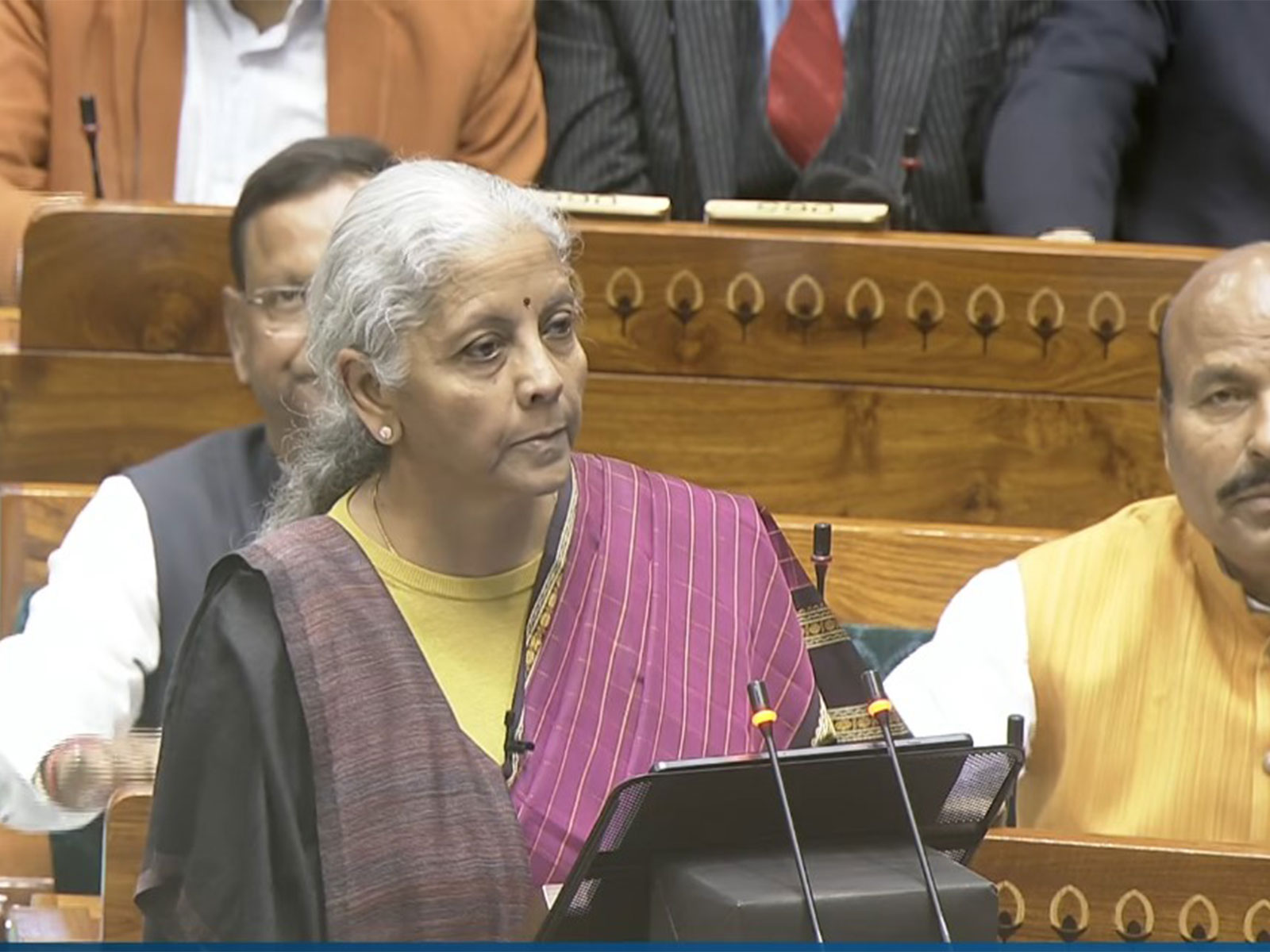

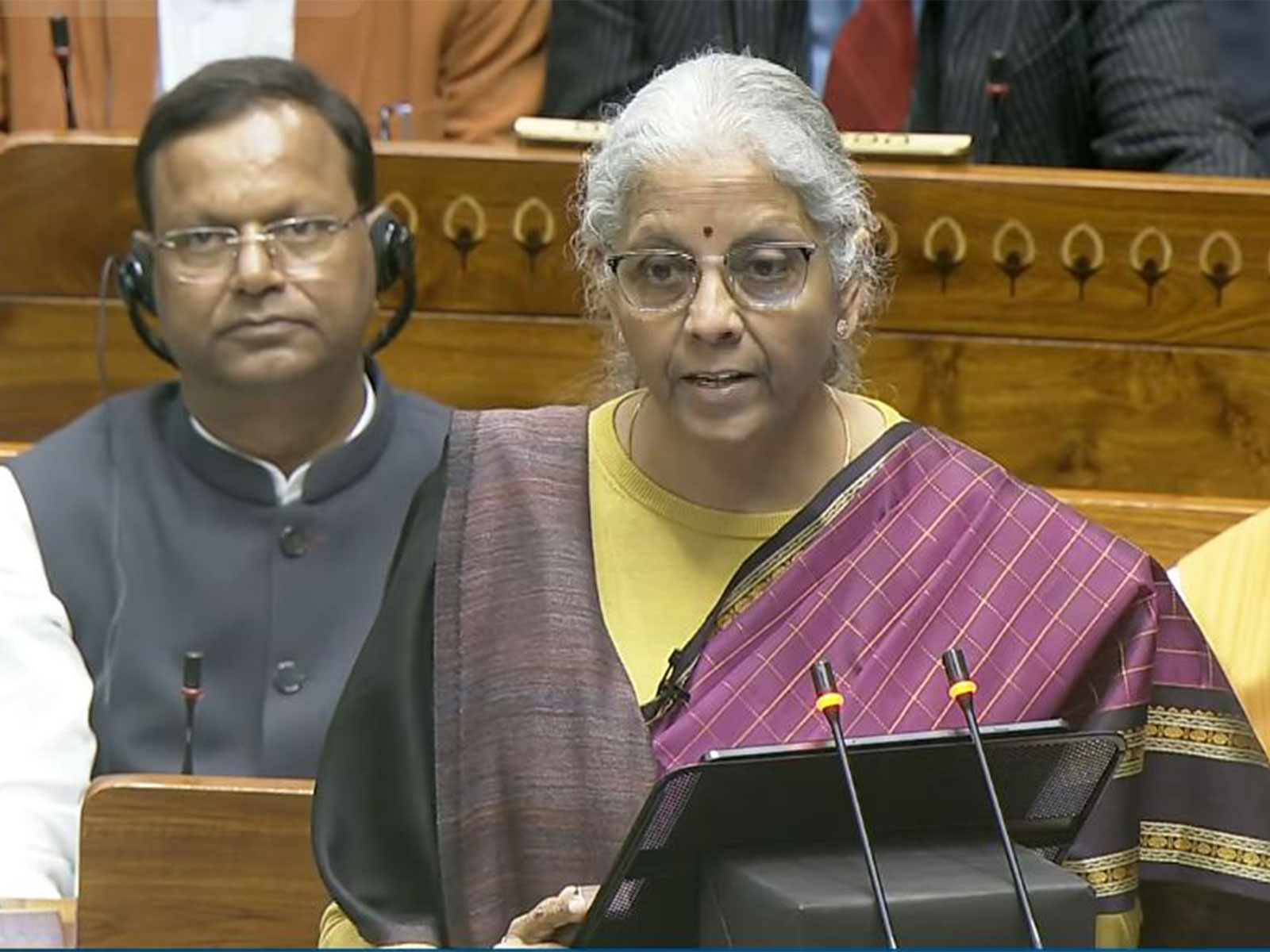

FM Nirmala Sitharaman arrives at Parliament to attend Cabinet meeting ahead of Budget presentation

Feb 01, 2026

New Delhi [India], February 1 : Finance Minister Nirmala Sitharaman on Sunday arrived at the Parliament to attend the Cabinet meeting ahead of presenting the Budget 2026-27 in Lok Sabha. FM Sitharaman is set to present her ninth consecutive Union Budget.

The Union Cabinet, headed by Prime Minister Narendra Modi, will approve the Union Budget 2026-27 in Parliament.

She will present the Union Budget for the financial year 2026-27 in the Lok Sabha as part of the ongoing Budget session of Parliament.

According to the List of Business, the Lower House will meet at 11 am. Sitharaman will present a statement of the estimated receipts and expenditure of the Government of India for the year 2026-27.

The Finance Minister will also lay on the table two statements under Section 3(1) of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003. These include the Medium-term Fiscal Policy-cum-Fiscal Policy Strategy Statement and the Macro-Economic Framework Statement.

The List of Business further states that Sitharaman will move for leave to introduce the Finance Bill, 2026, in the Lok Sabha. The Finance Bill gives legal effect to the financial proposals of the government.

She is expected to present a Rs 54.1 lakh crore Union Budget for FY 2026-27, registering a year-on-year growth of 7.9 per cent, according to a report by Sunidhi Securities & Finance Limited.

The report highlighted that the size of the Union Budget, measured by Total Expenditure (TE) as a percentage of GDP, is the clearest indicator of the government's fiscal intent.

This will mark the first Union Budget after the historic Goods and Services Tax (GST) reforms and Labour Codes.

The government has consolidated 29 labour laws into four Labour Codes covering wages, industrial relations, social security and occupational safety. The new framework extends social security benefits to unorganised, gig and platform workers, while improving workplace safety and simplifying compliance for employers.

Meanwhile, GST reforms, branded as 'GST 2.0', aimed to simplify indirect taxation through a two-rate structure of 5 per cent and 18 per cent, reduce compliance costs and lower the cost of living through rate cuts on essential goods and services.

This time, the budget document is significant, as the government is likely to focus on export growth following the United States' imposition of a 50 per cent tariff on Indian goods.

On Thursday, FM Sitharaman tabled the Economic Survey of India in Parliament for the 2025-26 financial year.

The Budget session will span 30 sittings over 65 days, concluding on April 2. The two Houses will adjourn for a recess on February 13 and reconvene on March 9 to enable the Standing Committees to examine the Demands for Grants of various ministries and departments.