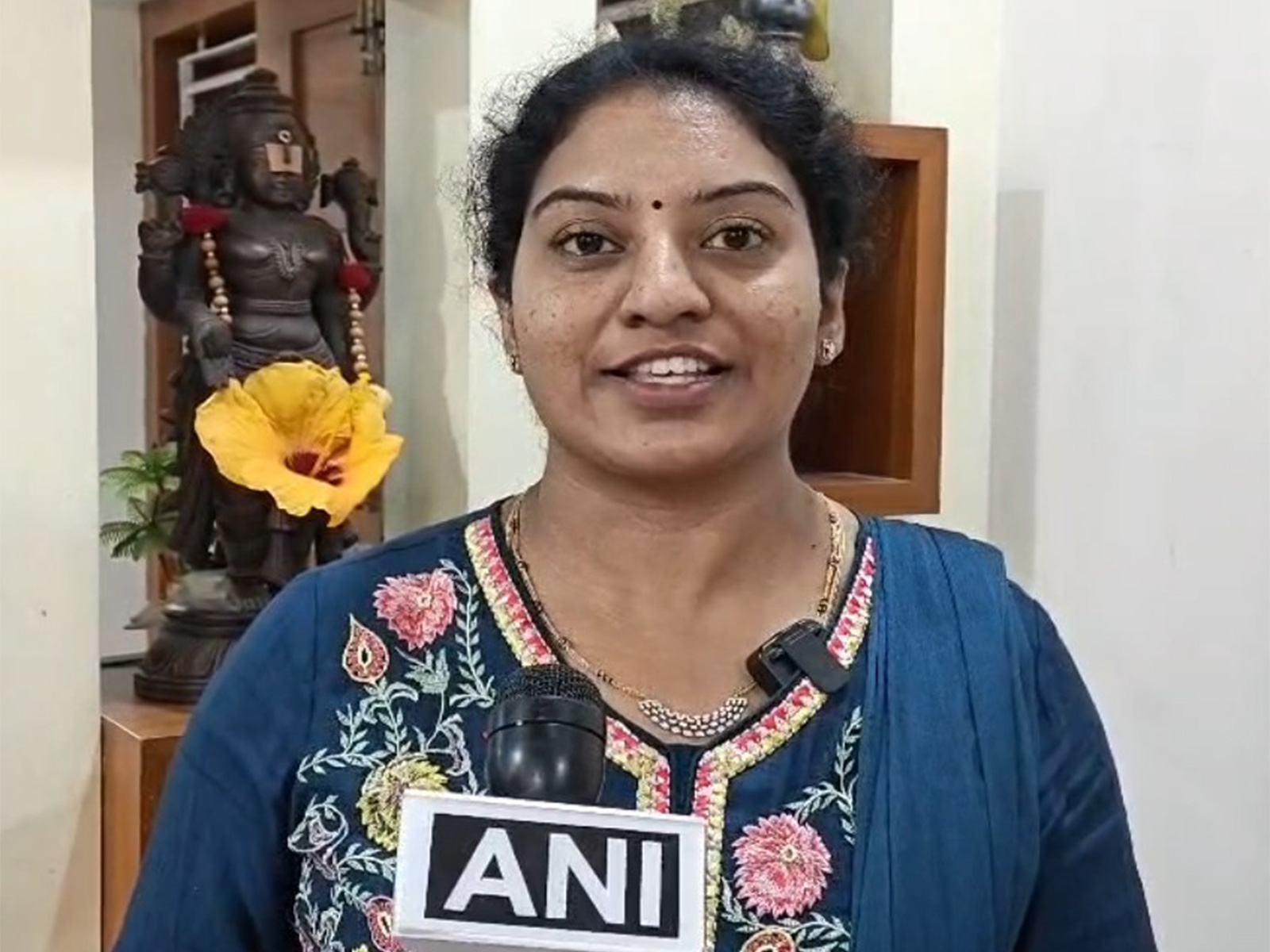

"Celebrating headline FDI numbers without asking who invested, how, and into what is misleading": Manickam Tagore

Jan 25, 2026

New Delhi [India], January 25 : Congress MP Manickam Tagore on Saturday raised concerns over the quantity of FDI, emphasising the quality and transparency of these investments after India achieved a remarkable milestone in its economic journey, with gross foreign direct investment (FDI) inflow reaching an impressive USD 1.1 trillion since April 2000 to June, 2025.

In a post on X, Tagore said that celebrating headline numbers without understanding the underlying investments can be misleading, as it may not translate to industrialisation or nation-building.

"When money quietly leaves the country and confidently returns as "FDI", the real question isn't where are the factories? It's what colour was the money before it crossed borders? That's why celebrating headline FDI numbers without asking who invested, how, and into what is misleading. Capital inflow is not the same as industrialisation. Money movement is not the same as nation-building. Data matters. Composition matters even more," he posted on X.

Notably, India's total annual FDI inflows have more than doubled from USD 36.05 billion in FY 2013-14 to USD 80.62 billion in FY 2024-25. During 2025-26 (up-to June, 25), India has recorded provisional FDI inflows of USD 26.61 billion up by 17% from last year.

Over the last 11 financial years (2014-25), India attracted USD 748.38 billion in FDI--an increase of 143% compared to the USD 308.38 billion received in the previous 11 years (2003-14). Almost 70% of total FDI inflows occurred during 2014-25, over the past 25 years (2000-25: USD 1,071.96 billion).

These figures underscore India's emergence as one of the most attractive investment destinations globally.

https://x.com/manickamtagore/status/2015293409356038216

Tagore said that it's crucial to look beyond the numbers and understand the composition of these investments.

"Singapore. Mauritius. Cayman Islands. Cyprus. These dominate India's FDI inflow charts in 2025. On paper, it looks impressive -- billions of dollars "invested" in India. In reality, many of these are financial routing hubs, not manufacturing powerhouses," he posted.

Based on data through late 2025 and early 2026, foreign direct investment (FDI) into India has shown significant growth, with a reported 73% surge in 2025 to $47 billion, driven by both services and manufacturing sectors.

While Singapore, Mauritius, and other jurisdictions remain major conduits, the composition of these investments is indeed shifting, with a notable rise in manufacturing-focused investments, according to UNCTAD and DPIIT reports.