"GST reforms are a historic initiative": Maharashtra CM Fadnavis lauds PM Modi's nation address

Sep 21, 2025

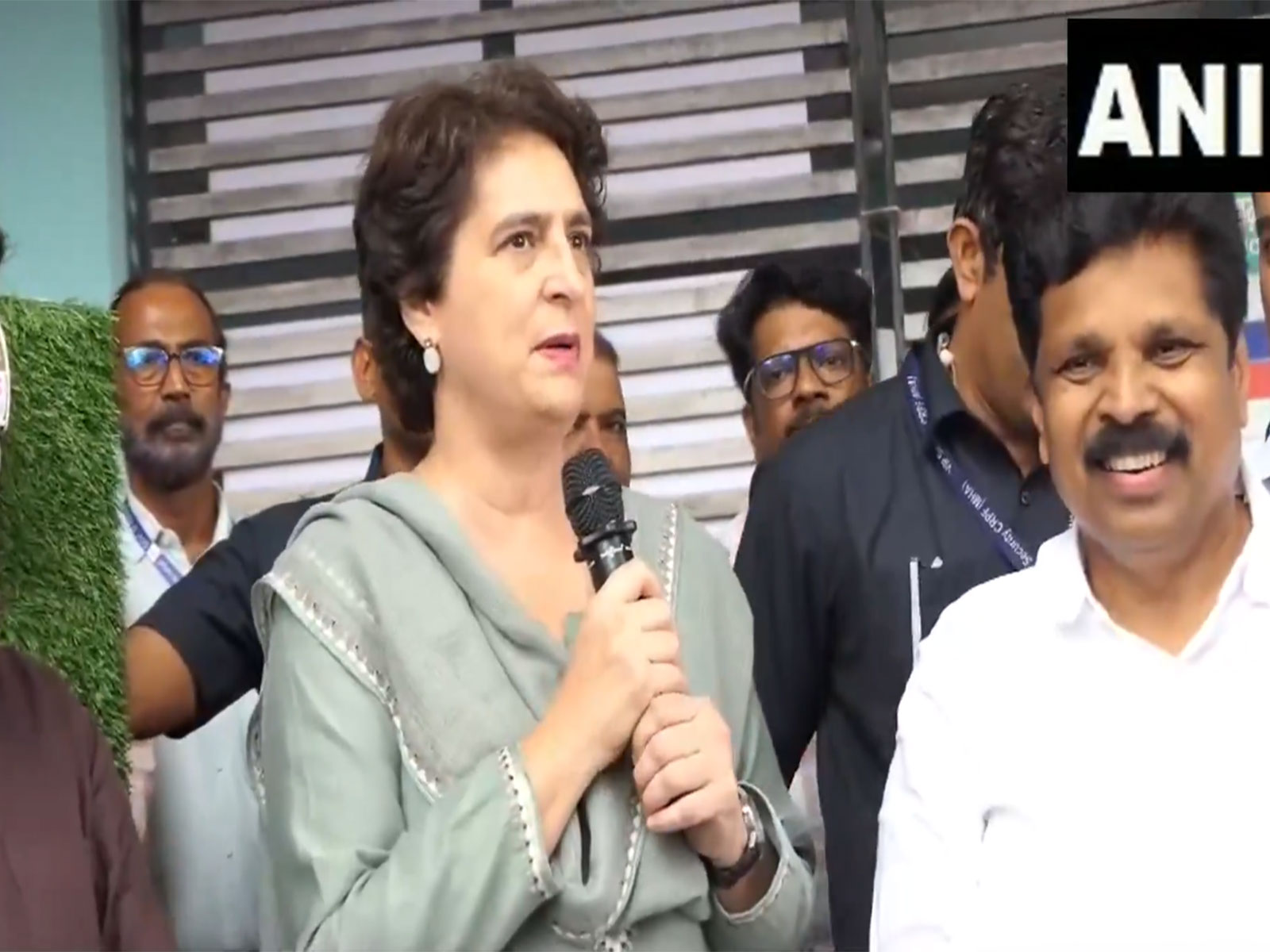

Mumbai (Maharashtra) [India], September 21 : Maharashtra Chief Minister Devendra Fadnavis on Sunday lauded the recently approved Goods and Services Tax reforms and termed it as a "historic initiative".

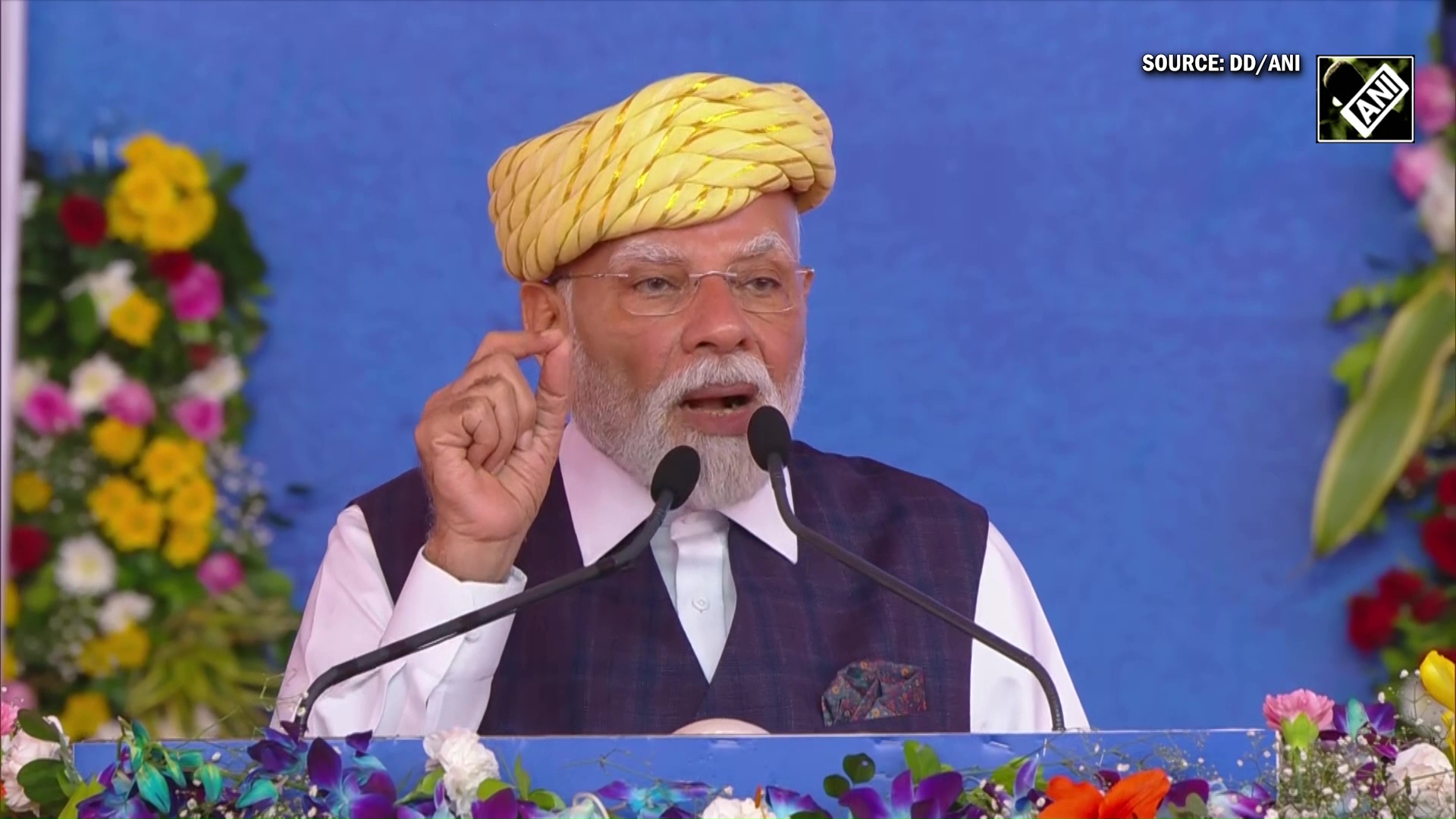

Speaking to the reporters, CM Fadnavis stated that the "bold" step taken by the PM Narendra Modi-led Union Government will reduce the prices of daily-use products. He also considered the step as a massive boost to the Indian economy and the Atmanirbhar Bharat initiative.

"The second generation GST reforms are a historic initiative...This is a very bold step taken by the PM Modi-led government and the prices of daily-use products will reduce and they will highly benefit from it...This will also boost the Indian economy and is a big step towards 'Atmanirbhar Bharat'," Devendra Fadnavis told reporters.

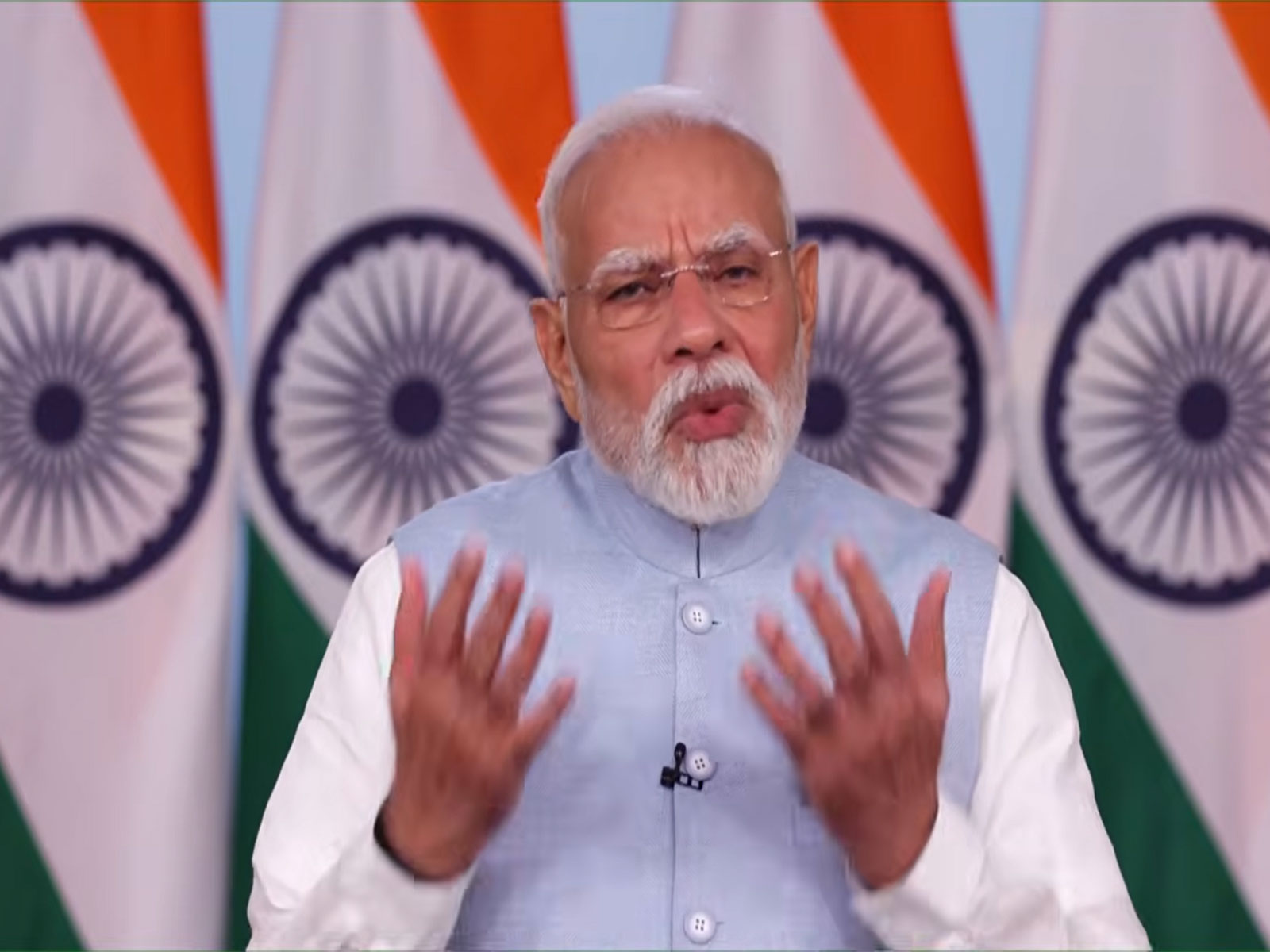

Earlier today, Prime Minister Narendra Modi urged citizens to adopt Swadeshi and prioritise Made in India products, as the newly approved Goods and Services Tax (GST) reforms come into effect from September 22, the first day of 'Shardiya Navaratri'.

"We need to make every home a symbol of Swadeshi... every shop should be adorned with Swadeshi products," the Prime Minister said in his address to the nation.

Calling the GST reforms a "Bachat Utsav", Modi appealed to people to buy products made in India, saying they carry the hard work and "sweat" of the country's youth. "We should buy products that are Made-In-India... in which the hard work of our country's youth is involved... the sweat of our country's sons and daughters," he said.

The Prime Minister said the GST reforms reflect the Union Government's "Nagrik Devo Bhava" mantra and will result in substantial savings for the public.

"We are moving forward by following the mantra of 'Nagrik Devo Bhava', and we can see its reflection in the next generation's GST reforms. If we combine the income tax exemption and the GST exemption, the decisions made in one year will save the people of the country more than Rs 2.5 lakh crore, and that's why I say, 'This is a savings festival,'" he said.

Emphasising self-reliance as the path to a developed India, Modi said the reduction in GST rates will directly benefit small businesses and MSMEs. "To reach the goal of a developed India, we must walk on the path of self-reliance, and a very big responsibility to make India self-reliant also lies on our MSMEs. What is needed by the people of the country, what we can make in our own country, we should make right here in the country... The reduction in GST rates and the simplification of rules and procedures will greatly benefit our MSMEs, small industries, and cottage industries," he added.

He also drew a parallel between Swadeshi during the independence movement and the drive for economic strength.

"Their sales will increase, and they will have to pay less tax, meaning they will also receive a double benefit... Just as the country's independence gained strength from the mantra of Swadeshi... similarly, the country's prosperity will also gain strength from the mantra of Swadeshi alone," he said.

The reform in the Goods and Services Tax (GST) structure approved during the 56th meeting of the GST Council earlier this month is set to come into effect from September 22.

The current four-rate system will now be replaced with a streamlined two-slab regime of 5 per cent and 18 per cent. A separate 40 per cent slab has been retained for luxury and sin goods.

This new framework is expected to ease compliance, reduce consumer prices, boost manufacturing, and support a wide range of industries, from agriculture to automobiles and from FMCG to renewable energy, and is intended to lower the cost of living, strengthen MSMEs, widen the tax base, and drive inclusive growth.

The textile and handicrafts industries are also major beneficiaries. The inverted duty structure on man-made fibres has been corrected, and GST on yarn and fibres has been reduced to 5 per cent.