"Hindenburg allegations is now behind Adani group once and for all": Amit Desai after SEBI clean chit

Sep 18, 2025

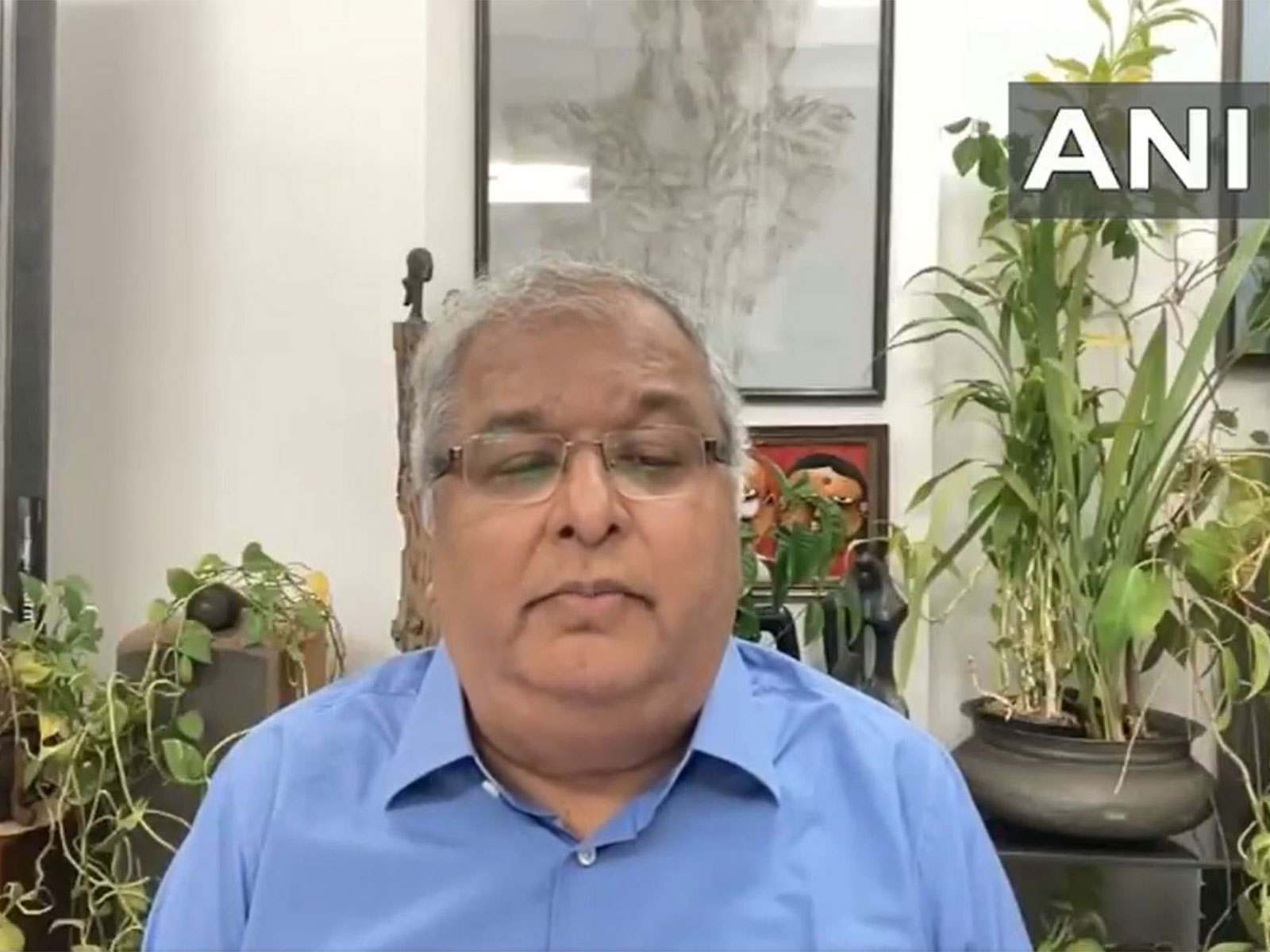

Mumbai (Maharashtra) [India], September 18 : Senior Advocate Amit Desai on Thursday said the Hindenburg allegations against the Adani Group are now "behind them once and for all" after SEBI gave a clean chit to the company.

He praised the stock market regulator's order as strong and well-reasoned, and said it would be hard to overturn even if challenged.

"I think this order is going to be sustainable in the long run. It's not going to be easy for this order to be set aside. I'm not so sure whether there would be an appeal against this order, but even if there is an appeal against this order, it's not going to be easy for the authorities to succeed against such a well-reasoned order. With this order, I think the chapter of the Hindenburg allegations is now behind the Adani group once and for all," Desai said.

He continued, "I think in many ways these two orders would strengthen the Adani Group's profile and perception in the marketplace amongst regulators, amongst bankers, amongst the people that they have been compliant in their various business activities and as a result of which the negative perceptions that were being carried about the Adani group, I think, should come to an end."

Earlier in the day, the SEBI refuted the allegations made by the US Short seller Hindenburg against the Adani Group. SEBI concluded that there is no violation of the listing agreement or SEBI Listing Obligations and Disclosure Requirements (LODR), and the impugned transactions do not qualify as "related party transactions".

According to SEBI, "Reading of Listing Agreement and SEBI (LODR) Regulations reveals that transactions between a listed company with unrelated party is not covered within the definition of "related party transactions" as it existed during the time when impugned transactions took place, though included specifically after the 2021 amendment.

SEBI said that the Supreme Court had rejected the plea of the petitioner and held that the procedure followed in arriving at the current shape of regulations is not tainted with any illegality.

SEBI said that there is no violation of Section 12A of the SEBI Act and SEBI-Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market. (PFUTP) Regulations as alleged. It concluded that no fraud, misrepresentation, or siphoning of funds was proven, and all funds were returned with interest. Thus, all allegations in Show cause Notice not established.

SEBI concluded that no liability or penalties were imposed on Adani Group entities or individual,s and the proceedings were disposed of without directions.

In January 2023, Hindenburg published a report accusing the Adani Group of financial irregularities, leading to a significant drop in the company's stock price. The group at the time had rubbished these claims.

The Adani group has repeatedly denied all the accusations in the Hindenburg Research report. While addressing the Annual General Meeting (AGM) of Adani Enterprises at the time, Group Chairman Gautam Adani had said they were "faced with baseless accusations made by a foreign short seller, that questioned our decades of hard work."