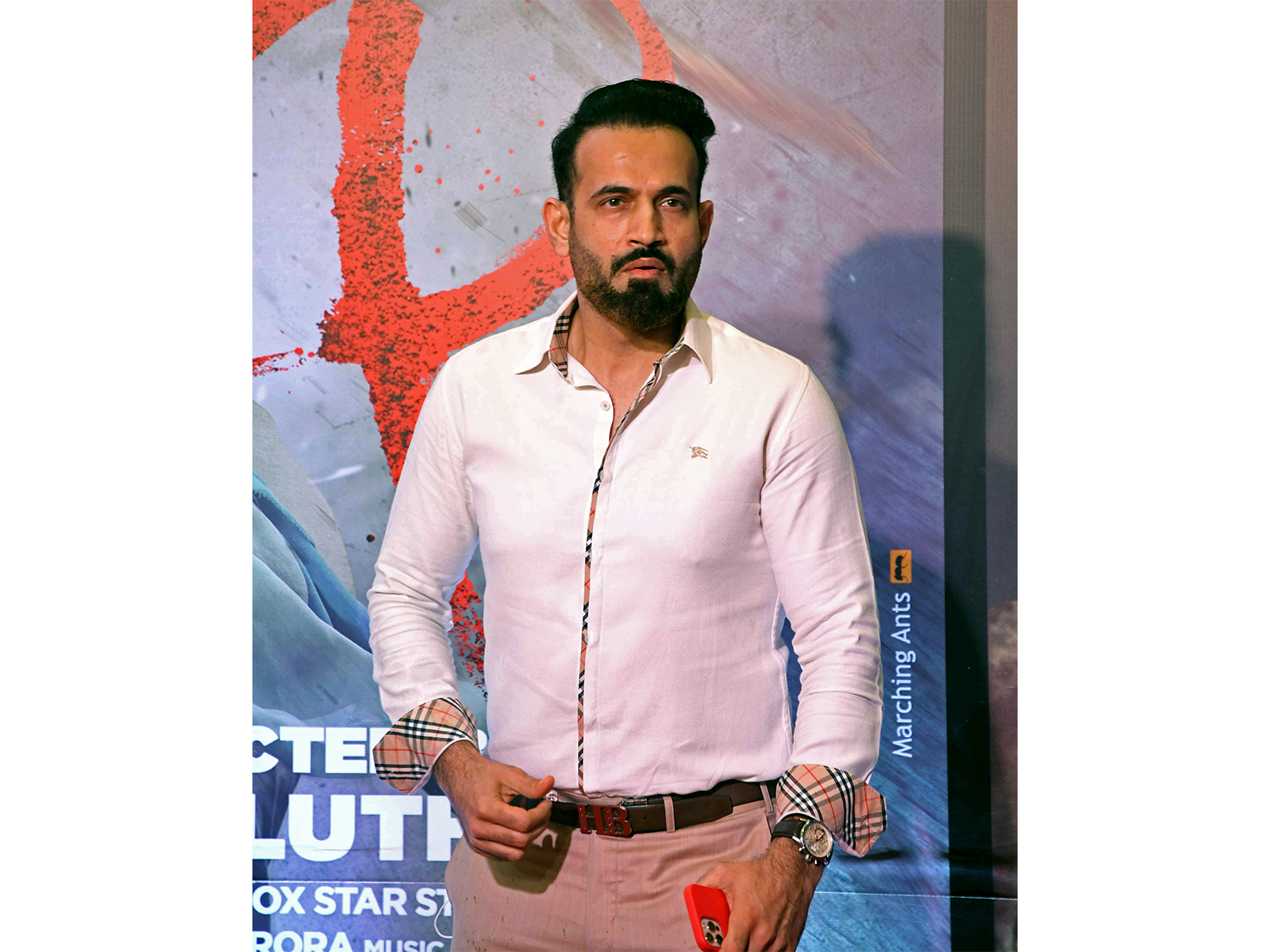

Congress leader Bhupendra Singh Hooda also came down heavily on the Centre, asking if the government will refund the amount of GST that has been collected over the past 7 years.

Hooda stated that there is still a great need to provide much more relief in the GST so that it benefits the common man of the country.

The Congress leader said, "GST was imposed by this government itself. Why didn't they think about this 7 years ago? Will they refund the amount of GST that has gone over the past 7 years? In the announcement that has been made now, there is still a great need to provide much more relief so that it benefits the common man of the country..."

The GST 2.0 reforms, which the Union Government approved on September 4, have been implemented from Monday.

Under the revised structure, the previous four-tier GST slabs have been consolidated into two main categories: 5 per cent and 18 per cent. Items that were earlier taxed at 12 per cent have been brought down to 5 per cent, while those in the 28 per cent category have been rationalised to 18 per cent. Essential commodities and daily-use items are now taxed at the lowest rate, making them more affordable for households.

The reform in the Goods and Services Tax structure, which was approved during the 56th meeting of the GST Council earlier this month, is set to come into effect from today. The current four-rate system will be replaced with a streamlined two-slab regime of 5% and 18%. A separate 40 per cent slab has been retained for luxury and sin goods.

This new framework is expected to ease compliance, reduce consumer prices, boost manufacturing, and support a wide range of industries, from agriculture to automobiles and from FMCG to renewable energy. It is intended to lower the cost of living, strengthen MSMEs, widen the tax base, and drive inclusive growth.

In the fast-moving consumer goods (FMCG) and dairy sector, major brands like Amul and Mother Dairy have announced substantial price cuts, reflecting the full benefit of the GST reduction.

Items like milk, butter, ghee, paneer, cheese, ice cream, snacks, and frozen foods have been brought under the 5 per cent slab, due to which 100 g of Amul butter will now cost Rs 58 instead of Rs 62, and Ultra High Temperature milk (UHT) has dropped to Rs 75 per litre from Rs 77. Mother Dairy has also slashed prices on milkshakes, paneer, ghee, and frozen products.