BJP's Bhupendra Chaudhary hails GST reforms as "huge relief" for common man

Sep 05, 2025

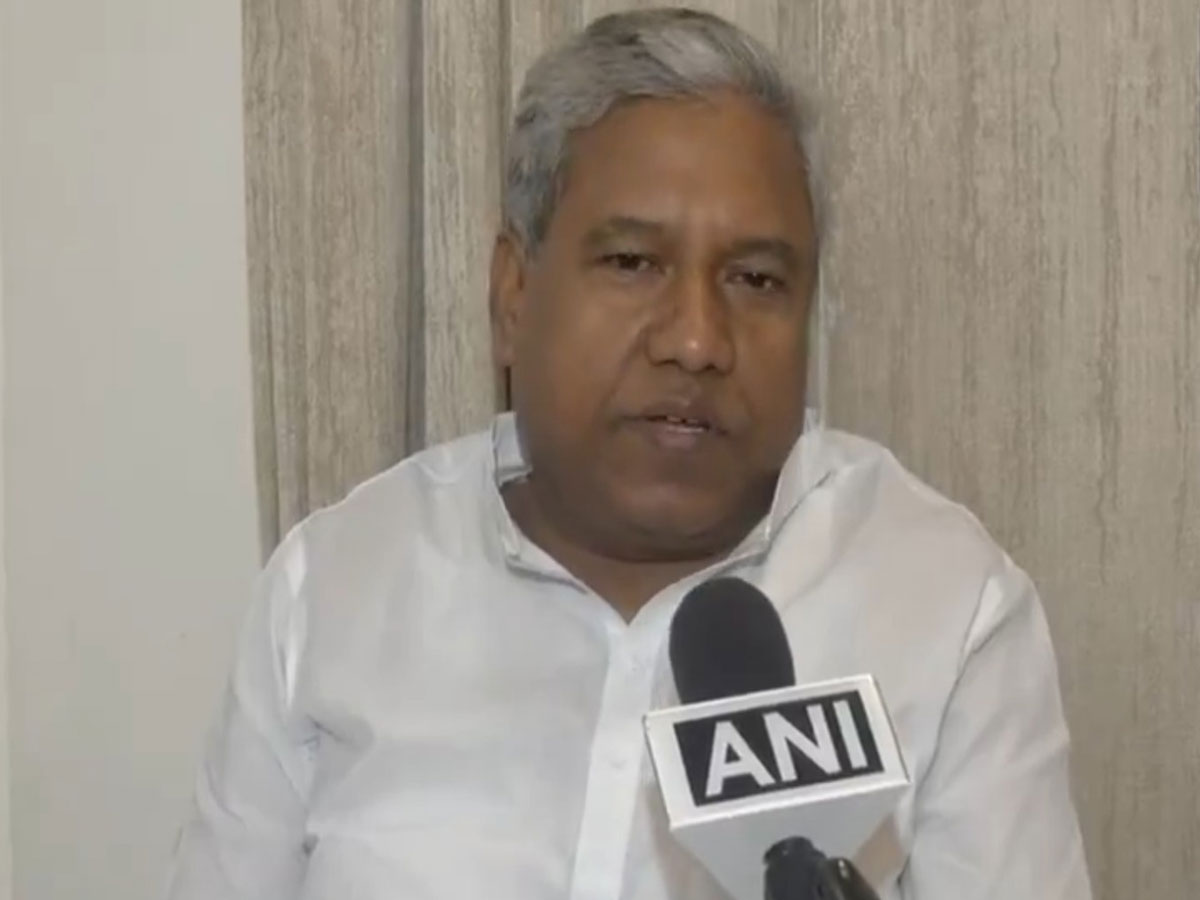

Kanpur (Uttar Pradesh) [India], September 5 : Uttar Pradesh Bharatiya Janata Party (BJP) President Bhupendra Singh Chaudhary on Friday hailed the Prime Minister Narendra Modi for the Goods and Services Tax (GST) reforms, describing them as a "huge relief" to the common man.

"This is a very big step and the government has given a huge relief to the common man...Prime Minister Modi has given a great gift to the countrymen even before Diwali..." Chaudhary told ANI.

At its 56th meeting, the GST Council decided to rationalise GST rates largely to two slabs of 5 per cent and 18 per cent by merging the 2 per cent and 28 per cent rates.

Earlier in the day, Union Finance Minister Nirmala Sitharaman said that the foremost priority of the government is to ensure that the benefits of the GST tax reforms reach all the people of the country.

Union Commerce and Industry Minister Piyush Goyal addressed a press conference at the BJP headquarters and termed the GST reforms as a "streamlined taxation", crediting Prime Minister Narendra Modi's leadership over the decision.

"Every state, including those ruled by opposition parties, came together to decide on GST slabs and implement the reform. Even during the COVID-19 pandemic, the Modi government provided compensation for five years (to states). PM Modi aims to simplify taxation for ease of doing business, marking a significant transformation. This change will have a large scope, making FMCG, cosmetics, bread, food items, and daily essentials cheaper, benefiting the poor, middle class, farmers, and women. Unlike the Congress tenure, which had multiple taxes like VAT and central tax, today we've streamlined taxation," Goyal said.

Meanwhile, Karnataka Chief Minister Siddaramiah also welcomed the GST Council's decision on the rationalisation of the rates, stating that it was an important step to reduce both monetary and compliance burden on people and businesses.

In a post on social media X, the Chief Minister hitting out at the Centre noted that the decision on the reforms was not a "new wisdom," but a long-delayed acceptance of what the Opposition had been demanding since 2016-2017, further stating that the Prime Minister Narendra Modi led government was already warned of the crushing effects of the "Gabbar Singh Tax," on the business and ordinary families.

"We welcome the decision of the GST Council to rationalise GST rates, an important step to reduce both the monetary and compliance burden on people and businesses. This decision is not new wisdom but a long-delayed acceptance of what Shri Rahul Gandhi, Opposition leaders, and opposition-ruled states have demanded since 2016-2017, when the Modi Government hurriedly rolled out a faulty GST. From the very beginning, we had warned that this "Gabbar Singh Tax" would crush small businesses, increase compliance costs, and burden ordinary families. Sadly, Prime Minister Narendra Modi chose to ignore these warnings for eight long years," he wrote.

Further in his post, the CM alleged that the Modi government had blocked the reforms that GST could have brought, stating that the current responsibility of the Union Government and the Central Board was to ensure that the benefits of GST rationalisation reached the consumer.

"To explain clearly: the GST system gives the Union Government one-third of the total voting power, while all states together share the remaining two-thirds. For any reform, a three-fourths majority is needed. This means that even if all states agree, a stubborn Central Government can block reforms. That is exactly what Mr. Modi's government did. Today's course correction proves that our stand was right all along. The people of India could have been spared years of hardship had the Union Government listened earlier. Now, the responsibility is on the Union Government and the Central Board of Indirect Taxes and Customs (CBIC) to ensure that the benefits of GST rationalisation actually reach the consumer. The reduction in rates must lower prices for the people, not increase profit margins for big corporates. If the benefits fail to reach the common man, the blame will rest squarely on the Union Government," he added.

Throwing light on the losses states could face due to the reforms, the CM stated that Karnataka could suffer from a revenue loss of Rs 15,000 crore to Rs 20,000 crore, urging the Central government to devolve the GST compensation cess.

"Karnataka alone may lose ₹15,000-20,000 crore in revenue due to this decision. Yet, keeping the welfare of our people above everything else, we welcome it. But we also strongly urge the Union Government to devolve the GST compensation cess, still being collected on certain sin goods, back to the states. As a state, we remain committed to building an economy that increases people's purchasing power, widens the tax base, and ensures prosperity for all. For us, governance is not about optics; it is about empowering every citizen of Karnataka and India," the post further read.