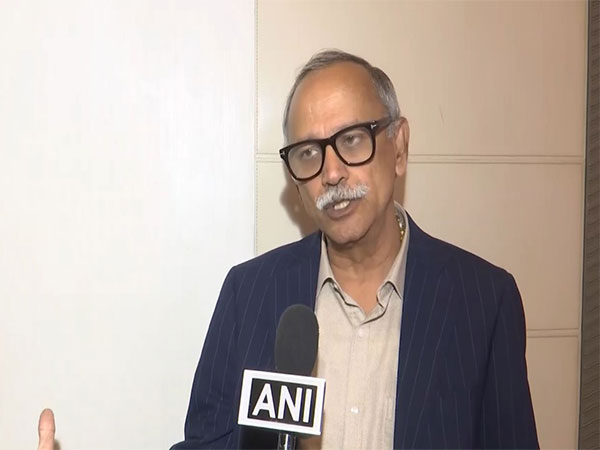

InvITs in India may grow upto 85% in 5 years: CEO Bharat InvITs Association Venkatesh

Sep 05, 2025

New Delhi [India], September 5 : The InvITs industry is witnessing its growth at a great pace and targets that the total InvITs in the country will rise to around 50 in the next five years, against the current 27, said NS Venkatesh, CEO, Bharat InvITs Association.

Speaking to ANI on the sidelines of Bharat InvITs Association and Indian REITs Association, Venkatesh, "The rate of growth of InvITs industry has been good as we were two in 2019. In 2025, we are 27. As an association our mission is to grow to 40-50 in another 5 years."

InvITs (Infrastructure Investment Trust) have emerged as a structured and transparent investment platform, well-suited to India's evolving infrastructure financing needs. They have created a distinct and credible asset class that brings long-term capital into infrastructure while offering stable returns to investors.

In the InvITs industry in India, cumulative distributions of 68,000 crore rupees have been made since inception, he said.

InvITs distributed a total of 24,267 crores rupees to unit holders in FY 2024-25, he said.

The association aims to attract more domestic investments as it was dependent heavily on foreign capital, he said. It has made specific representations to several institutional investors, like the Life Insurance Corporation of India, to make them invest in InvITs.

"We are quite confident that such additional pool of capital will increase the growth of InvITs," he said.

Educational institutions will also come in the future, and as we go ahead, data centres could be there.

"Public sector enterprises like NTPC, thermal power plants, NHPC, hydro power plant. Such institutions will also start seriously looking for monetising their operational assets so that they can recycle their capital for investment into other assets," he said.

With the Center's ambitious National Infrastructure Pipeline and visionary National Monetisation Pipeline,

InvITs have the potential to achieve an AUM of Rs 21 lakh crore by 2030, he added.

Indian InvITs are tax investment vehicles and are mandatorily required to distribute at least 90% of their net distributable cash flows on a semi-annual basis.

Talking on the role of SEBI and the Centre in its growth, he said, "Support from the government of India and SEBI is tremendous. They also understand that this industry is at a nascent stage, so they are handling the industry very well, he said.

Underscoring its scale, stability and increasing investor confidence. With increasing participation from diverse investor categories and a strong regulatory oversight and support from SEBI, InvITs are poised to play an integral role in supporting India's infrastructure goals, he said.

Venkatesh also presented his view on GST and said that his association is thankful to the government for taking that step.

"We are looking at it much more deeply with the help of some consultants. We are understanding that what is better framework for that and sort of communicate it to my members to help them to utilise the concessions or the remissions or the rationalisation of the slabs things GST Council has announced," Venkatesh stated.