Budget should bring safe harbour for off-market listed share deals to ease M&A tax risks: SAM Partner

Jan 30, 2026

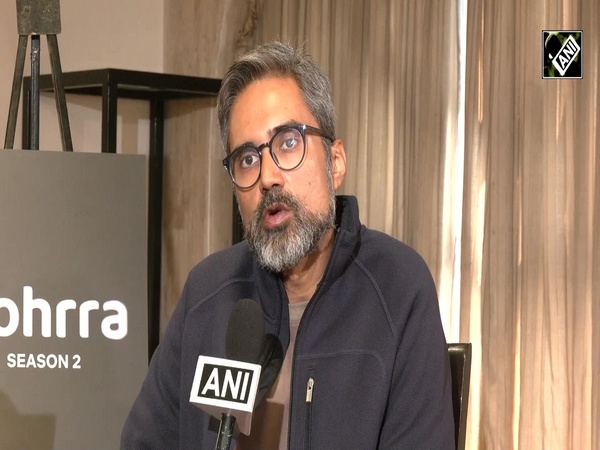

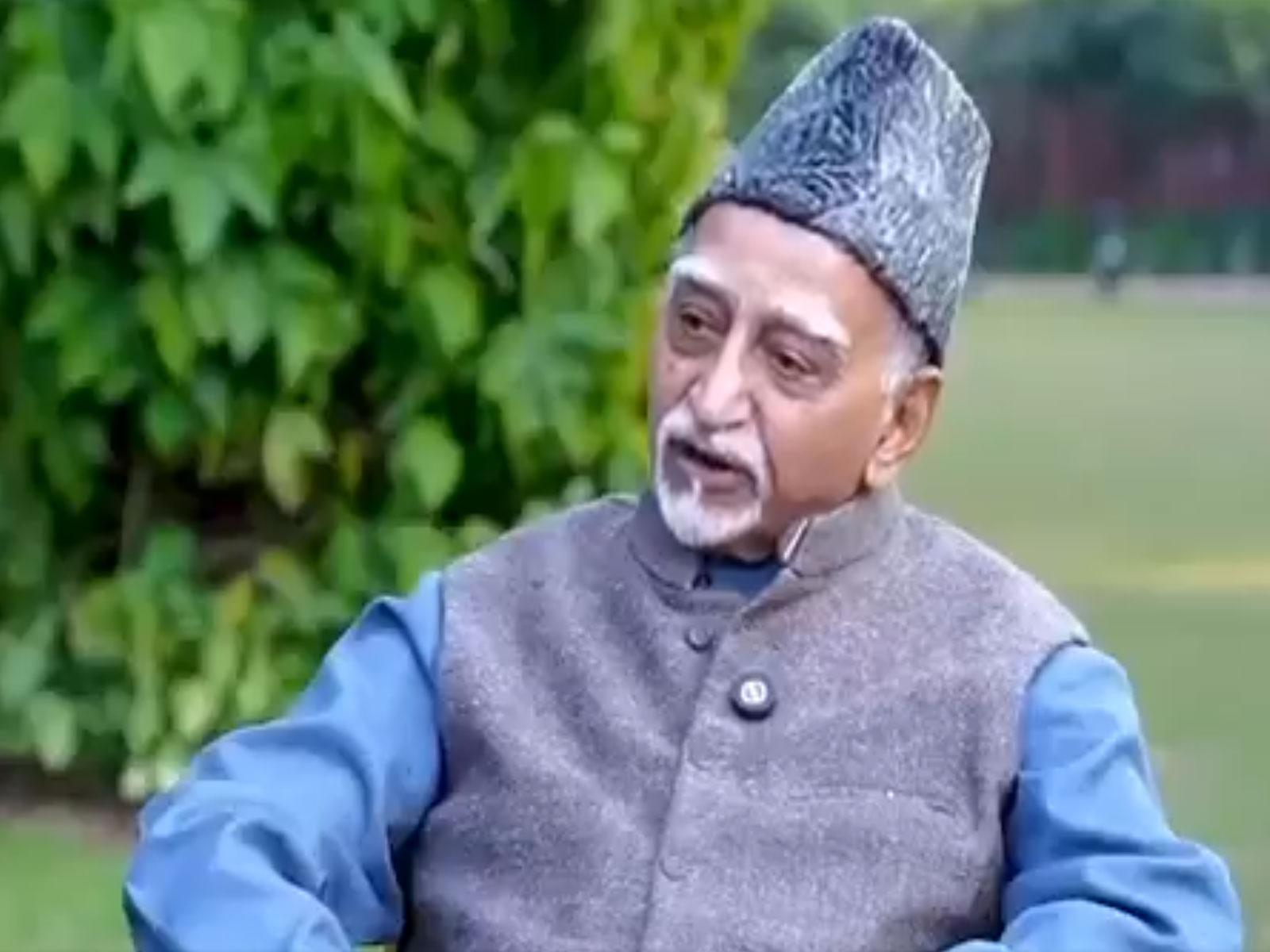

New Delhi [India], January 30 : India's Union Budget 2026 could introduce safe harbour measures for off-market transactions in listed shares to prevent unintended tax liabilities in genuine mergers and acquisitions (M&A) deals, Rahul Yadav, Partner at Shardul Amarchand Mangaldas & Co (SAM), told ANI on Friday.

"Today, if a purchaser pays a price below the tax fair market value, the difference is taxed in the hands of the purchaser as ordinary income. In listed shares, the fair market value is pegged to the stock exchange price, and in off-market deals, parties have no control over price movements between signing and closing," Yadav said while speaking with ANI.

This statement of Yadav came in the backdrop of the Union Budget due on February 1, 2026.

"If the trading price rises by closing, the purchaser risks being taxed on the delta. These provisions were introduced as an anti-abuse measure, but in this limited context, they have strayed from their intended objective, and we expect safe harbour measures in the budget."

Yadav also flagged the need for clarity on the taxation of contingent or earn-out consideration in M&A transactions. Under current law, the entire consideration is taxable in the year of transfer, regardless of when or whether contingent payments are actually received.

He said this creates a harsh liability for promoters and sellers on income that has not accrued and may never be received.

"There are conflicting judicial rulings, and buyers also grapple with withholding tax obligations," he said, adding that taxing contingent payments on an accrual basis would align with judicial principles and the broader accrual-based framework of income taxation.

On tax policy, Yadav emphasised that tax stability is critical for India as an emerging economy reliant on foreign capital. He said tax policy should not be viewed solely as a tool for recovery and collection but as a reflection of India's economic priorities.

"For an investor, tax is a cost of doing business. As long as there is clarity upfront, investors can structure investments optimally and calibrate their returns," he said.

He also highlighted concerns stemming from a recent Supreme Court ruling on treaty benefits, which held that entities lacking sufficient substance in Mauritius were not entitled to benefits under the India-Mauritius tax treaty.

The ruling reinforced that a tax residency certificate (TRC) alone is insufficient and that taxpayers must demonstrate genuine substance in the home jurisdiction.

Yadav said a passing observation in the ruling on indirect transfers has unsettled settled interpretations that treaties do not allocate taxing rights to India for indirect transfers. He warned that this could give authorities ammunition to question indirect transfer structures and urged the government to clarify its intent, possibly through a circular, to reassure investors that only structures failing anti-abuse tests would be targeted.

While acknowledging that the ruling unsettles settled jurisprudence, Yadav said it is binding on taxpayers and the revenue. He said investors must focus on the substance of transactions and structures rather than relying on paperwork, and treaty entitlement will no longer be automatic.

If the government addresses contingent consideration taxation, clarifies indirect transfer treatment, and introduces safe harbour rules for off-market listed share deals, Yadav said it would significantly improve ease of doing business in India's M&A landscape by reducing uncertainty and unintended tax exposure.