GST rate drones slashed to 5%

Sep 09, 2025

New Delhi [India], September 9 : Under the new Goods and Services Tax (GST) reforms, a uniform GST of 5% has been introduced for all drones, regardless of whether the camera is integrated or separate and irrespective of whether they are used for commercial or personal purposes, said the Union Ministry of Civil Aviation in a release.

This reform aligns with the Government of India's vision to foster a robust, safe and internationally competitive drone ecosystem.

The GST reforms approved by the 56th GST Council Meeting will support the growth of various sectors, including India's rapidly growing drone ecosystem.

Earlier, the GST rate was 18% for drones with integrated cameras and 28% for drones classified for personal use. Under the new reforms, a uniform GST of 5% has been introduced for all drones, regardless of whether the camera is integrated or separate and irrespective of whether they are used for commercial or personal purposes. This reform aligns with the Government of India's vision to foster a robust, safe and internationally competitive drone ecosystem, said the ministry.

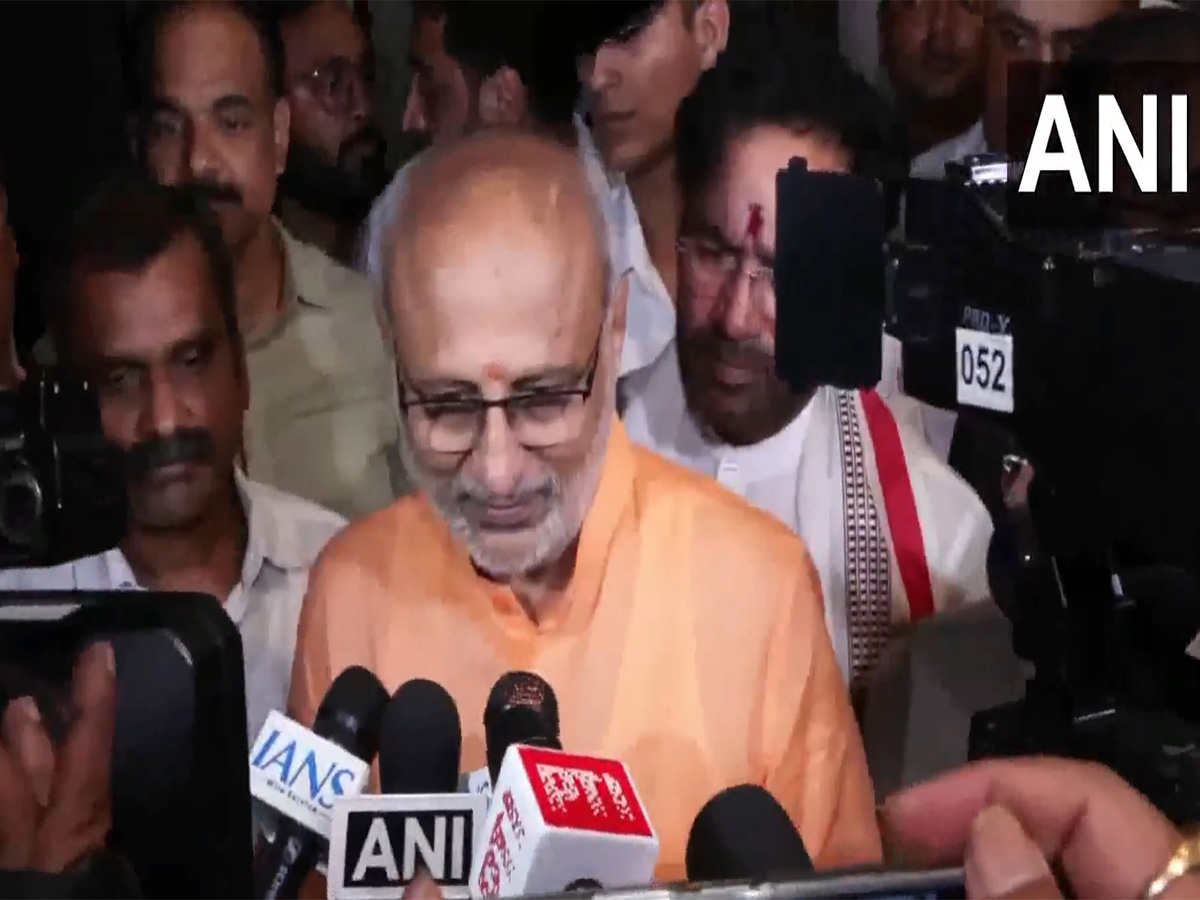

Minister for Civil Aviation, Ram Mohan Naidu, appreciated the reforms, saying, "The GST rate rationalisation with a simplified two-slab structure of 5% and 18% is the biggest reform in India's indirect taxation ever. Under the strong leadership of our Prime Minister Narendra Modi, we are charting the path towards our goal of Viksit Bharat 2047 with Atmanirbhar Bharat as its foundation."

He said that the sweeping rate reductions across sectors will strengthen ease of living, ease of compliance and ease of doing business in the country.

"It is going to be a big boon for the consumers and at the same time a big boost for the Indian manufacturers. This significant measure will also enable India to emerge as a leader in transformative technologies like drones. A uniform 5% GST will now apply on all drones, providing significant policy certainty and eliminating classification disputes. Furthermore, flight simulators and motion simulators, which are critical for pilot training, have also been exempted from GST. I believe it will encourage the training ecosystem in the country, helping airlines and academies reduce expenditure on training equipment," he said.

Greater clarity for manufacturers and lower costs for users will boost drone adoption, especially in sectors like agriculture (crop monitoring, pesticide spraying), petroleum and mining (pipeline and asset inspection), infrastructure (surveying and mapping), logistics (last-mile delivery) and defence/security (surveillance and rapid response).

Affordable and accessible drones will advance India's goals under Make in India and Atmanirbhar Bharat, while enhancing the efficiency of multiple industries and public services.

The rationalised GST rate is also expected to generate employment opportunities in drone manufacturing, assembling, software development, data analytics and field operations.

With the revised rates and exemptions, GST has become more growth-oriented for aviation and emerging technologies like UAVs. This landmark step recognises drones as both an economic opportunity and a strategic necessity for India. The sunrise Sector of Drones will benefit significantly with the simplified regime, said the ministry.