Gold and Silver see sharp correction after record rally; experts say fall is due to profit booking

Oct 18, 2025

By Nikhil Dedha

New Delhi [India], October 18 : After a bumper rally over the past few weeks, the precious metals market witnessed a sharp correction on Friday, as both Gold and Silver prices tumbled on the Multi Commodity Exchange (MCX).

The decline came amid a profit-taking wave triggered by specific external market factors that temporarily eased geopolitical and economic anxieties.

Gold prices of 24 kt on MCX, which had recently touched a record high of Rs 1,32,294 per 10 grams, fell by around 3 per cent to Rs 1,25,957 per 10 grams.

Silver saw an even steeper fall, declining by more than 8 per cent, slipping from Rs 1,70,415 per kg to Rs 1,53,929 per kg.

Market experts described the correction as a healthy and expected development following an extraordinary rally in recent months.

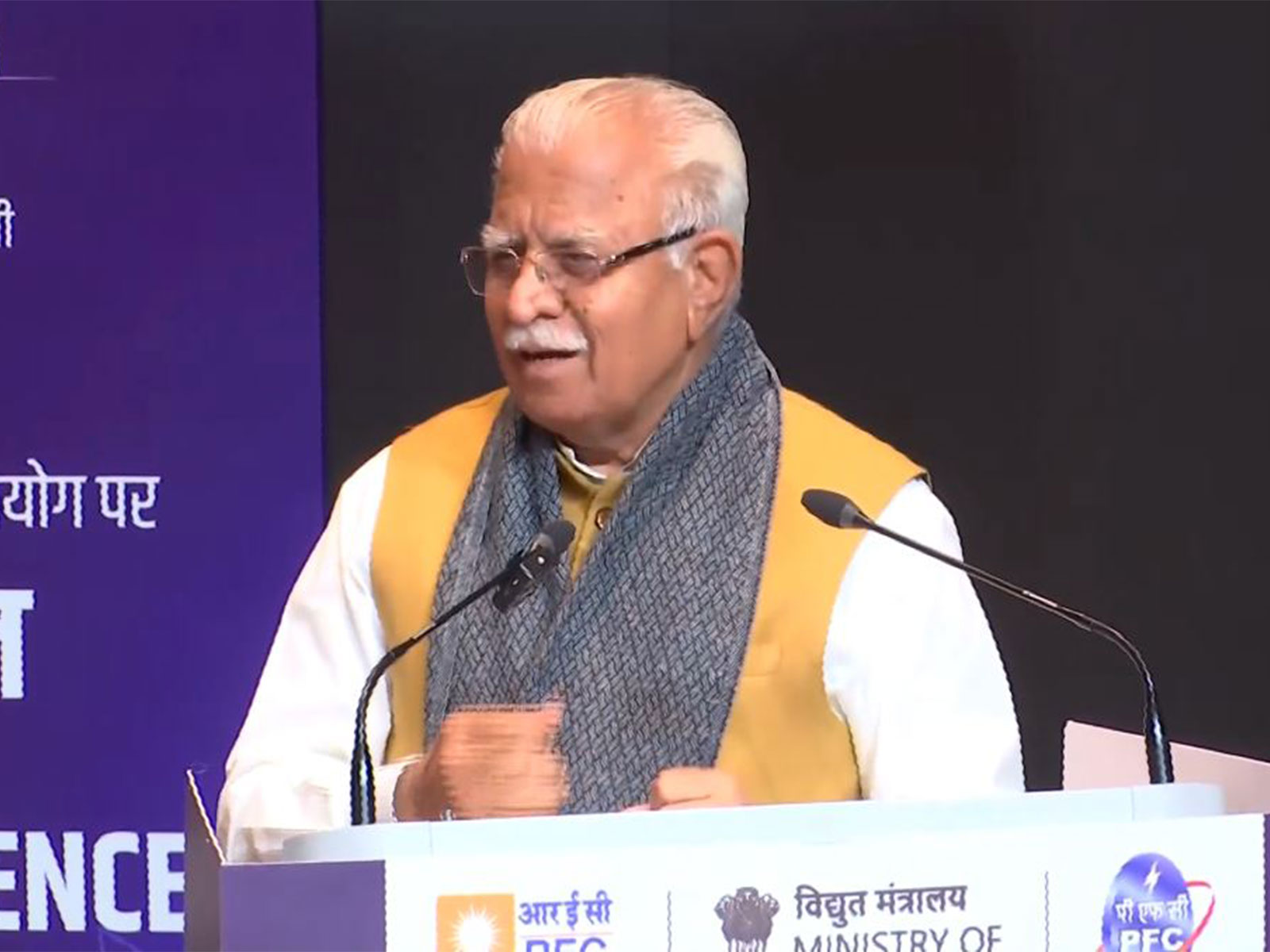

Ajay Bagga, Banking and Market Expert, told ANI that Friday's price fall was a "necessary tactical retreat" driven by short-term sentiment shifts and natural profit-taking after a historic rally.

He pointed out that one of the key factors behind the sudden pullback was the more conciliatory tone from U.S. President Donald Trump regarding the threatened high tariffs on China, which helped ease global tensions.

"The strategic case for Gold and Silver remains highly compelling, supported by structural factors including global de-dollarization, persistent supply deficits in Silver, central bank accumulation, and an environment of low real interest rates and high geopolitical risk," Bagga added.

He advised investors to view the correction as an opportunity to establish or add to long-term positions.

According to Bagga, Silver's outlook remains even stronger than Gold's due to its dual nature as both a precious metal and a critical industrial metal.

"Given the recent speculative frenzy and physical market dislocation, traders must be cautious. However, the long-term trend remains firmly upward, supported by industrial growth," he said.

MCX, which stands for Multi Commodity Exchange of India, is India's first listed electronic commodity derivatives exchange where online trading of commodity futures and options takes place.

It functions similarly to stock exchanges like the BSE and NSE, but focuses on commodity contracts such as gold, silver

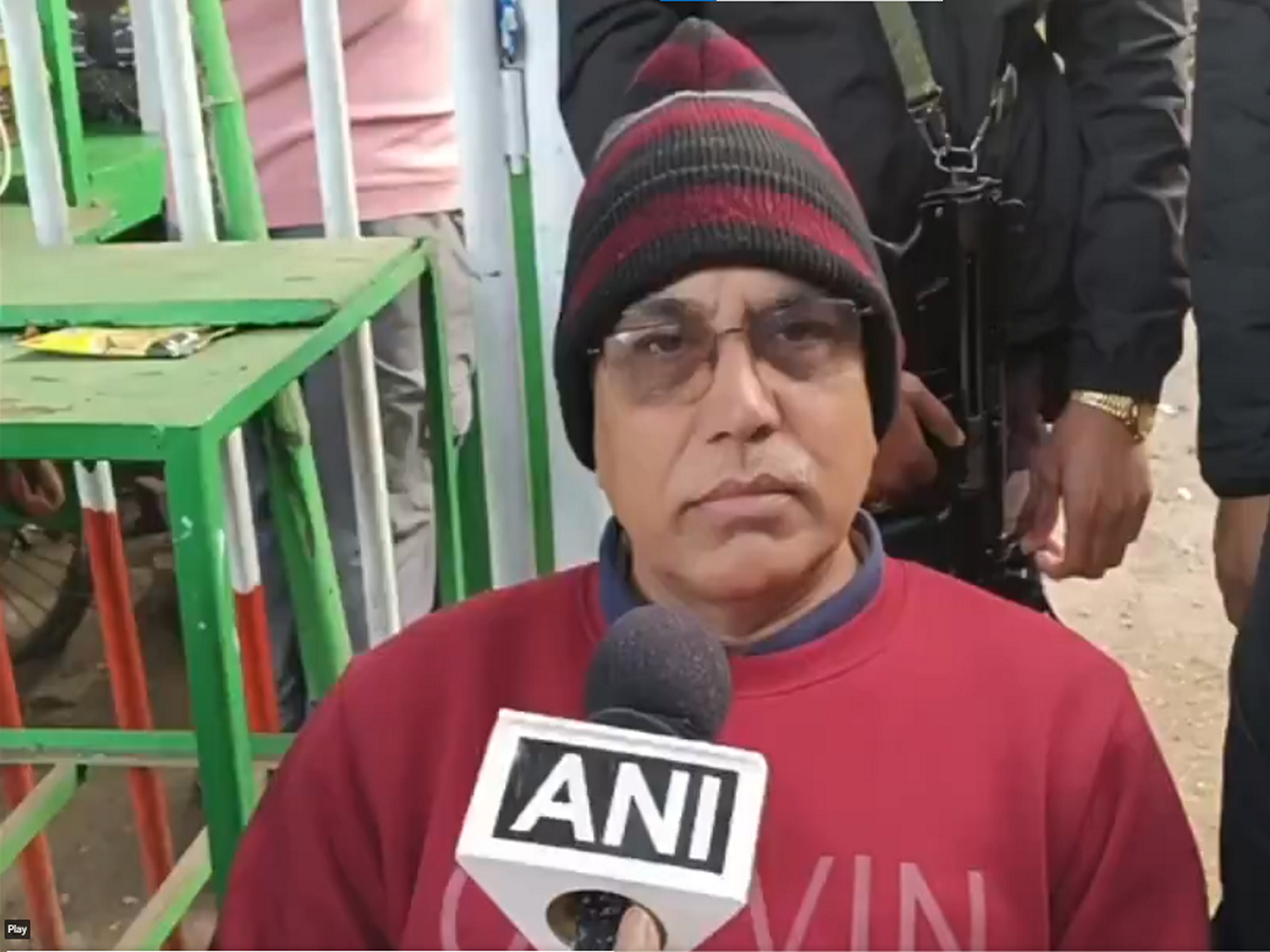

Echoing a similar sentiment, Ajay Kedia, Founder and Director of Kedia Commodities, told ANI the sudden fall was on expected lines.

"Just as we witnessed a parabolic rise in the last two months, this correction was overdue. From August till now, we've seen the biggest rally in nine weeks -- a one-sided surge," he explained.

Kedia said that apart from profit-booking, the planned talks between the U.S. and China, as well as discussions between the U.S. and Russia regarding peace, also contributed to the pullback.

"All these developments together triggered the fall, and technically, the market was highly overbought, which made a correction necessary," he noted.

However, Kedia emphasized that the fall does not mean the market has taken a complete U-turn. "No one knows when Donald Trump might make a move. As of now, this is the first major drop in eight weeks. The next week will be important," he said.

He added that on Dhanteras, people can still buy gold and silver for ceremonial purposes, but for those seeking returns, the market remains uncertain. "Silver can fall 8 per cent in a single day even though it has doubled in a year, so a correction is still due," Kedia said.

Despite the sharp fall, both experts agreed that the broader outlook for precious metals remains strong in the long run, with the current correction being part of a normal market cycle following a sustained rally.