India may become 3rd pillar in US-Japan rare earth network after Trump-Xi deal: Analysis

Nov 07, 2025

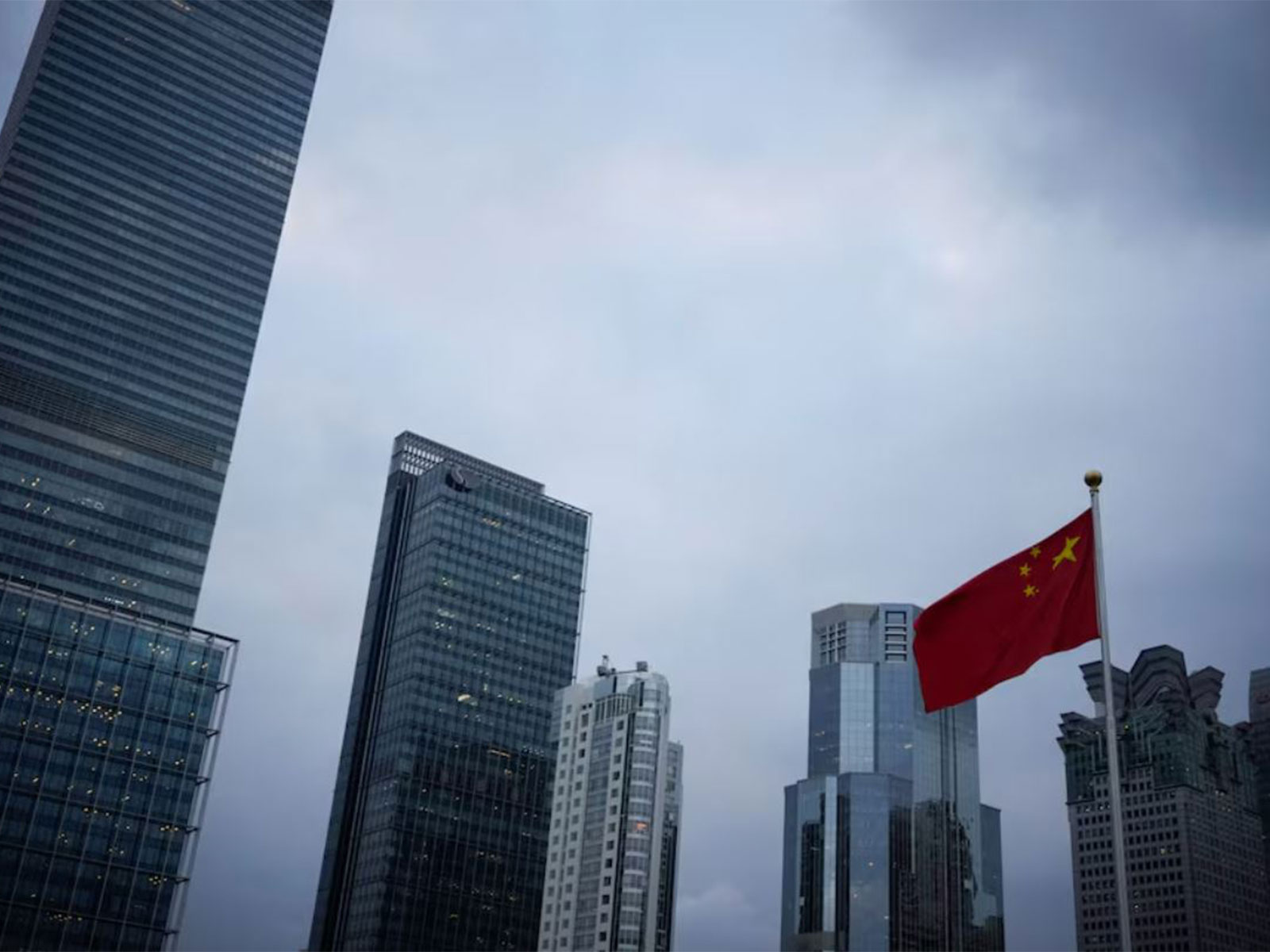

New Delhi [India], November 7 : India stands poised to become a key player in the global rare-earth supply chain as the Donald Trump-Xi Jinping summit buys a one-year respite from China's export controls and decade-long monoply, offering New Delhi a window to build its refining, magnet-making and downstream capabilities, according to a recent analysis in The Diplomat.

India has significant raw-material potential- its beach-sand deposits contain rich reserves of monazite, bastnaesite, and other rare-earth minerals, but the country's processing capacity and environmental rules have lagged. That is now changing, says Jianli Yang in the magazine which reports on events across the Asia-Pacific region.

"With strong political will and a growing technological ecosystem, India could soon emerge as the third pillar - alongside the United States and Japan - of a democratic rare-earth network," The Diplomat analysis noted.

The Trump-Xi summit in South Korea last month has "bought breathing space" and "India now offers a path to breathe freely," the publication said.

According to a White House fact sheet, Beijing has after a meeting of Xi and Trump in Busan, South Korea last month, agreed to delay specific export controls on rare earth materials for one year following a trade agreement with Washington.

In June this year, India announced that it is negotiating with companies and planning a fiscal incentive scheme for domestic rare-earth magnet manufacturing, aimed at reducing reliance on China. Indian companies such as Sona Comstar are setting up magnet production lines. State-owned Indian Rare Earths Ltd. has been tasked with expanding refining capability, and the Indian Space Research Organisation is helping adapt high-purity separation technology initially designed for satellite components, writes Yang.

Even more significantly, India is linking these domestic moves to strategic partnerships abroad. Talks with the United States, Japan, and Australia under the Quad framework have accelerated joint exploration, co-financing and technology-transfer projects, the research fellow at the Kennedy School of Government of Harvard University wrote in The Diplomat.

The fifth largest economy in the world, the author says, "brings both scale and credibility" to the rare earths race with a manufacturing base large enough to absorb downstream industries - magnets, motors, batteries - that smaller rare earth producers like Australia or Brazil cannot fully host.

Yang points out that while Australia remains indispensable for mining and early-stage processing, Brazil brings much-needed Western Hemisphere diversification and the US has made progress in producing NdPr metal in California and magnets in Texas- all of them cannot alone can offset China's dominance.

"India, however, changes the calculus by linking supply diversification with market demand," the author notes adding the country can consume what it produces, export what it refines, and - if integrated with allied partners - become a hub for both production and processing.

India's strategy is also less vulnerable to short-term political reversals as Prime Minister Narendra Modi's "Atmanirbhar Bharat" (self-reliant India) agenda enjoys bipartisan support, he says.

Washington should treat India not just as a partner in defence or semiconductors but as a cornerstone of a new "rare earth alignment" says the analysis, which lists out several steps including exploring co-financing magnet plants in India through US International Development Finance Corporation loans or EXIM guarantees.

India and the US can also establish reciprocal stockpiles, says the author noting that "fast-tracking technology sharing on refining and waste treatment will allow India to leap-frog costly trial-and-error phases that slowed the United States and Australia."

Further, it notes that rare earth cooperation should be "embedded into the core agenda" of the Quadrilateral grouping- that includes India, Japan, Australia, and the United States- making it as central as joint naval exercises or semiconductor collaboration

Yang says that India's recent success in attracting high-tech manufacturing, from Apple assembly lines to chip design centres, shows it can deliver when strategic alignment and financial incentives converge.

The industrial push by the PM Narendra Modi led government coupled with Quad alignment and global manufacturing leverage could work in India's favour.

If the United States, Japan, Australia, and Brazil "rally behind India's rise as a credible supplier and processor", they can lay the foundation for a truly pluralistic rare-earth market and with it, greater geopolitical resilience, according to The Diplomat.