India's coking coal imports set to rise as steel capacity targets 300 MT by 2030: Report

Sep 12, 2025

New Delhi [India], September 12 : India's coking coal imports are projected to grow significantly as the nation targets 300 metric tons (MT) of steel production capacity by 2030, according to the latest report by EY Parthenon in association with the Indian Steel Association (ISA).

The report further states that India, the world's second-largest steel producer, remains heavily reliant on coking coal, with the steel industry consuming 95 per cent of the demand.

The blast furnace-basic oxygen furnace (BF-BOF) route, accounts for approximately 65 per cent of installed capacity and 58 per cent of actual production, with the steel industry consuming 95 per cent of India's total coking coal demand.

This reliance means demand is projected to increase sharply from 87 MT in FY25 to 135 MT by 2030, the report added.

To strengthen self-reliance, the government's Atmanirbhar Coal Mission under Mission Coking Coal seeks to scale domestic raw output to 140 MT by FY30--105 MT from Coal India and 35 MT from private allocations--while enhancing the washed coal capacity to 15 MT.

Policy reforms, including 100 per cent FDI in mining, revenue-sharing auctions, and 20-30 per cent capital subsidies for washeries, aim to reduce import dependence from 90 per cent today to below 80 per cent by 2030, accelerate beneficiation, and enhance supply security.

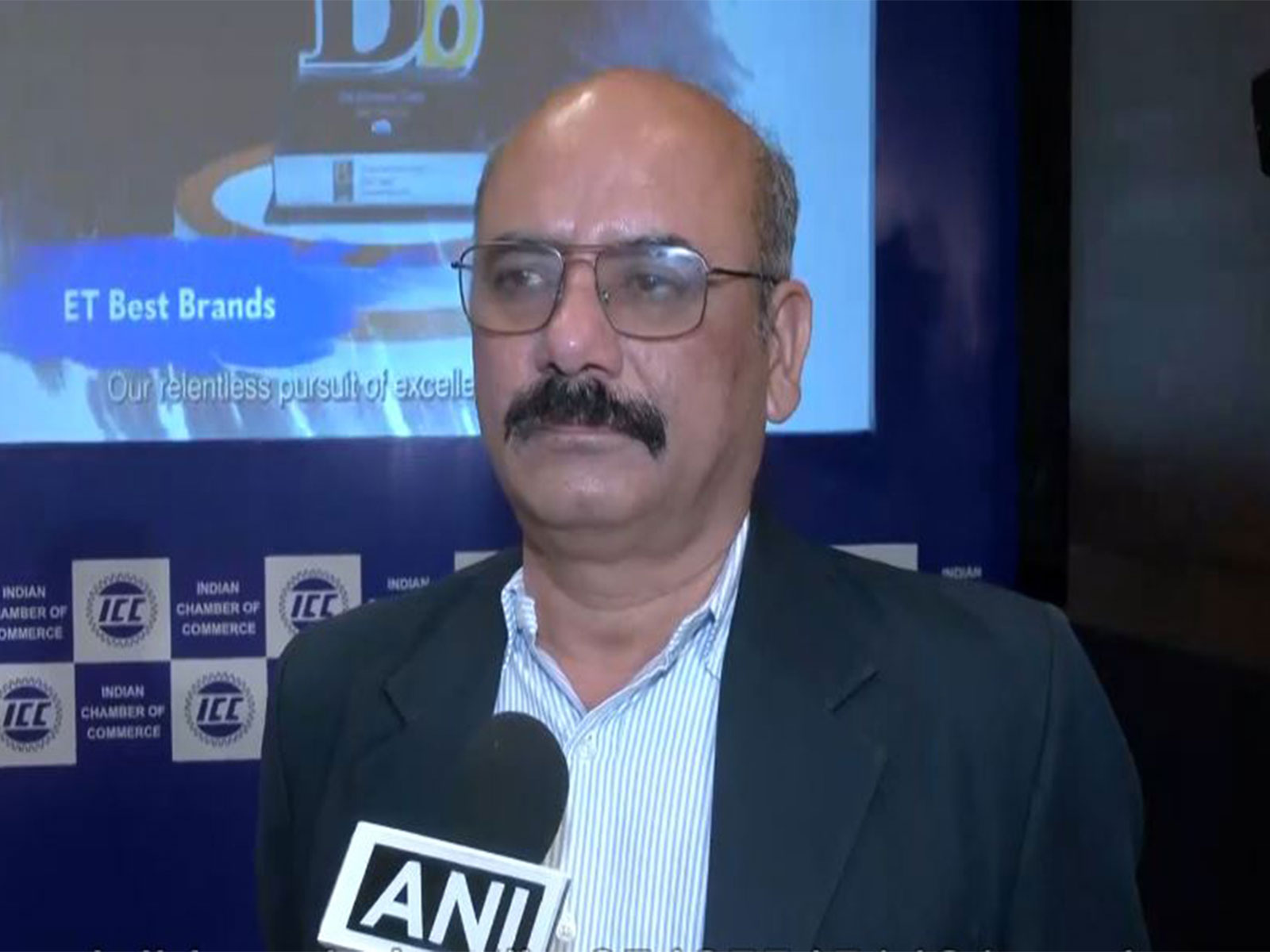

Commenting on the report, Vinayak Vipul, Partner, Business Consulting, EY Parthenon said, "The way ahead is clear--India must accelerate beneficiation to unlock the true value of its reserves, diversify sourcing to reduce risk, and invest in technologies that pave the way toward low-carbon steel. Building a transparent pricing index and a national reserve will be equally critical to balance growth with resilience and sustainability."

With rising coal consumption in steel production, the industry has also become a significant contributor to greenhouse gas (GHG) emissions, both globally (7 per cent-8 per cent) and 12 per cent within India. This reality underscores the urgent need for cleaner technologies and comprehensive decarbonization efforts across the sector.

Naveen Jindal, President Indian Steel Association said, "India's steel industry is entering a transformative era, driven by rising domestic demand and global competition. Coking coal remains the backbone of steelmaking, and securing a reliable, high-quality supply is a strategic necessity for national growth."

As per the report, India currently relies on imports for about 90 per cent of its coking coal needs, but aims to reduce this to under 80 per cent by 2030 through enhanced domestic beneficiation, increased washed coal capacity (targeting 15 MT), and new supply corridors.

The government plans to double domestic production from 66.8 MT in FY24 to 140 MT by FY30, supported by initiatives like Mission Coking Coal, WDO models, and First Mile Connectivity. However, heavy import dependence exposes the country to global price volatility, prompting calls for an India-specific CFR index and CFR-linked futures contracts to help steelmakers hedge risks.

On the sustainability front, the steel sector, responsible for 12 per cent of national emissions, is targeting a transition from 89 per cent coal-based production in 2030 to 29 per cent by 2050, aiming for net-zero by 2070 through technologies like green hydrogen DRI, scrap-based EAF, and CCUS.

The report added that a cohesive industry-government partnership, through joint investment in washery expansion, strategic stockpiles at key ports, and public-private consortia for overseas mine equity, will be vital in securing supply chains, capturing value closer to the source, and modernising beneficiation.