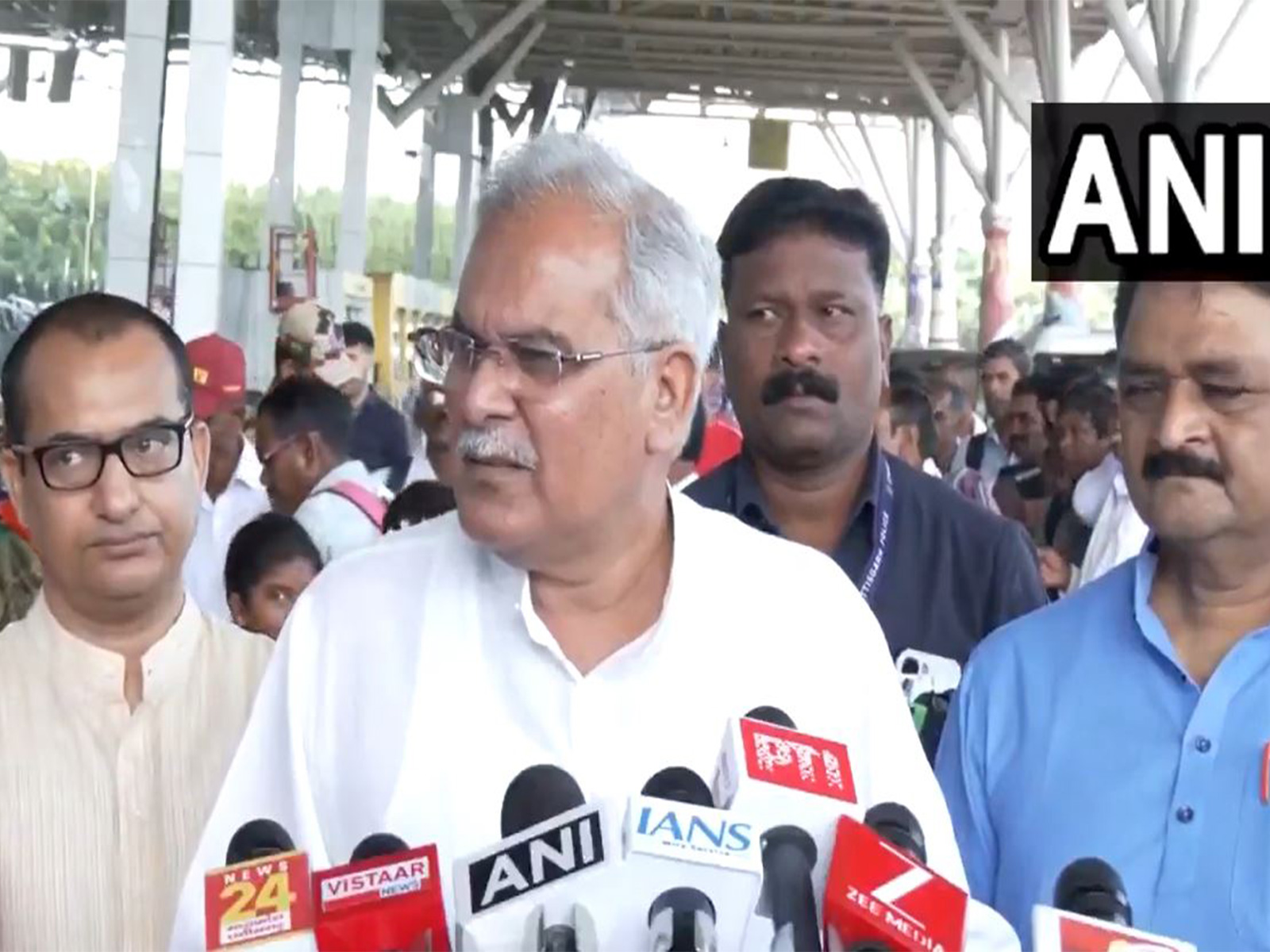

"Country was looted for 8 years by imposing wrong GST": Congress' Bhupesh Baghel criticises Centre

Sep 23, 2025

Raipur (Chhattisgarh) [India], September 23 : Congress leader Bhupesh Baghel on Tuesday accused the Central government of "looting" people by imposing the "wrong" rates of the Goods and Services Tax (GST) for the past eight years, which he claimed severely limited people's income and wiped out businesses.

"For 8 years, the country was looted by imposing wrong GST. Businesses were wiped out and the common people's income was limited. They kept on saying 'One Nation One Tax' but imposed five slabs. Businesses were wiped out and the common people's income was limited, and now 8 years later they understood that prices have increased," Baghel told reporters in Raipur.

Accusing the Bharatiya Janata Party of repeating the same promises of creating jobs and helping businesses they did years ago, the Congress leader took a jibe at Prime Minister Narendra Modi and asked him to check his previous speeches too, while saying that the rate rationalisation will not be beneficial enough to the people.

"These people had earlier also been saying the same thing that this (GST) would control inflation. Even today, after 8 years, these people are repeating the same language. The Prime Minister should look at his own speeches, he said the same thing then and now the same too. This means there is no understanding of the economic situation. How much will people save with this? 115 per month for each person? What will happen? They keep on saying 2 lakh crore, 40 crore will be given to the people, but what will people do with Rs 115 per month?" he said.

The new GST rate rationalisation has reduced the earlier five slabs for the indirect tax to just two slabs, with an additional 40 per cent tax levied on specifically luxury and sin goods.

The 40 per cent tax is levied on luxury and sin goods, including tobacco and pan masala, cigarettes, bidis, and aerated sugary beverages and on luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

Meanwhile, a "GST Bachat Utsav" is also being celebrated across the country, as automobile manufacturers pass on the benefits to the rate reduction on certain cars and two wheelers to the consumers.

The reform in the Goods and Services Tax structure, which was approved during the 56th meeting of the GST Council earlier this month, has come into effect on September 22.