India's chemical market projected to surpass USD 300 billion by 2030, reports BCG, outlines 10-point blueprint to build next Indian chemical giant

Jan 15, 2026

New Delhi [India], January 15 : A new BCG report sets out a 10-point blueprint to build the next Indian chemical giant as the domestic market prepares to exceed USD 300 billion by 2030. The report indicates that the industry reaches a decisive inflection point where incremental growth is no longer sufficient.

"India's domestic chemical market is projected to reach over $300 billion by 2030, up from nearly $150 billion today. Capital is available, equity remains strong, debt is accessible for the right projects, and manufacturing incentives exist for select value chains," the report said.

While the sector delivers strong world-leading shareholder returns over two decades, the focus now shifts from maintaining momentum to achieving global scale.

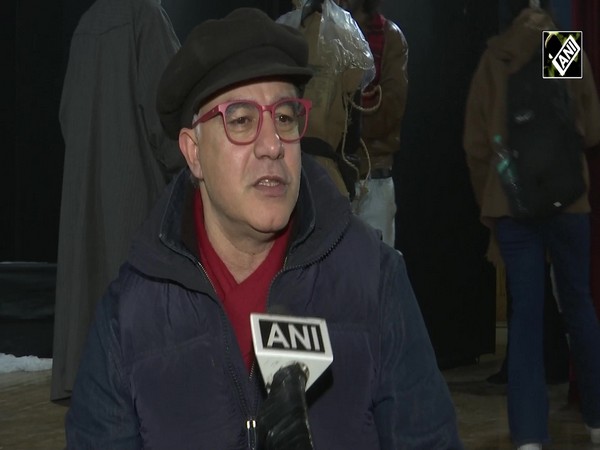

Amit Gandhi, Managing Director and Senior Partner at BCG India, notes that Indian chemical companies possess the necessary capability, capital, and credibility. He states, "ChemCos (chemical companies) today have the capability, capital, and credibility. What they need next is bold ambition and deliberate choices. The next global chemical giants can be built from India, but not by doing more of the same."

The proposed 10-point agenda combines five strategic moves with five organizational capabilities to help national champions transition into billion-dollar global players.

Strategic recommendations include, first, a pivot from selling volumes to solving specific chemistry problems for customers.

Second, the report suggests that firms place one significant decadal bet by integrating into capex supercycles early to capture returns in the 2030s.

Third, companies must also identify where to play in the value chain to scale cash from more stable segments.

Fourth, the blueprint encourages the acquisition of mid-sized European or Japanese firms to secure intellectual property and market access.

Fifth, establishing a dedicated partnerships office to act as a gateway to India.

Sixth, develop true marketing strength, build teams that understand brand, sales and digital presence, especially for global markets.

Seventh, improve margins by 200-300 bps with digital+AI at the core.

Eight, it suggests to professionalize with intent, strengthen HR processes, build talent pipeline, and plan succession.

Ninth, bet on new technology as a chemical-focused VC, actively working with startups pursuing technologies that could pay off 2030+.

And for the final point, BCG suggests investing in 1-2 fundamental R&D fields, with a budget of USD 2.5-5 million annually for deep research.

Amita Parekh, Managing Director and Partner at BCG India, emphasizes that scale is determined by how companies rewire their operating models.

She explains, "Improving margins through digital and AI, investing consistently in R&D, and building strong global partnerships are no longer optional--they are core to long-term competitiveness. With rising import dependencies and large gaps in specialty and advanced materials, this is a rare opportunity for Indian players to localize, innovate, and position India as a critical node in global chemical supply chains."