India's capital markets scaled rapidly in last 10 years, Rs 1.7 lakh crore raised in current fiscal through 311 IPOs: SEBI Chairman

Jan 10, 2026

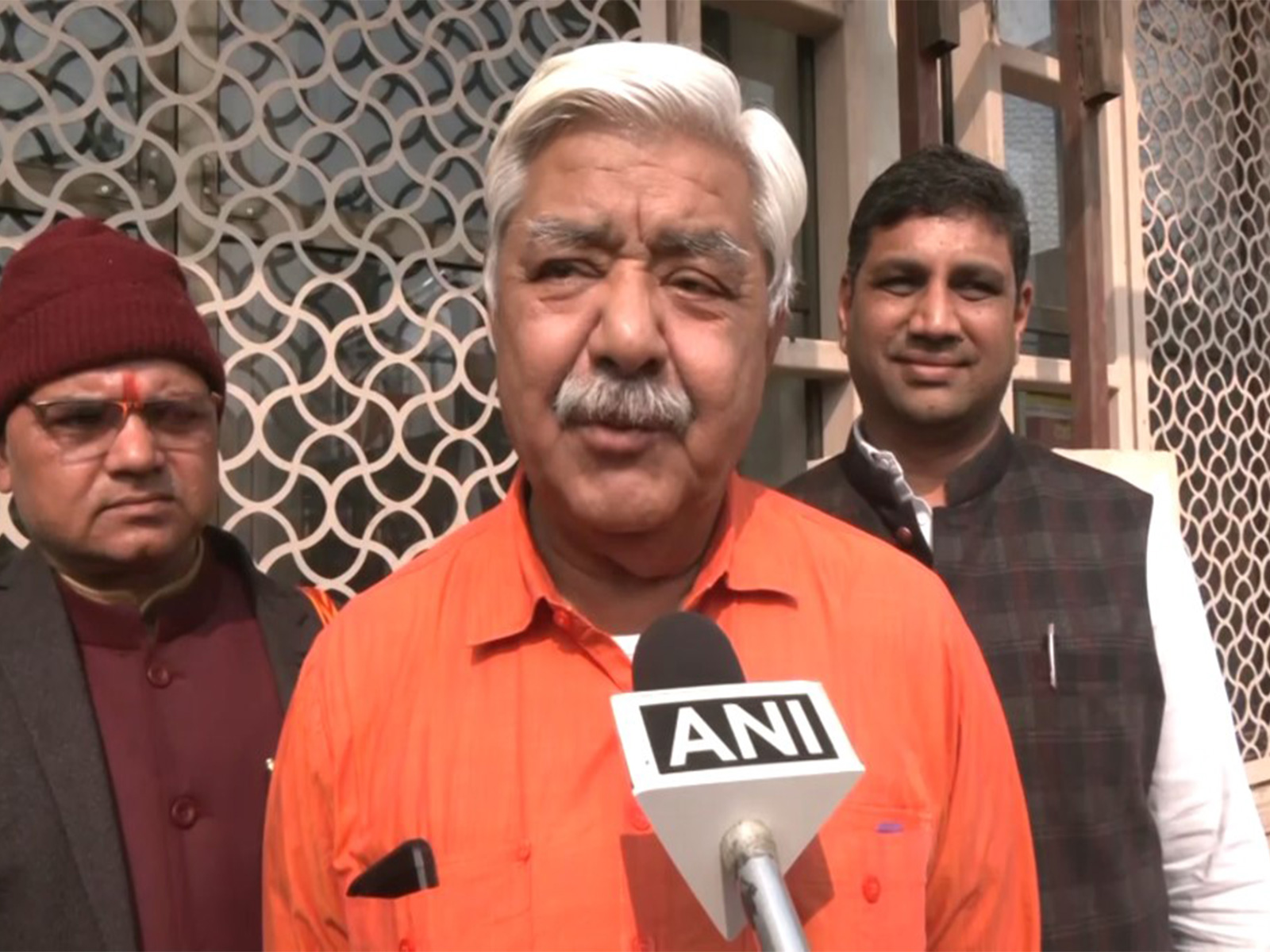

Chennai (Tamil Naidu) [India], January 10 : The Securities and Exchange Board of India (SEBI) Chairman, Tuhin Kanta Pandey on Saturday highlighted that India's capital markets have scaled rapidly over the last decade across equity, derivatives, Mutual Funds, REITs (Real Estate Investment Trusts), InvITs (Infrastructure Investment Trusts) and corporate bonds.

Highlighting the performance in the current Financial Year, he said, "The number of unique investors has surged from 4.3 crore in FY20 to 13.7 crore, as of today. The first nine months of this financial year have seen 1.7 lakh crore raised through 311 IPOs (Initial Public Offerings), with total equity mobilisation already crossing 3.8 lakh crore."

While speaking at the Association of National Exchanges Members of India (ANMI) 15th International Capital Market Convention 2026 in Chennai, Pandey also talked about the regulatory architecture saying, "We are building a smarter regulatory architecture, one that streamlines compliance and removes duplication while safeguarding investor protection and market integrity. Recently, we notified the SEBI stockbrokers regulations 2026. We have permitted diversification into activities overseen by other financial sector regulators, subject to prescribed safeguards."

"A revised framework to address technical glitches in the stockbrokers' trading system was issued yesterday. The new framework will ease compliance for small stockbrokers, as it is applicable only to stockbrokers with a sizable clientele and technology dominance," he said.

Notably, on Friday, SEBI announced a major overhaul of its framework for addressing technical glitches in stock brokers' electronic trading systems, aiming to reduce compliance burden and improve ease of doing business for market intermediaries.

The framework is now applicable to stock brokers having more than 10,000 registered clients. As a result of new eligibility criteria approximately, 60% of stock broker would be moving out of this framework and consequently reduce their overall compliance requirement, SEBI said.

The revised framework simplifies the reporting requirement by providing the extension of time for reporting of technical glitches (from one hour to two hours), consideration to the trading holiday's while submitting reports and streamlining the reporting requirement from reporting to all the exchanges to a single reporting platform (i.e. Common Reporting Platform).

According to the National Stock Exchange's (NSE) annual highlights for Calendar Year (CY) 2025, the mainboard IPOs collectively mobilised Rs 1.72 lakh crore, up 8% year-on-year. Maharashtra, Delhi-NCR and Karnataka led mainboard IPO activity by both volume and value.