Committee on Banking for Viksit Bharat should address ownership structure, promoter voting rights: ICRA

Feb 02, 2026

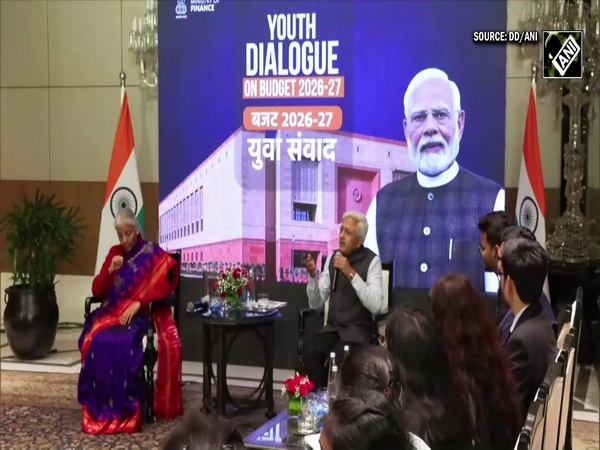

New Delhi [India], February 2 : The High Level Committee on Banking for Viksit Bharat, announced by the Union Finance Minister Nirmala Sitharaman during the Budget 2026 speech, should address some key matters such as ownership structure and voting rights of promoters, said credit rating agency ICRA on Monday.

The committee should address some matters such as ownership structure and voting rights of promoters as these continue to dampen private sector and foreign investor participation, ICRA said in its report.

The banking sector has undergone significant consolidation since the merger among public sector banks in 2020 while bank privatisation has not seen material progress, it highlighted.

Finance Minister had said, the High Level Committee on Banking for Viksit Bharat will comprehensively review the banking sector and to safeguarding financial stability, inclusion and consumer protection.

Further, the Union Budget also proposed to restructure the Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) to achieve scale and improve efficiency in the Public Sector NBFCs. The vision for NBFCs for Viksit Bharat has been outlined with clear targets for credit disbursement and technology adoption.

ICRA said the proposed restructuring of PFC and REC seems like an attempt to clearly define target segments, enhance segment diversity (Green financing, etc) and consequently strengthen credit flow to the infrastructure sector.

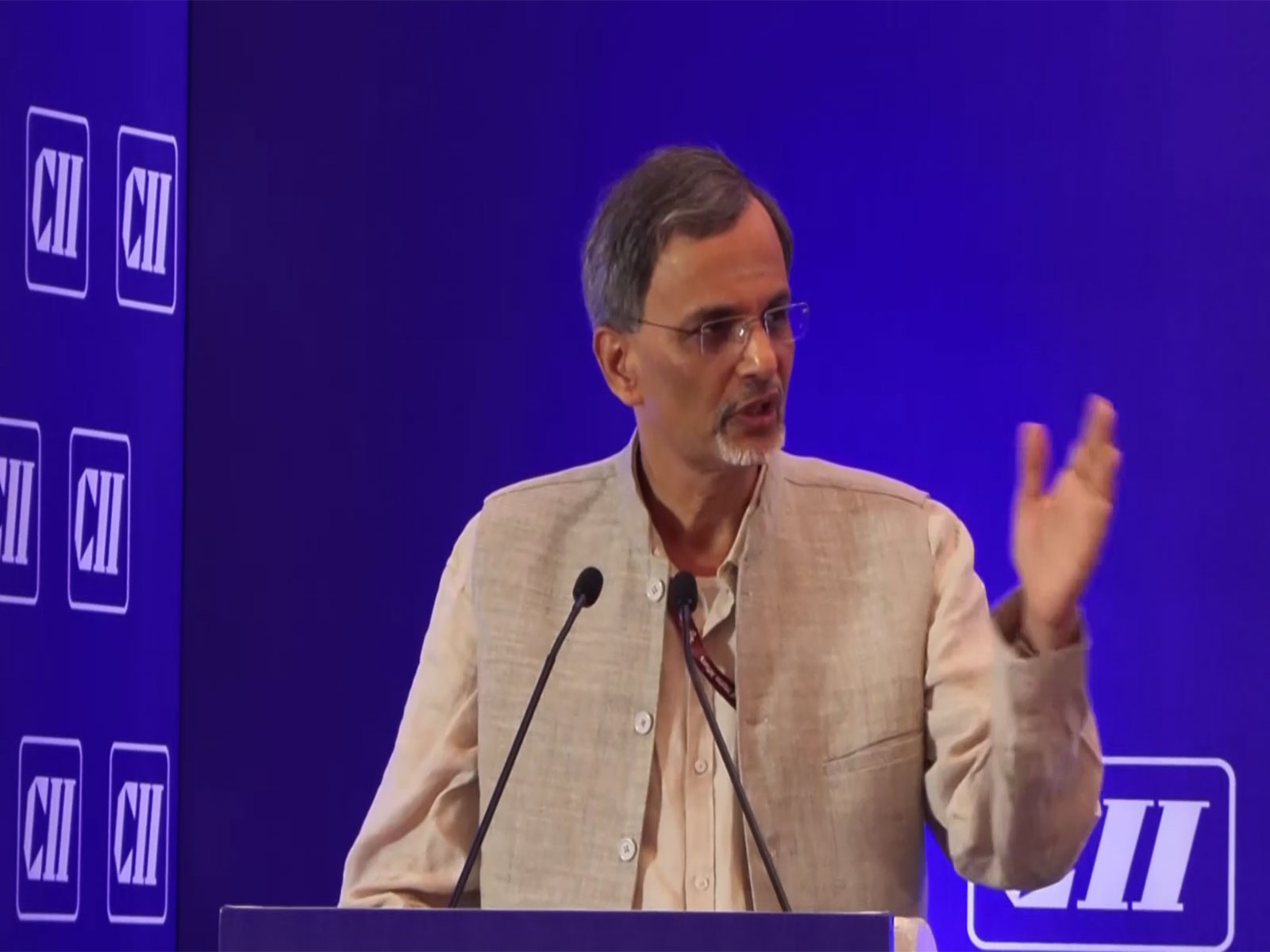

In a post-Budget conversation with ANI, M Nagaraju, Secretary, Department of Financial Services (DFS), on Sunday said the consolidation would enhance capital strength, enabling the merged entity to borrow more and extend financing to a larger number of projects.

"Both Rural Electrification Corporation (REC) and Power Finance Corporation (PFC) provide project financing to the public and private sectors in energy. If two NBFCs are financing the same projects in the same sector, it makes rational sense to examine a merger," Nagaraju said.

He added that consolidation would enhance capital strength, enabling the merged entity to borrow more and extend financing to a larger number of projects. "With a stronger balance sheet, they will be able to lend more and support infrastructure and energy projects more effectively," Nagaraju said.