India witnesses surge in millionaires, outpacing Asia Pacific; eyes 55% rise by 2029

Jun 25, 2025

Mumbai (Maharashtra) [India], June 25 : The number of individuals in the top wealth brackets--those with more than a million dollars in financial wealth -- is set to grow by over 55 per cent from 2024 to 2029 -- far outpacing the global average of 21 per cent, Boston Consulting Group (BCG) said in a report Wednesday.

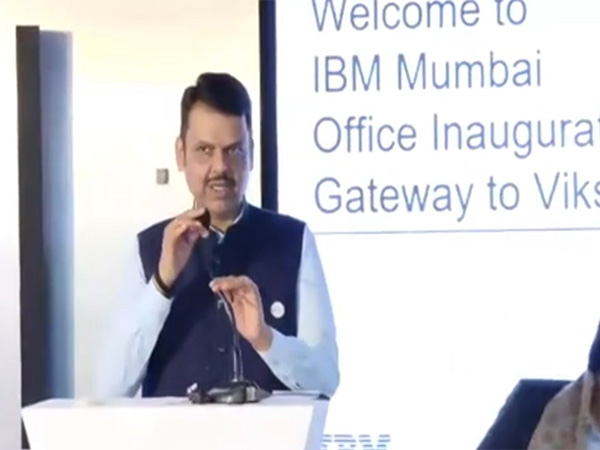

"From 2014 to 2024, organic growth varied sharply by region, with wealth managers in Asia Pacific achieving rates of 50 per cent --more than double that of their peers in Europe, the Middle East and Africa (EMEA) and North America, driven decisively by emerging markets like India," Mayank Jha, Managing Director and Partner, BCG, said.

"India's wealth management market is undergoing a seismic shift, with the number of dollar millionaires expected to grow by over 55 per cent from 2024 to 2029--far outpacing the global average of 21 per cent," he said.

"A generational wave of first-time wealth creators, especially millennial entrepreneurs and corporate leaders, is reshaping the industry. As India rises as a wealth management powerhouse, sharp customer segmentation and the end-to-end integration of AI and GenAI--from prospecting to advisory to service--will be critical to staying ahead," Jha added.

Global financial wealth surged to a record USD 305 trillion in 2024, propelled by an 8.1 per cent rise in financial assets amid strong equity market performance.

According to BCG, India's financial wealth rose by 10.8 per cent between 2023 and 2024, surpassing the Asia-Pacific (APAC) average of 7.3 per cent and underscoring the country's growing economic muscle.

With Asia-Pacific projected to grow at 9 per cent annually through 2029--well ahead of North America's 4 per cent and Western Europe's 5 per cent--India is poised to be a key engine powering this global shift in financial wealth.

This rapid expansion in India marks a significant shift in the financial landscape and signals unprecedented opportunity for advisors and institutions ready to serve this emerging demand.

Organic growth of Asset Under Management (AUM) from 2014-24 varied sharply by region, with wealth managers in APAC achieving rates of 50 per cent, more than double that of their peers in EMEA and North America, driven largely by emerging markets like India.

A generational surge in first-time wealth creators, especially millennials, has enabled both new and established advisors to attract fresh clients and assets.

"What defines winners today is no longer exposure to market performance or the ability to poach senior bankers, but their ability to grow from within," said Michael Kahlich, managing director and partner at BCG.

"Firms that deliberately invest in advisor enablement, brand identity, and next-gen client strategies are outperforming peers--not just in revenue, but also in valuation multiples," added Kahlich.