Budget 2026: CII pitches further tax reforms, decriminalisation of minor offences, procedural ease

Oct 31, 2025

New Delhi [India], October 31 : The Confederation of Indian Industry (CII) on Friday suggested a comprehensive set of tax reform proposals for the forthcoming Union Budget 2026-27, calling for a decisive move towards a compliance system rooted in trust, simplicity, and technology.

The proposals, covering both direct and indirect taxes, aim to consolidate India's fiscal gains, reduce litigation, and align the country's tax architecture with its ambition of becoming a developed economy under the Viksit Bharat 2047 vision, the industry chamber said in a statement after meeting with the government.

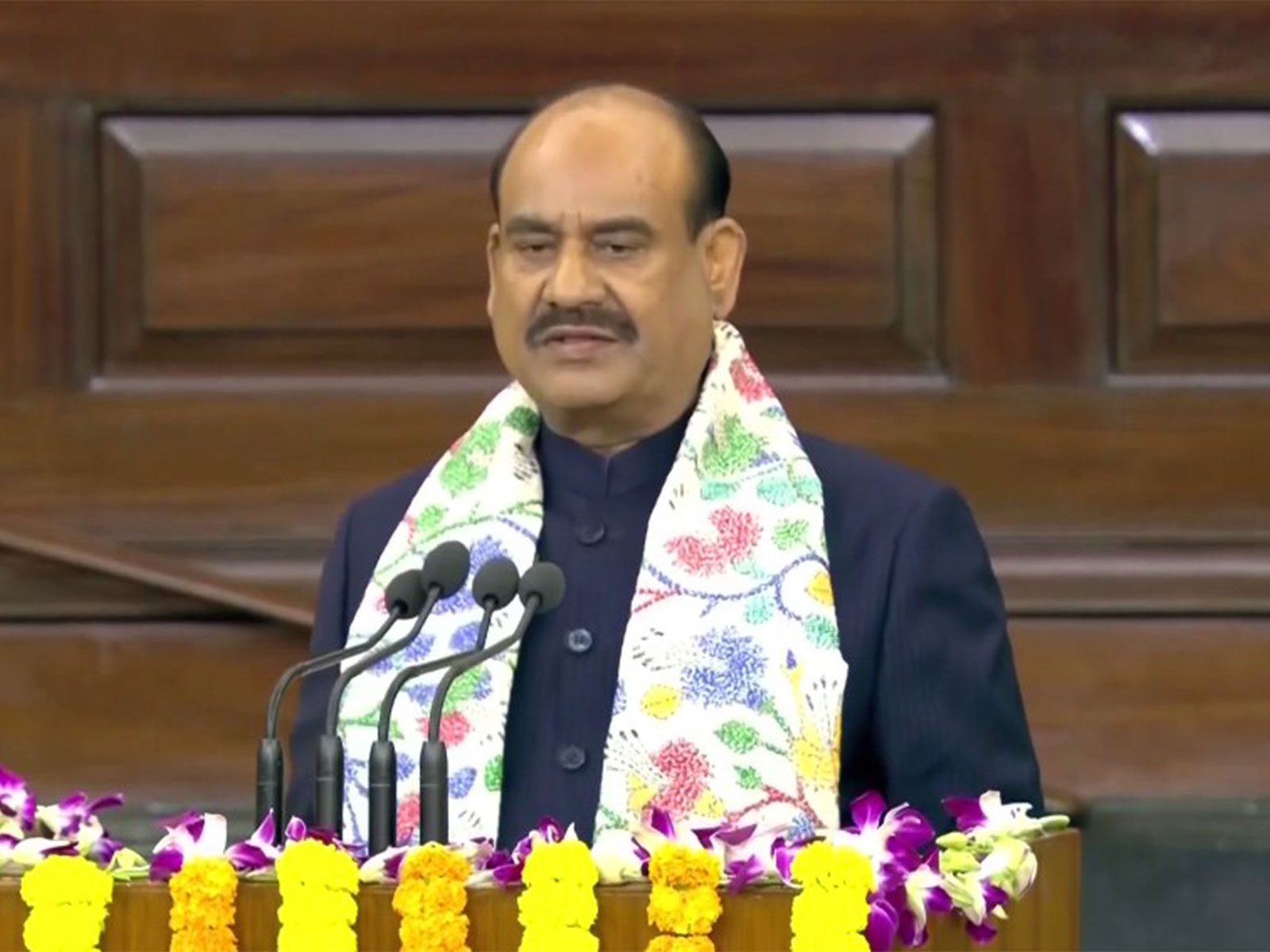

"We are seeing that some of the negative sentiment that happened because of the tariff has been more than mitigated. So, the growth sentiment is strong; we complement the government. Therefore, the thrust of what we wanted to say was really to say how we can focus more on ease of doing business, on decriminalisation, on procedural ease, what are the things that can be done for greater procedural ease for dispute resolution, for mediation, for alternate dispute resolution, for procedural simplification. That was the thrust of what we wanted to so and in very few cases to look at how can capital expenditure, how can investment be encouraged and particularly in some sectors which are doing very well, how are those sectors we can if there are any tax issues or in future if there are tax issues that come up, how can we ensure proactively that we deal with them so that those sectors are encouraged," said Rajiv Memani, CII, President.

CII expressed deep appreciation for the strong reform momentum created by the Ministry of Finance in recent years, which, according to them, has led to a more predictable, technology-enabled, and growth-oriented tax environment.

The success of GST 2.0, the buoyancy in revenues, and the credibility of the fiscal consolidation path have demonstrated that prudence and progress can move hand in hand, CII said.

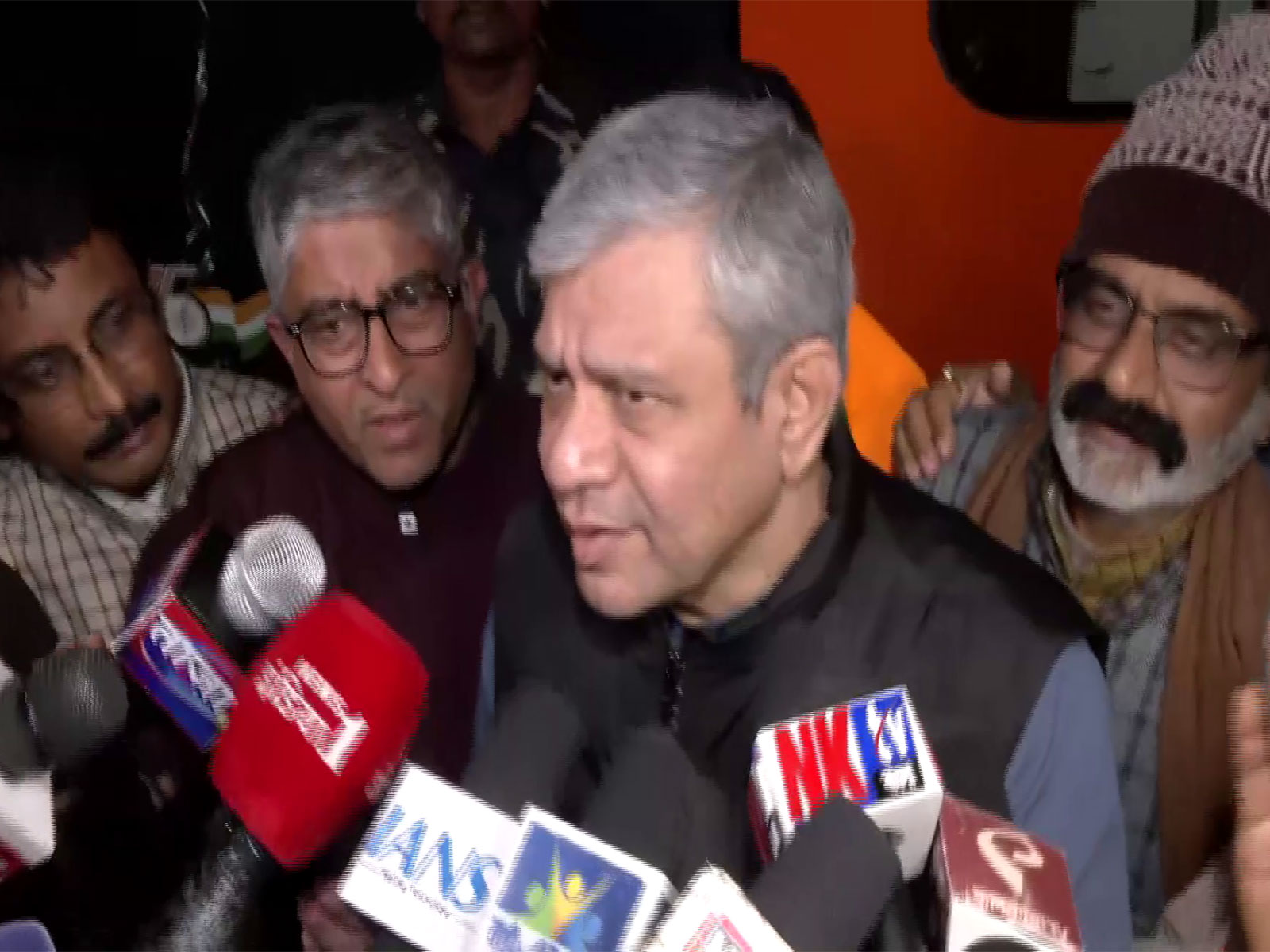

"The next stage of reform," said CII Director-General Chandrajit Banerjee, "must ensure that taxation not only raises revenue efficiently but also acts as a catalyst for investment, innovation and competitiveness. The Budget can be a pivot for a truly modern, transparent and globally benchmarked tax regime."

CII stated that it believes India's tax administration must now shift from being dispute-driven to being dispute-preventive.

More than five lakh appeals are pending before Commissioners (Appeals), involving almost eighteen lakh crore rupees of disputed demand. The industry body has therefore recommended that all high-demand cases above one hundred crore rupees be fast-tracked for resolution within one year through multiple virtual hearings and close CBDT monitoring. Parallel penalty proceedings should remain suspended until the main appeal is resolved, and draft orders should be shared for factual verification before finalisation, CII suggested.

The Confederation also noted that India's TDS/TCS framework, with more than thirty-five categories and rates ranging from 0.1 per cent to 30 per cent has become overly complex, creating reconciliation challenges and liquidity strain. It has therefore proposed a reduction to two or three broad categories, exempting transactions between GST-registered entities since these are already captured digitally.

"Tax simplification is not a concession; it is an investment in governance efficiency," remarked Banerjee. "When rules are clear and systems are digital, compliance becomes automatic and disputes become exceptional."

The fifth focus area is the modernisation of customs systems and indirect taxes. CII has welcomed the recent Master exemption Notification on Imports and suggested building upon it through a one-time dispute-resolution scheme, longer validity for advance rulings, and complete digitalisation of clearance systems via API-based data exchange.

CII proposed a phased roadmap toward a Paper-Free Customs System by 2028, encompassing e-refunds, e-adjudication, and e-appeals.

In addition, CII pressed for a continued rationalisation of India's tariff structure. The coexistence of multiple exemption notifications and complex schedules, it said, generates uncertainty and disputes. Consolidation into a limited set of mega-notifications would enhance clarity and improve alignment with global value chains.

Simplified appeal procedures, such as a single consolidated appeal against multiple Bills of Entry involving common issues, along with automatic release of bonds and guarantees once export obligations are fulfilled, would sharply improve the ease of doing business.

The sixth and equally important strand relates to predictability. CII has proposed a clear, multi-year corporate tax roadmap and the removal of minor, non-wilful offences from prosecution provisions in both direct and indirect tax laws. Compounding thresholds should be rationalised, and small procedural defaults treated as civil, not criminal, matters. These changes, the Industry Body emphasised, can reinforce voluntary compliance without any revenue loss.

Finally, CII concluded that the overarching principle guiding India's tax reforms must be to simplify, stabilise, and digitise.

"India has already shown the world that large-scale reforms like GST 2.0 can succeed," concluded Chandrajit Banerjee. "If we now make our tax systems as simple and predictable as they are digital and fair, we will not only raise revenues more efficiently but also build the foundations of an economy that inspires confidence--both at home and abroad."

As always, the annual Budget document is presented in the Parliament on February 1 each year. In the run-up to it, a series of mandatory pre-Budget meetings is held between the Finance Minister, secretaries and various stakeholders to make the budget-making process all-inclusive.