ED to auction seized aircraft Hawker 800A in Hyderabad on Dec 9

Dec 02, 2025

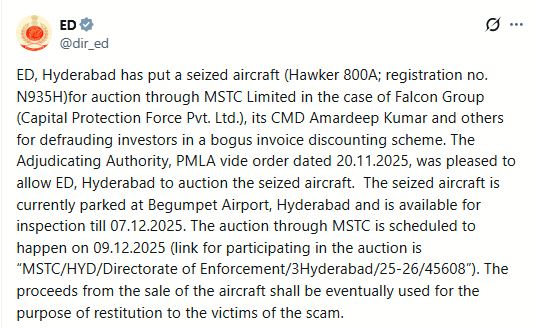

Hyderabad (Telangana) [India], December 2 : The Enforcement Directorate's (ED) Hyderabad Zonal Office on Tuesday announced the auction of a seized aircraft, Hawker 800A, through MSTC Limited.

https://x.com/dir_ed/status/1995856534245703778?s=20

The aircraft, currently parked at Begumpet Airport, Hyderabad, is available for inspection until December 7, with the auction scheduled for December 9.

The proceeds from the sale will be used to compensate the victims of the related scam. The aircraft was seized by ED from Rajeev Gandhi International Airport during a search operation on March 7 under the provisions of the Prevention of Money Laundering Act (PMLA), 2002

Earlier in the day, the Enforcement Directorate (ED) on Tuesday launched extensive searches across multiple locations in Jharkhand, Maharashtra, and Gujarat in connection with an ongoing probe under the Foreign Exchange Management Act (FEMA), officials said.

The searches began early Tuesday following actionable intelligence and were carried out in coordination with state police."The action is being carried out under Section 37 of FEMA and is primarily focused on Ranchi-based chartered accountant Naresh Kumar Kejriwal, who is suspected to be a key figure in an illicit hawala and foreign fund diversion network. Searches are simultaneously underway at his residence and premises linked to his family members and close associates in Ranchi, Mumbai, and Surat," said the officials privy to the development.

According to senior officials familiar with the investigation, the ED's action was prompted by a detailed report from the Income Tax Department.

"The findings reportedly revealed that Kejriwal has financial control over a network of undisclosed offshore shell firms operating out of the United Arab Emirates, Nigeria, and the United States. Officials stated that despite being incorporated abroad, these shell entities were allegedly being managed from India and lacked legitimate commercial activity."

Preliminary scrutiny suggests that these offshore firms collectively amassed unexplained financial reserves exceeding Rs 900 crore, they said.

Investigators believe that a significant portion of this amount was illegally funnelled back into India through fraudulent telegraphic transfers. Officials estimate that nearly Rs 1,500 crore may have been routed into domestic accounts through forged documentation, layered corporate channels, and sham import-export declarations.

The agencies suspect that these transactions were part of a larger organised hawala network facilitating tax evasion, foreign exchange violations, and possible money laundering. Authorities also highlighted that these foreign holdings and transactions were never disclosed in statutory filings, a mandatory compliance requirement under Indian financial and taxation laws.

During ongoing searches, the ED is focusing on retrieving key documentary evidence, digital records, transaction trails, and communication logs to establish the scale of cross-border violations and identify additional beneficiaries or conspirators.