GST rate cuts welcomed in Shimla as citizens, traders say relief will boost consumers and economy

Sep 22, 2025

Shimla (Himachal Pradesh) [India], September 22 : The implementation of the revised Goods and Services Tax (GST) rates from Monday has been widely welcomed across Shimla, with residents, vendors, and traders calling it a "positive step" that will directly benefit ordinary citizens, reduce inflation, and boost business activity in the coming festive season.

Locals pointed out that the decision to simplify slabs into primarily 5 percent and 18 percent, while lowering or eliminating GST on several essential commodities, will ease household expenses and create wider economic opportunities.

"The public will benefit a lot from this move because no item will have GST above 18 percent now. Items that earlier had 28 percent GST are down to 5 percent or even exempted. Milk, curd, pulses and flour have been reduced to 5 percent, which will directly help households," said Sanjay Singh, a local resident of Shimla. He added that the cuts will bring down the prices of electronics and food items, which had earlier become costlier due to higher GST rates.

"Now things will be cheaper, and inflation will come down. GST should be properly implemented so that every citizen buys with a bill and contributes to the nation's revenue. During upcoming festivals like Navratri, Dussehra, and Diwali, this reduction will directly benefit consumers," he said.

For small vendors, the GST cuts are also being seen as a boost for business as well as government revenues. "I read in the newspapers that where GST was 28 percent, it has now been reduced. Every customer should take a bill and pay GST. This way, the government earns revenue which will be spent on development," said Ratan Lal Gautam, a local vendor in Shimla.

"When GST is lower, inflation also reduces. People will buy more. The money collected through GST will go into the country's development. Common citizens will also benefit directly since essential goods like milk, curd and daily household items are cheaper now." He added.

Traders too expressed optimism that the changes will reduce operational complexities and improve sales.

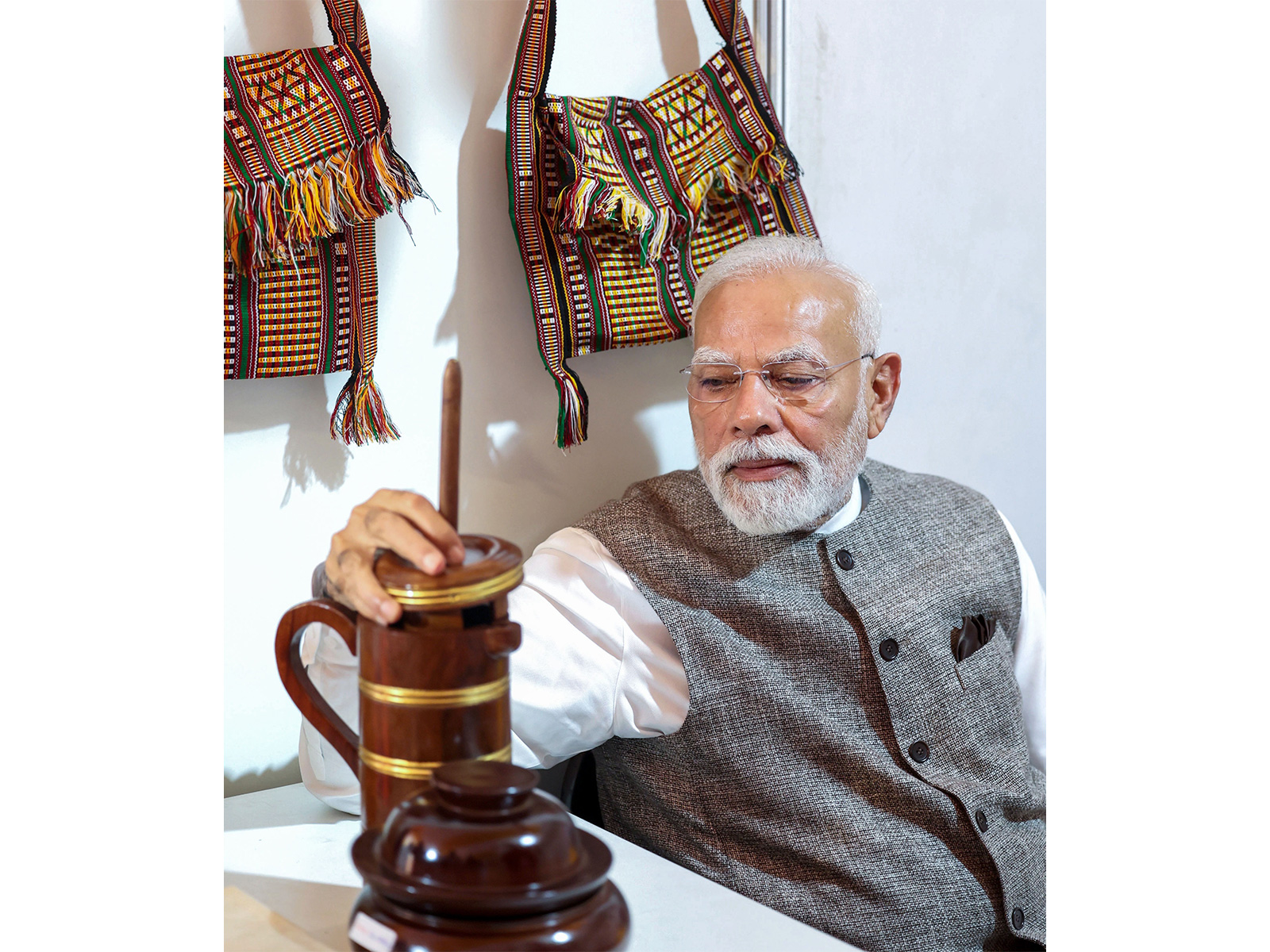

"This is a big change. Around 95 percent of items have now been put into simplified slabs. This will benefit both traders and consumers. It's a very important step by Prime Minister Modi," said Pyar Singh, a trader dealing in hardware and supplies.

"When taxes are simplified and rates reduced, both sides gain. Consumers save money and traders also see higher sales. This is a win-win situation for all," he added.

Retired officer and local resident Subhash Verma highlighted the long-term macroeconomic benefits of the reform. "This move to reduce GST to 5 percent and 18 percent is a very good initiative. While in the short term there may be some dip in revenue collection for the state, in the long run, cheaper goods will mean higher demand and higher production, which will generate employment," he said.

"Tourism, agriculture and small industries will benefit. Lower GST on room rents will attract more tourists, while reduced costs for horticulture and agricultural products like apples and potatoes will directly help farmers. When production rises, unemployment will reduce, and both small and medium industries will see growth. Even transport costs will come down if petrol and diesel are taxed lower, which will make essentials more affordable in markets," Verma said.

Overall, the reactions from across sections in Shimla reflect a clear optimism that the GST rationalisation will bring relief to households, encourage fair billing practices, and fuel economic growth at both local and national levels.