IDFC FIRST Bank launches FD backed Hello Cashback Credit Card with up to 5% Cashback

Feb 16, 2026

VMPL

Mumbai (Maharashtra) [India], February 16: IDFC FIRST Bank launches Hello Cashback Credit Card, a fixed-deposit-backed offering designed to make credit more accessible for digitally savvy customers, especially young adults aged 18+ with online-first and UPI-led spending habits. The card enables customers to begin building their credit history while benefiting from a strong and clearly differentiated cashback proposition on everyday digital payments.

Hello Cashback features a powerful tiered cashback structure, offering 5% cashback on online spends above ₹10,000, 3% cashback on online spends up to ₹10,000, and 1% cashback on in-store, contactless, and UPI transactions. Uniquely, the 1% cashback also extends to essential categories such as utilities, education, and insurance. The card is priced at a joining fee of ₹1,000 and an annual fee of ₹1,000, with the joining fee waived until March 31, 2026, and the annual fee waived on annual spends of ₹2,00,000 in the previous year, making it a compelling combination of rewards, access, and credit building.

10 Unique benefits of the Hello Cashback Credit Card

1. Everyone is eligible.

2. Up to 5% Cashback on Online Spends: 3% cashback on online spends up to ₹10,000 per statement cycle, and 5% cashback on incremental online spends beyond ₹10,000, with cashback on online spends capped at ₹1,000 per statement cycle. No merchant restriction.

3. 1% Cashback across In-store, UPI, & Essential Spends: 1% cashback on in-store purchases, UPI spends via the Bank's app, and essentials including utilities, education, insurance, FASTag recharge, railway bookings, govt. payments, rent, jewellery, and wallet & gift card loads.

4. Bonus Cashback on Travel Bookings: Additional 1% Bonus Cashback on flight and hotel bookings made via IDFC Bank app. Total cashback on travel bookings goes up to 6%.

5. Monthly Cashback Cap of ₹1,500 across all categories per statement cycle.

6. One fixed deposit. Two returns. The fixed deposit earns interest and powers cashback on every card spend.

7. 100% FD-Linked Credit Limit: Credit limit equal to 100% of fixed deposit value.

8. Access to FD Funds via Card: ATM cash withdrawal limit up to 100% of FD value, interest-free for up to 45 days, with a nominal ₹199 + GST withdrawal fee.

9. Instant Credit Limit Enhancement: Flexibility to link additional fixed deposits and increase credit limit instantly.

10. Built-In Safety & Convenience includes insurance covers, purchase protection, lost card liability, roadside assistance, and 1% fuel surcharge waiver, making credit safer & convenient for first-time users.

Fees & Eligibility

The Hello Cashback Credit Card is available against a fixed deposit starting at ₹10,000. The joining fee of ₹1,000 + GST is waived until March 31, 2026 as an introductory offer. The annual fee of ₹1,000 + GST is:

* 100% reversed on annual spends of ₹2 lakh or more, or

* 50% reversed on annual spends between ₹1 lakh and ₹2 lakh

This makes it one of the most affordable and rewarding secured credit cards in the market.

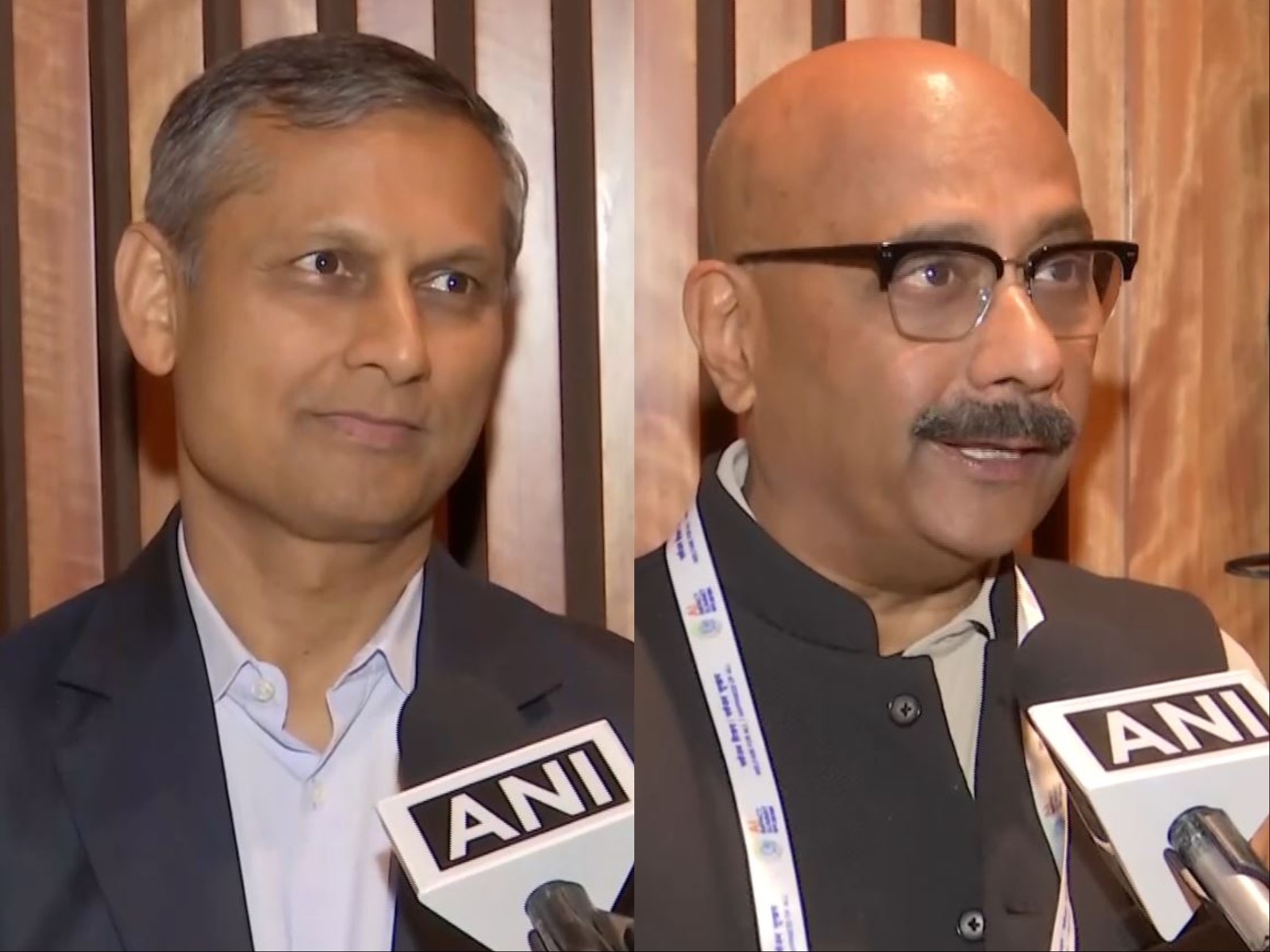

Shirish Bhandari, Head - Credit Cards, FASTag & Loyalty, IDFC FIRST Bank, said:

"Hello Cashback brings up to 5% online cashback to an FD-backed credit card, designed for digitally savvy customers beginning their credit journey, particularly young adults aged 18+ entering the credit ecosystem with online-first and UPI-led spending habits. With cashback across all online purchases and UPI transactions, a low entry threshold starting at ₹10,000, and flexible annual fee waivers, it makes rewarding digital payments accessible from day one."

For Applications: The Hello Cashback Credit Card is now open for applications, and fully digital and instant. Click the link to access more information and apply:

https://www.idfcfirst.bank.in/credit-card/hello-cashback-credit-card

About the Bank

1. Vision: To build a world-class Bank in India, founded with principles of Ethical, Digital, and Social Good Banking.

2. Scale: IDFC FIRST Bank is one of India's fast-growing private banks, building its UI, UX, and tech stack like a fintech. As of December 31, 2025, the Bank serves 35 million customers, with a customer business of Rs. 5,62,090 crore ($63.0b) comprising customer deposits of ₹2,82,662 crores ($31.7b) and loans & advances of ₹2,79,428 crores ($31.3b). Customer deposits grew 24.3% YoY and loans 20.9% YoY. We reach over 60,000 cities, towns, and villages, operate through 1,066 branches.

3. Scope: We are a universal Bank offering complete range of services, including Retail, MSME, Rural, Startups, Corporate Banking, Cash Management, Credit Cards, Wealth Management, Deposits, Government Banking, Working Capital, Trade Finance, and Treasury solutions.

4. Ethical Banking: We are committed to doing right even when customers are not watching. We have simplified descriptions, calculations, and legal jargon to avoid confusing customers.

5. Digital Banking: The Bank's modern technology stack delivers high-quality services across all channels like mobile, branch, internet banking, call centers and relationship managers. Built on cloud-native, API-led, microservices architecture, supported with data, analytics, AI, and fine aesthetics, we strive to deliver fintech-grade experiences on banking platform.

6. Social Good: We work for society. We have impacted over 40 million lives including 3.6 million women entrepreneurs. We have financed over 7.5 million lifestyle improvement loans (for laptops, washing machines, refrigerators etc. that enhance the quality of life of middle class), 2.5 lakh electric 2W and 3W vehicles, 2.7 lakh water, sanitation, and hygiene loans, 2 million livelihood (cattle) loans, and 300,000+ SMEs. On deposits, we provide access of premium investment research, which is usually reserved for the wealthy, even to those holding balances as low as ₹5,000. Our ESG scores are high and improving.

7. Customer Friendly Banking: We make banking easy by having a customer first approach. We have waived fees on 36 essential savings account services which are commonly charged in the market, the first and only bank in India to do so. We create "pull" products that customers actively seek out.

8. Governance: We adhere to regulatory guidelines in letter and spirit and actively work with regulators to make things better. We take pride in maintaining highest levels of corporate governance.

9. Shareholders: We are building a well-diversified universal banking portfolio designed to deliver consistent ROE of 16%+.

10. Employees: IDFC FIRST Bank is designed to be a happy place to work, with cutting-edge roles, meaningful growth opportunities, and a culture of meritocracy. Compensation is healthy, efforts are recognized, and employees experience the pride and excitement of creating a world-class Bank in India.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)