Indian stocks extend losses into fresh week, risk appetite weakens

Jan 19, 2026

New Delhi [India], January 19 : Domestic benchmark equity benchmarks commenced the fresh trading week on a downward trajectory on Monday, as global risk appetite seemed to have faded following new international trade threats. The Sensex and Nifty closed 0.4 per cent lower each today.

Indian stock indices extended losses from the previous week. So far in 2026, they declined around 2 per cent each.

Most sectors ended lower, with heavyweights from energy, banking and IT leading the declines as earnings disappointment and macro concerns weighed on sentiment, said Ajit Mishra - SVP, Research, Religare Broking Ltd.

"The broader market mirrored this weakness, with both midcap and smallcap indices also slipping, indicating widespread selling rather than isolated sector moves," Mishra noted.

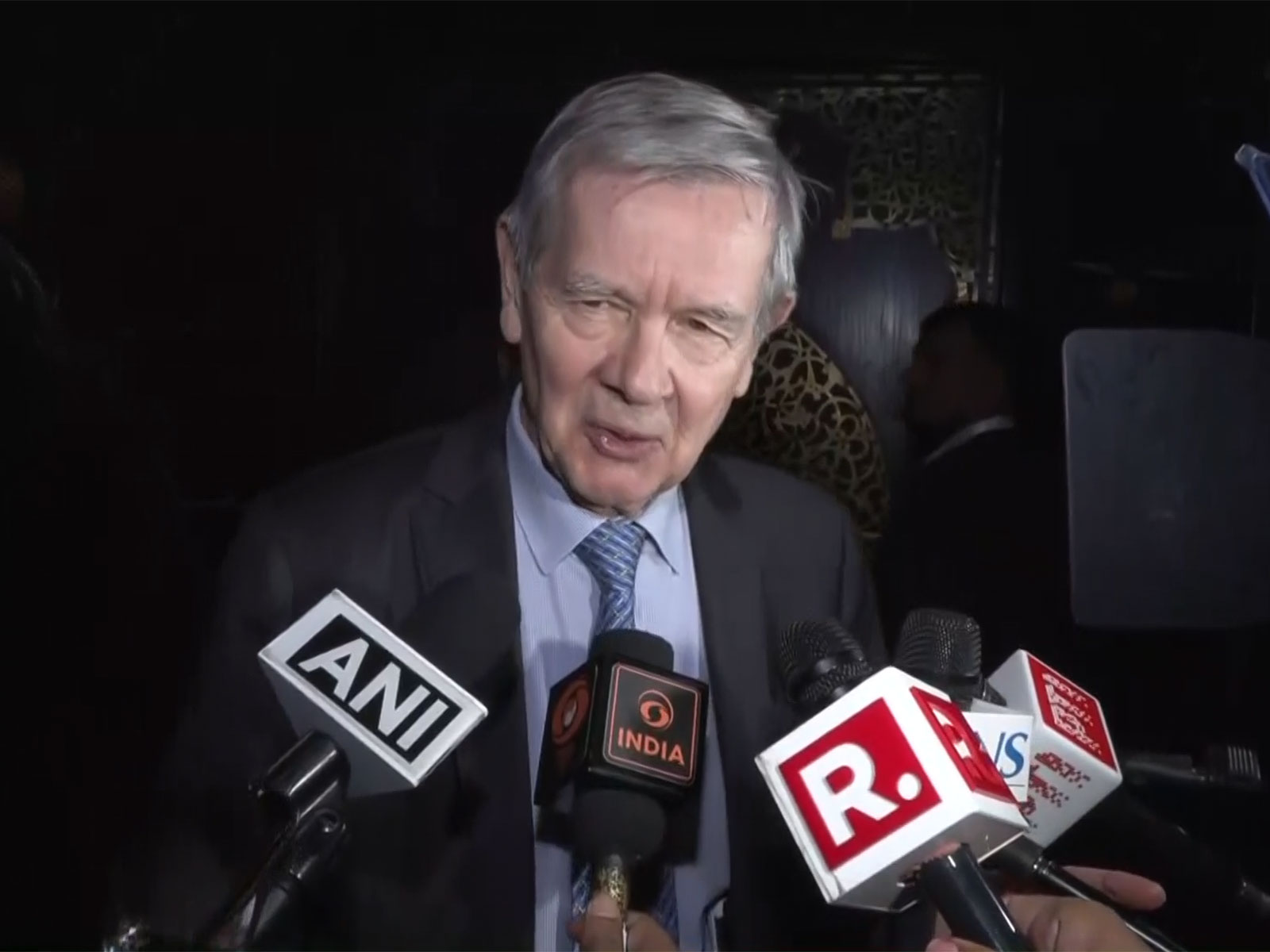

"In addition, weakness in the IT space, highlighted by a sharp fall in Wipro after softer revenue forecasts, added to the negative bias. Investor caution was also reinforced by ongoing global uncertainties, including fresh concerns around potential tariff actions by the US President, along with continued foreign institutional selling."

Going ahead, markets are expected to trade sideways, tracking global cues and ongoing earnings, while any escalation on the geopolitical front would remain a key overhang, said Siddhartha Khemka - Head of Research, Wealth Management, Motilal Oswal Financial Services Ltd.

Global risk appetite weakened after US President Donald Trump announced new tariff threats against eight European nations, reigniting concerns of a potential US-EU trade dispute.

"This development triggered a broad risk-off mood across global equity markets, prompting investors to rotate toward safe-haven assets like gold," said Vinod Nair, Head of Research, Geojit Investments Limited.

With the Q3 earnings season progressing, stock-specific volatility is likely, particularly where performance has been mixed, Nair added. "Overall, given the blend of global uncertainty and domestic triggers, markets are expected to remain in a consolidation zone."

Sensex and Nifty cumulatively rose 8-10 per cent in 2025, lower than the recent-year trends.

Market participants remained cautious, with experts pointing to low foreign investor participation. Foreign portfolio investors remained net sellers in India in 2025, data showed. Overall, Indian equity markets had largely been choppy over the past months, barring some bullish days, as investors remained uncertain over the trade deal with the United States, which has imposed a 50 per cent tariff on Indian goods.

In 2024, Sensex and Nifty accumulated a growth of about 9-10 per cent each. In 2023, Sensex and Nifty gained 16-17 per cent, on a cumulative basis. In 2022, the indices gained a mere 3 per cent each.