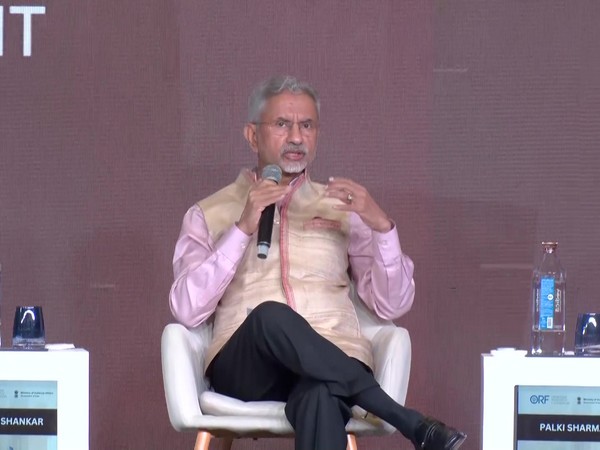

Japan's rising bond yields driven by political change, fiscal stimulus expectations: Ajay Bagga

Jan 21, 2026

By Nikhil Dedha

Mumbai (Maharashtra) [India], January 21 : Japan's bond markets surged to new highs due to rising expectations of fiscal stimulus under the country's new political leadership and shifting global market dynamics triggered by tariff policies of US President Donald Trump, banking and market expert Ajay Bagga said in an exclusive conversation with ANI.

Detailing the reasons behind the sharp rise in Japanese bond yields, Bagga said markets are reacting to major political changes in Japan. The new Prime Minister, who is seen as a protege of former Prime Minister Shinzo Abe, is expected to pursue a strong foreign policy, higher defence spending, a firm stance against China, and fiscal stimulus to lift economic growth.

"So what the markets are seeing is that the fiscal deficit will increase, there will be a lot of stimulus in Japan, and on the back of a very high debt to GDP ratio already, we are seeing the bond rates going up in Japan," Bagga said.

The market expert noted that on Monday Japan's Prime Minister Sanae Takaichi had announced that elections will be held on February 8. He pointed out that she remains popular with the Japanese public, and markets believe that if her position strengthens, fiscal stimulus will increase.

"As a result, markets are factoring in a higher fiscal deficit in Japan," Bagga said. "Given that Japan already has a very high debt-to-GDP ratio, expectations of more borrowing are pushing bond yields higher."

Japan's 30-year and 40-year government bond yields have risen by more than 25 basis points and touched new highs due to these concerns.

Bagga explained that higher Japanese bond yields are also affecting global markets because of the long-standing yen carry trade. For many years, investors borrowed money in Japanese yen at very low interest rates and invested that money across global markets to earn higher returns.

"Now, if lenders in Japan can earn around 3.5-4 per cent by investing at home, without taking currency risk or country risk, they will be less willing to send that money abroad," he said. "Some of that money is coming back to Japan."

This shift has led to a sell-off across global assets, including cryptocurrencies, stocks and bonds.

On global markets, Bagga said volatility has remained high since last April. He recalled that markets saw a sharp sell-off after Trump announced "Liberation Day" tariffs, which hit American assets.

However, within a few days, Trump reversed the tariffs, leading to a rebound in markets and the emergence of the so-called "TACO" trade, based on the belief that Trump would reverse policies that are seen as anti-market.

"Now Trump is talking about fresh tariffs on the European Union and is weaponising tariffs," Bagga said. "That has brought back the 'sell American trade'."

He added that this has led to the US dollar weakening, US bond yields rising and US stock markets falling, indicating a global sell-off of American assets.

In summary, Bagga said Japan's rising bond yields are being driven by three key factors, political change and fiscal stimulus expectations in Japan, global market shifts linked to US tariff policies, and a reversal of global carry trades, all of which are reshaping global capital flows.