Budget 2026: STT raised on F&O to discourage derivatives trading

Feb 01, 2026

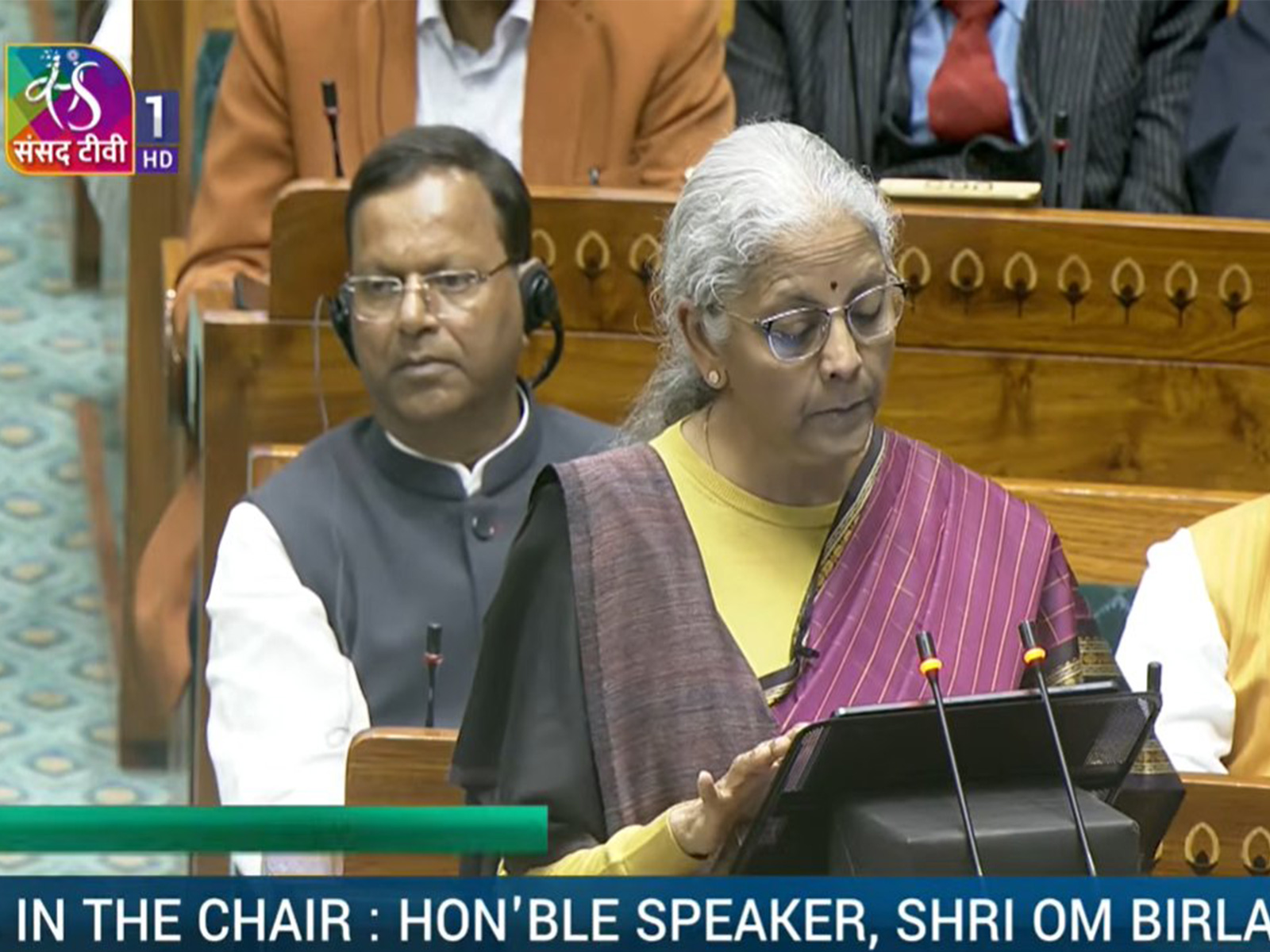

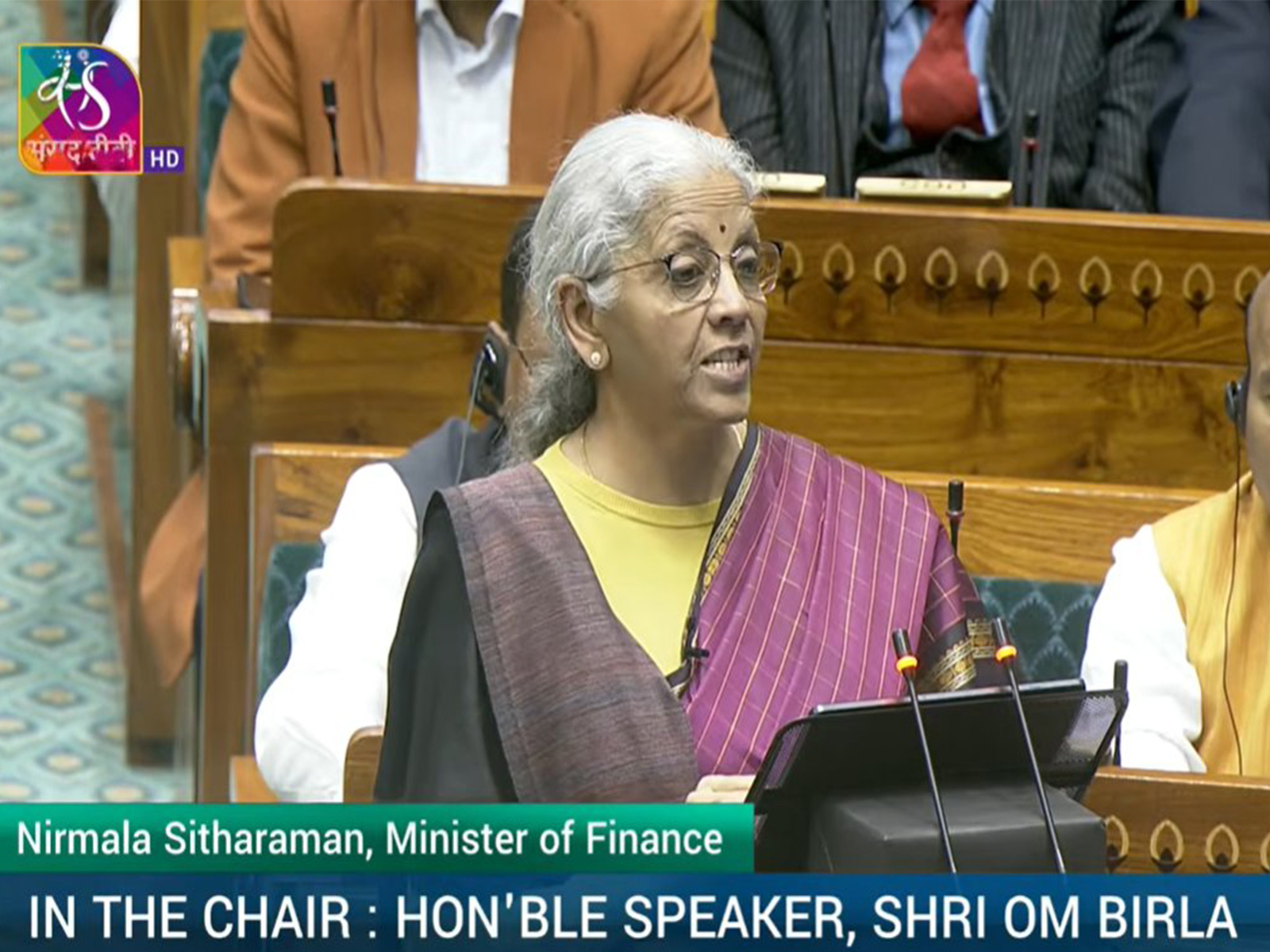

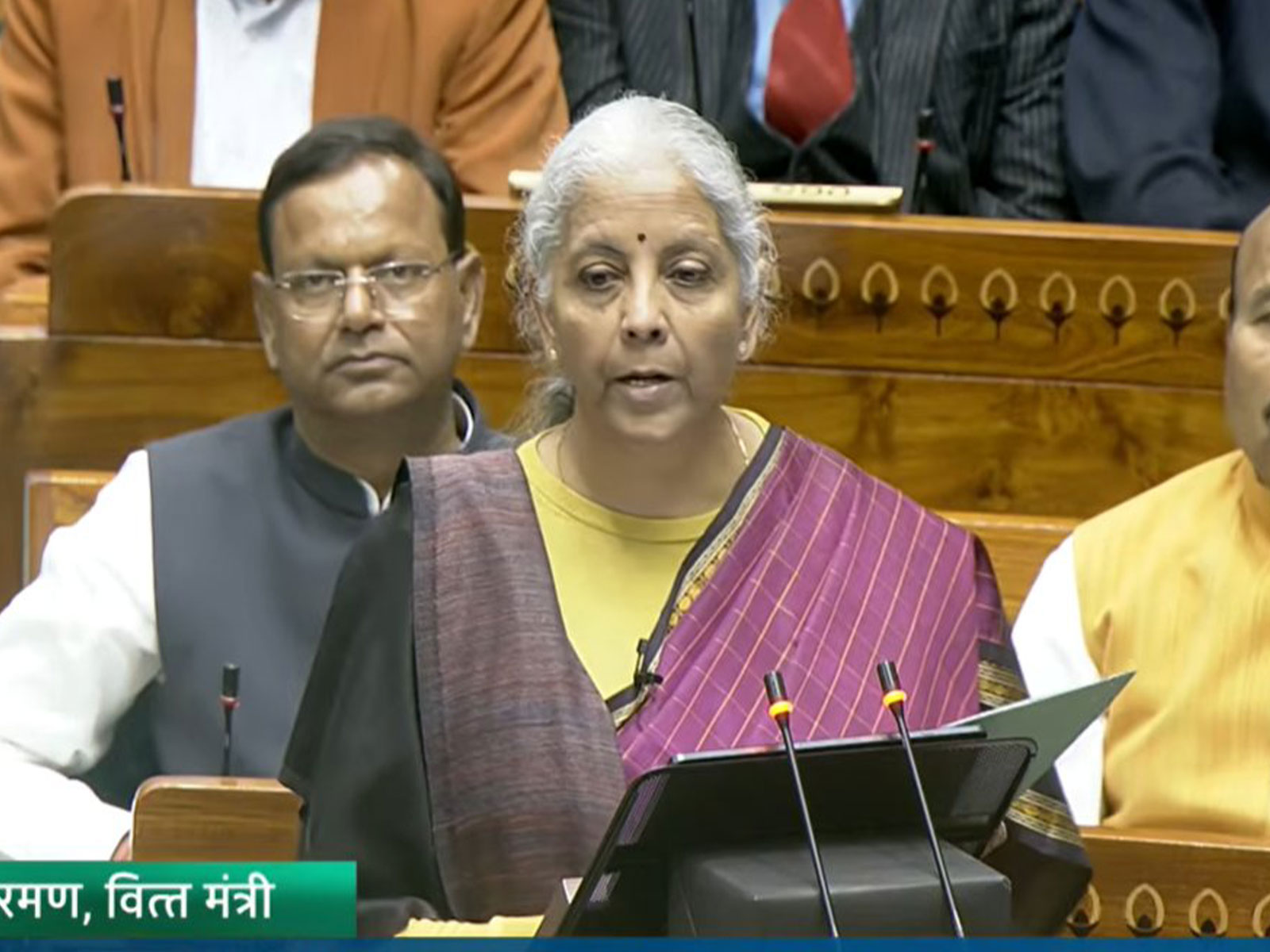

New Delhi [India], February 1 : In an effort to discourage futures and options (F&O) trading, Finance Minister Nirmala Sitharaman has proposed to raise Securities Transaction Tax (STT) on such derivatives trade.

Presenting the Union Budget for 2026-27, the finance minister proposed to raise the STT on futures trades to 0.05 per cent from 0.02 per cent.

On options premium and exercise of options, the STT on both is proposed to be raised to 0.15 per cent from 0.1 per cent and 0.125 per cent, respectively.

"I propose to raise the STT on Futures to 0.05 percent from present 0.02 percent. STT on options premium and exercise of options are both proposed to be raised to 0.15 percent from the present rate of 0.1 percent and 0.125 percent respectively," she said.

She also proposed to tax buy-backs as capital gains.

"In the interest of minority shareholders, I propose to tax buyback for all types of shareholders as Capital Gains. However, to disincentivize misuse of tax arbitrage, promoters will pay an additional buyback tax. This will make effective tax 22 percent for corporate promoters. For noncorporate promoters the effective tax will be 30 percent," she said.

The steep increase in STT on futures and options, coming on top of last year's hike, is likely to raise impact costs for traders, hedgers, and arbitrageurs, Shripal Shah, MD and CEO Kotak Securities, said.

"This could cool derivative activity and lead to a reduction in volumes. The intent appears to be volume moderation rather than revenue maximisation, as any potential revenue gain could be offset by lower derivative volumes," Shah added.

As retail investors are increasingly incurring losses in equity index derivatives (F&O) trade, SEBI and the government have been from time to time putting in place measures to strengthen the derivatives framework, including raising minimum contract size, to disincentive such trades.

Derivatives market assist in better price discovery, help improve market liquidity and allow investors to manage their risks better, but there is inherent risk attached to it.

A study conducted by the Securities and Exchange Board of India (SEBI) had earlier revealed that approximately 93 per cent, or over 9 out of 10 individual traders in the equity futures and options (F&O) segment, continue to incur significant losses. Despite consecutive years of losses, more than 75 per cent of loss-making traders continued trading in F&O.

F&O, which stands for Futures and Options, refers to financial derivatives that allow traders to speculate on asset price movements without owning the asset itself. The underlying asset can range from stocks, bonds, commodities, and currencies to indices, exchange rates, or even interest rates.

India's financial market regulator SEBI had expressed concern over speculative activities in the derivatives segment, which go against the original purpose of these asset categories.

The government had also highlighted concerns over derivatives trading in the Indian financial market and called for increased financial awareness.