"GST Bachat Utsav" will begin tomorrow: PM Modi says Next Gen reforms will benefit poor, middle-class

Sep 21, 2025

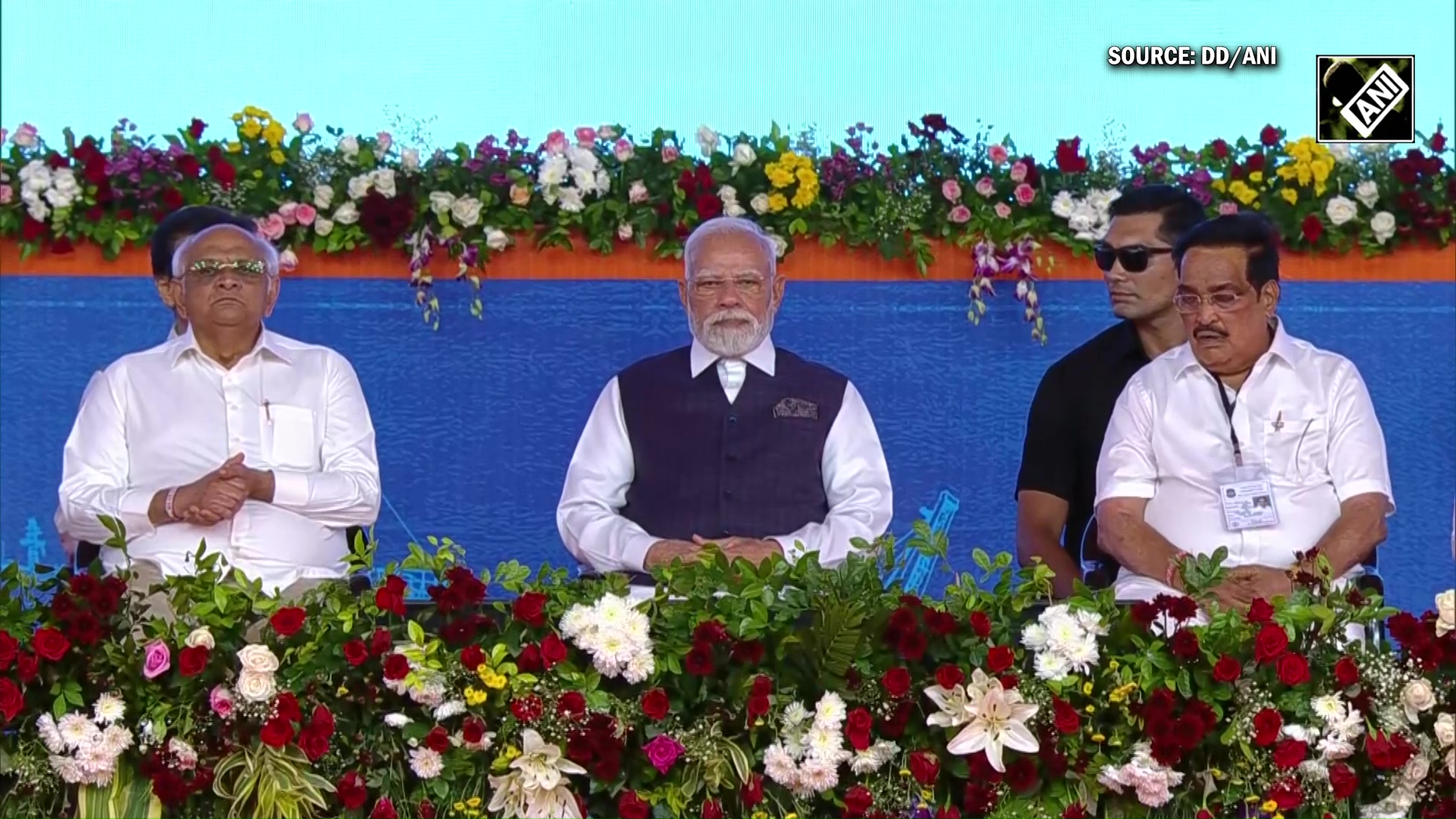

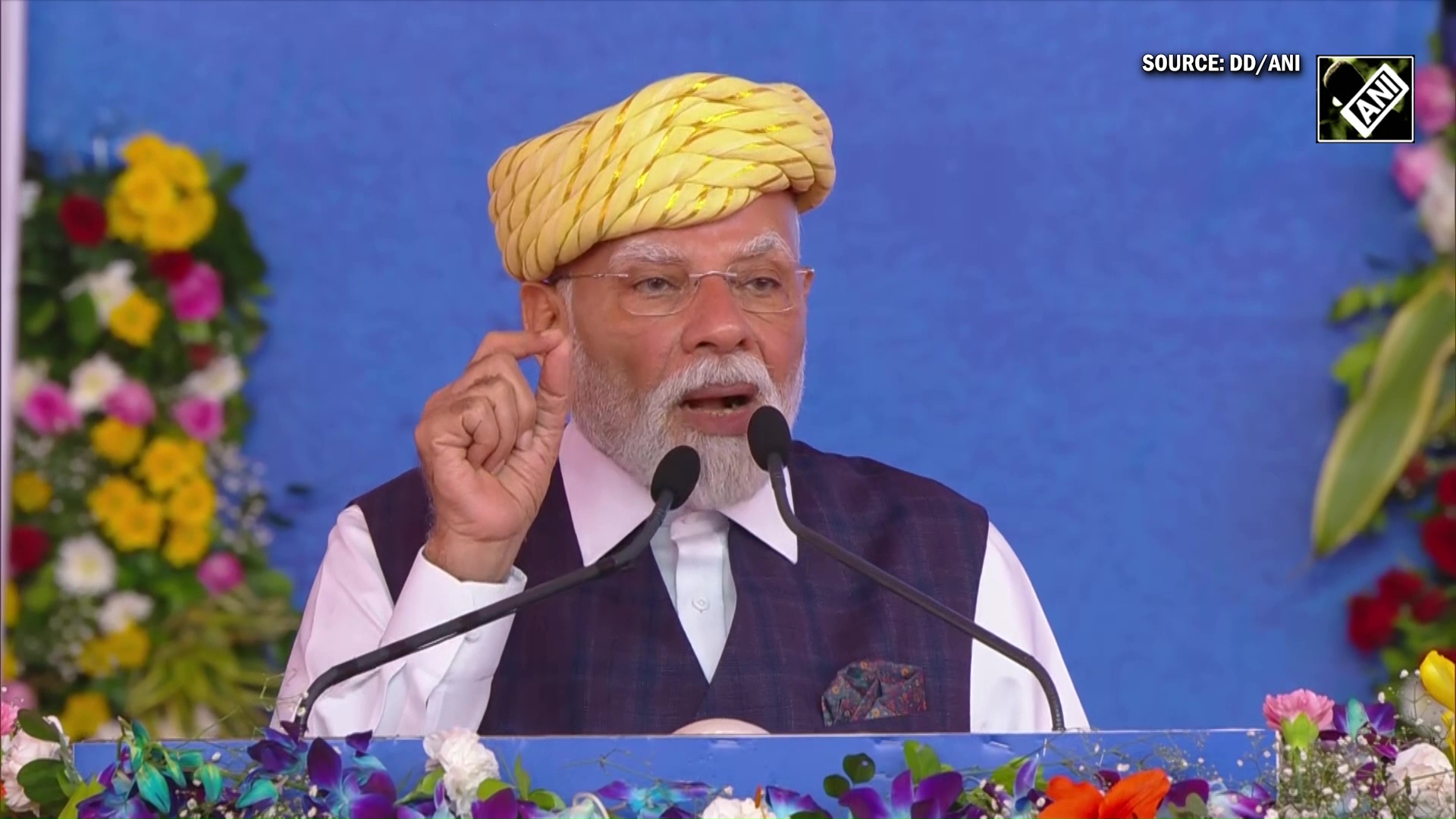

New Delhi [India], September 21 : Prime Minister Narendra Modi on Sunday announced the implementation of the next-generation Goods and Services Tax (GST) reforms from September 22, marking what he called a major step towards the Aatmanirbhar Bharat Abhiyan.

Addressing the nation ahead of the rollout, PM Modi said the reforms would usher in a countrywide "GST Bachat Utsav," benefiting poor, middle-class, farmers, traders, and entrepreneurs alike.

"From the sunrise of the very first day of Navratri, the nation is taking another important and major step towards the Aatmanirbhar Bharat Abhiyan. Tomorrow, on the first day of Navratri, September 22, along with the rising of Suryadev, the Next Generation GST Reforms will come into effect," he said.

The Prime Minister said that with the increased savings and easier purchases, the poor, middle class, farmers, women, traders and entrepreneurs of the country are all set to "benefit greatly."

"From tomorrow, across the country, a 'GST Bachat Utsav' will begin. In this GST Bachat Utsav, your savings will increase and you will be able to purchase your favourite items more easily. The poor, middle class, neo middle class, youth, farmers, women, shopkeepers, traders, and entrepreneurs -- all will benefit greatly," he said.

PM Modi said, "During this festive season, everyone will have reason to celebrate, and the happiness of every family in the country will grow."

Calling it a festive gift, the Prime Minister said the reforms would accelerate India's growth story, make business easier, attract investment, and ensure every state becomes an equal partner in development.

"When India took the historic step of implementing GST in 2017, it marked the beginning of changing an old system and creating a new history. For decades, the people of our country, including all of you and our traders, were caught in the web of multiple taxes -- octroi, entry tax, sales tax, excise duty, service tax, and dozens of other such levies," he said.

The reform in the Goods and Services Tax structure was approved during the 56th meeting of the GST Council earlier this month is set to come into effect from September 22.

The current four-rate system will now be replaced with a streamlined two-slab regime of 5 per cent and 18 per cent. A separate 40 per cent slab has been retained for luxury and sin goods.

This new framework is expected to ease compliance, reduce consumer prices, boost manufacturing, and support a wide range of industries, from agriculture to automobiles and from FMCG to renewable energy, and is intended to lower the cost of living, strengthen MSMEs, widen the tax base, and drive inclusive growth.

In the fast-moving consumer goods (FMCG) and dairy sector, major brands like Amul and Mother Dairy have announced substantial price cuts, reflecting the full benefit of the GST reduction.

Items like milk, butter, ghee, paneer, cheese, ice cream, snacks, and frozen foods have been brought under the 5 per cent slab, due to which 100 g of Amul butter will now cost Rs 58 instead of Rs 62, and Ultra High Temperature milk (UHT) has dropped to Rs 75 per litre from Rs 77.

Mother Dairy has also slashed prices on milkshakes, paneer, ghee, and frozen products.

The automobile sector has seen one of the most impactful reforms. Two-wheelers up to 350cc, small cars, and auto parts have moved from the 28 per cent slab to 18 per cent, lowering the cost of ownership.

Tractors under 1800 cc will now attract only 5 per cent GST, down from 12 per cent, while commercial goods vehicles and buses will also be taxed at 18 per cent. These changes are expected to boost vehicle sales, benefit gig workers and farmers, and create employment across the entire automotive value chain.

In the housing and construction sector, cement has been moved from the 28 per cent to the 18 per cent slab, while essential building materials such as granite blocks, marble, and sand-lime bricks have been placed under the 5 per cent rate. These changes aim to make homes more affordable and support infrastructure development across urban and rural India.

Agriculture has received a significant push, with key farm equipment like harvesters, threshers, sprinklers, and drip irrigation systems now taxed at just 5 per cent.

The healthcare and pharmaceutical sectors have also been given priority. Over 30 life-saving drugs and diagnostic kits have been made fully exempt from GST, while other essential medicines, including those used in traditional systems like Ayurveda and Unani, will attract just 5 per cent GST. Medical devices like thermometers, glucometers, and corrective lenses have also been moved to the lower tax bracket, making healthcare more affordable for the masses.

The service sector has not been left behind. Hotel stays priced up to Rs 7,500 per day will now attract 5 per cent GST instead of 12 per cent, while services such as gyms, salons, barbers, and yoga centres have seen their rates fall from 18 per cent to 5 per cent.

In the field of education, tools like pencils, crayons, erasers, and exercise books have been fully exempted from GST. Geometry boxes and other school supplies, previously taxed at 12 per cent, will now fall under the 5 per cent slab. Education and core healthcare services will continue to be exempt.

The textile and handicrafts industries are also major beneficiaries. The inverted duty structure on man-made fibres has been corrected, and GST on yarn and fibres has been reduced to 5 per cent.

The Ministry of Railways has also announced a reduction in the price of Rail Neer packaged drinking water, with the 1-litre bottle now priced at Rs 14, down from Rs 15, effective across the country starting September 22.

The renewable energy sector stands to gain significantly, with GST on equipment and components cut from 12 per cent to 5 per cent. The Ministry of New and Renewable Energy estimates that this will bring down the capital cost of large-scale solar projects by Rs 20 to Rs 25 lakh per megawatt. This could translate into savings of over Rs 100 crore for a 500 MW solar park, ultimately lowering electricity costs for households, businesses, and public utilities.

Government sources say GST on essentials like soaps, shampoos, and packaged foods has been cut to 5 per cent, while appliances like ACs and large TVs now fall under the 18 per cent slab.

While most goods and services now fall under the simplified two-slab system, luxury and sin goods, such as tobacco, pan masala, high-end motorcycles, yachts, and aerated drinks, will continue to be taxed at the special 40 per cent rate along with an additional compensation cess.