Counter to US tariffs: Centre reduces tariff rate on goods imported for personal use, exempts customs duty on manufacturing lithium-ion cells for batteries

Feb 01, 2026

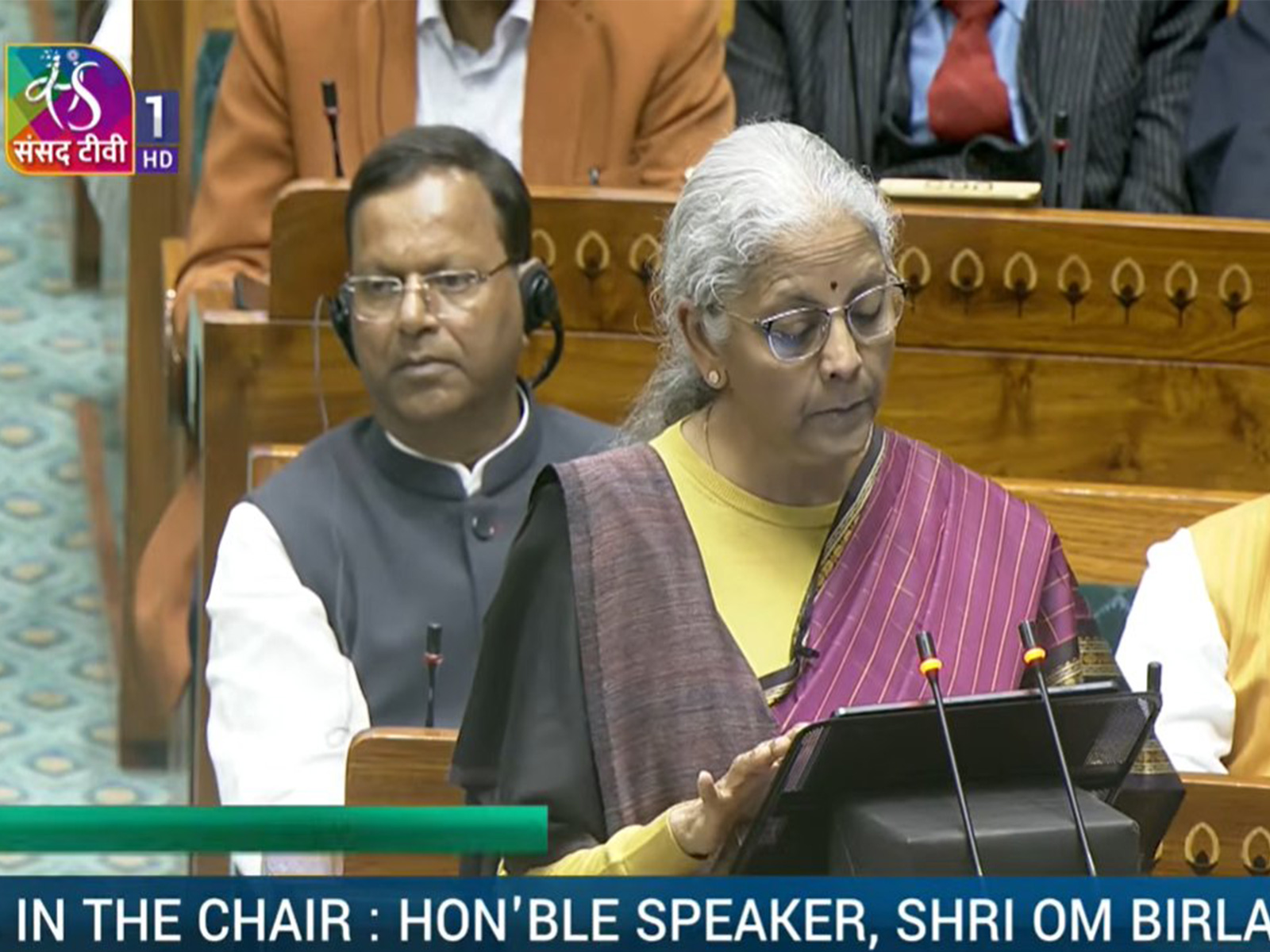

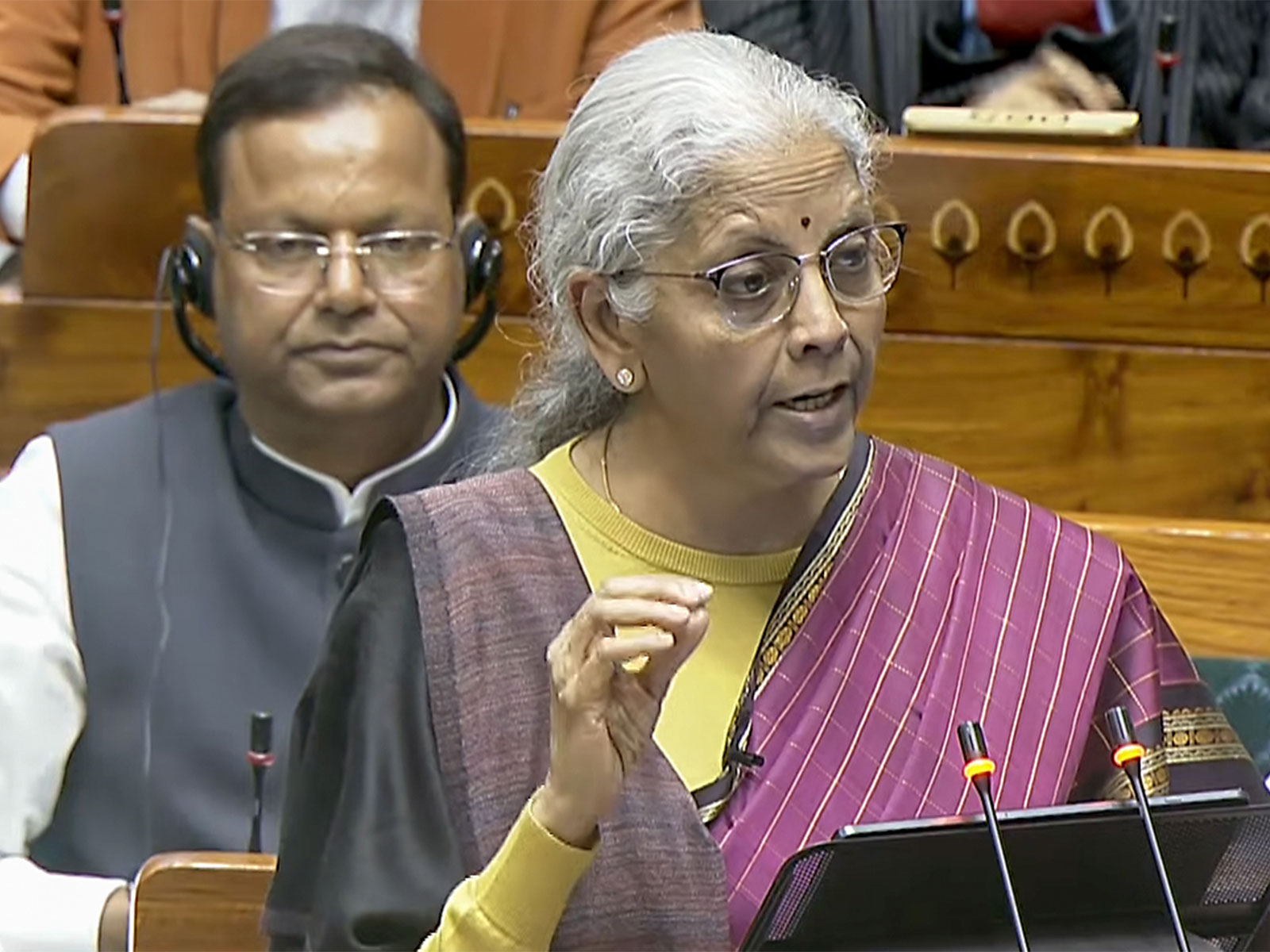

New Delhi [India], February 1 : In response to the US tariffs, Union Finance Minister Nirmala Sitharaman on Sunday proposed reducing the tariff rate on all dutiable goods imported for personal use from 20 per cent to 10 per cent.

In line with the government's aim to promote exports and lift the seafood industry hit by US tariffs, FM Sitharaman propose to increase the limit for duty-free imports of specified inputs used for processing seafood for export from the current one per cent to three per cent of the FOB value of the previous year's export turnover.

Union FM Nirmala Sitharaman said, "I propose to increase the limit for duty-free imports of specified inputs used for processing sea foods for export from the current one per cent to three per cent of the FOB value of the previous year's export turnover. I also propose to allow duty-free imports of specified inputs, which is currently available for exports of leather or synthetic footwear to exports of shoe uppers as well."

In a boost to the defence sector, FM Sitharaman announced, "It is proposed to exempt basic customs duty on raw materials imported for the manufacture of parts of aircraft to be used in maintenance, repair or overhaul requirements by units in the defence sector."

The Finance Minister proposed a basic customs duty exemption to capital goods used for manufacturing lithium-ion cells for batteries and critical minerals.

Union FM Nirmala Sitharaman said, "I propose to extend the basic customs duty exemption on import of goods required for nuclear power projects till 2035 and expand it for all nuclear plants irrespective of their capacity."

"I propose to extend the basic customs duty exemption given to capital goods used for manufacturing lithium-ion cells for batteries to those used for manufacturing lithium-ion cells for battery energy storage systems also. I propose to exempt the basic customs duty on the import of sodium antimonate for use in the manufacturing of solar glass. It is proposed to provide basic customs duty exemption to the import of capital goods required for the processing of critical minerals in India," the Finance Minister added.

The customs duty exemptions and aid to export comes after the United States President Donald Trump imposed 50 per cent tariffs on imports of Indian goods, affecting the Indian textile, seafood and other exports.

Finance Minister Nirmala Sitharaman has also proposed to support mineral-rich states such as Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to establish dedicated rare earth corridors.

FM Sitharaman presented the Union Budget for the record ninth time.