Latest Economy Observer report from Dun & Bradstreet highlights domestic resilience under threats of higher-than-expected US tariffs

Aug 20, 2025

PRNewswire

Mumbai (Maharashtra) [India], August 20: Dun & Bradstreet, a global leader in business decisioning data and analytics, has released its Economy Observer report for August 2025. Economy Observer is a monthly report sharing in-depth analysis of key macroeconomic developments in India and provides forecasts for key economic indicators, and insight into the expected direction of the Indian economy.

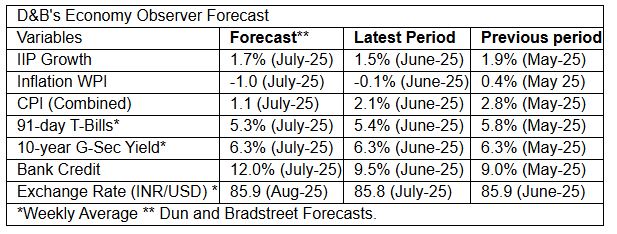

Key economic forecast:

Real Economy: India's industrial activity continues to expand at a modest pace. Dun & Bradstreet expects the Index of Industrial Production (IIP) to have grown by 1.7% in July 2025, reflecting steady momentum in manufacturing, especially in basic metals, and construction-linked sectors, despite contractions in mining and electricity. However, the outlook will be clouded by the US announcement on 6th August of an additional 25% tariff on imports from India due to purchase of oil and derivatives from Russia, bringing the total rate to 50% effective August 27, 2025. A bilateral trade deal is still under negotiation, which could offer some relief if agreed upon in the coming months, but until then exports from sectors like gems and jewelry, and certain electronic items will be impacted. The Comprehensive Economic and Trade Agreement (CETA) signed by India and the UK in July, which eliminates tariffs on 99% of Indian exports, might offset the impact partially.

Price Scenario: India's inflation trajectory continues to moderate, reinforcing price stability. Dun & Bradstreet forecasts Consumer Price Index (CPI) inflation to ease further to 1.1% in July 2025, down from 2.1% in June 2025, driven by consistent decline in food prices. Food and beverages inflation has remained subdued, with vegetable and pulse prices stabilizing at lower levels given favorable seasonal trends. So far normal monsoon season has supported early kharif sowing across key regions, helping to stabilize agricultural output expectations and contain food inflation pressures. CPI inflation touched a 77-month low in June, and it is expected that in July, CPI will potentially breach historic lows. On the wholesale front,Wholesale Price Index (WPI) inflation is expected to decline by 1.0% in July 2025, following a 0.1% fall in June 2025, reflecting persistent softness in input costs, subdued global commodity prices, and easing transportation charges, particularly in fuel and freight. WPI recorded its first contraction since October 2023, led by a sharp fall in food and mineral oil prices.

Money & Finance: India's financial markets in July 2025 were supported by steady yields, improving credit conditions, and sustained fiscal discipline. Dun & Bradstreet forecasts the 10-year G-Sec yield to remain around 6.3% in July 2025, reflecting continued investor confidence (the D&B Investment Confidence Index for India was 12.6% y/y higher for Q3 2025) and stable borrowing cost expectations. The 91-day T-Bill yield is expected to ease slightly to 5.3%, indicating improved liquidity conditions. The RBI cancelled the 14-day variable rate repo (VRR) auction for the third consecutive time in June, signaling that systemic liquidity remains comfortably in surplus. Meanwhile, bank credit growth is also projected to accelerate to 12.0% in July 2025, suggesting healthy uptake from MSMEs and retail borrowers. There was strong demand in the July G-Sec auction, which raised ₹36,000 crore across two papers, reflecting market confidence and robust investor appetite.

External Sector: The Indian rupee has remained broadly stable through July 2025, supported by capital inflows and a narrowing trade deficit. Dun & Bradstreet expects the rupee to average around ₹85.9/USD in August 2025, close to ₹85.8/USD in July 2025, indicating relative stability despite global uncertainties. The forecast is supported by easing crude oil prices, and improved services exports. However, the rupee may face depreciation pressure due to FII outflows and loss in exports if significantly higher tariffs are implemented on India, though the RBI remains active in curbing excessive volatility and maintaining orderly currency movement.

Arun Singh, Global Chief Economist, Dun & Bradstreet , said, "The additional 25% US tariffs on Indian exports (bringing the total to 50%) clouds the near-term outlook for trade and investment, though hope still remains for a negotiated settlement at lower rates in the months ahead. Domestically, the economy continues to display resilience, with industrial activity advancing at a measured pace. Inflationary pressures are easing on the back of softer food prices and proactive policy interventions. Monetary conditions remain supportive, with recent rate cuts and liquidity measures aimed at spurring credit growth and lowering borrowing costs for MSMEs and consumers. The external sector will draw some support from the India UK CEFTA, which targets a doubling of bilateral trade by 2030."

About Dun & Bradstreet:

Dun & Bradstreet, a leading global provider of business decisioning data and analytics, enables companies around the world to improve their business performance. Dun & Bradstreet's Data Cloud fuels solutions and delivers insights that empower customers to accelerate revenue, lower cost, mitigate risk and transform their businesses. Since 1841, companies of every size have relied on Dun & Bradstreet to help them manage risk and reveal opportunity. For more information on Dun & Bradstreet, please visit www.dnb.com.

Dun & Bradstreet Information Services India Private Limited is headquartered in Mumbai and provides clients with data-driven products and technology-driven platforms to help them take faster and more accurate decisions in domains of finance, risk, compliance, information technology and marketing. Working towards Government of India's vision of creating an Atmanirbhar Bharat (Self-Reliant India) by supporting the Make in India initiative, Dun & Bradstreet India has a special focus on helping entrepreneurs enhance their visibility, increase their credibility, expand access to global markets, and identify potential customers & suppliers, while managing risk and opportunity. Dun & Bradstreet India is also proud to be Great Place to Work® Certified (2025-26), a recognition of its commitment to fostering a high-trust, high-performance workplace culture.

India is also the home to Dun & Bradstreet Technology & Corporate Services LLP, which is the Global Capabilities Center (GCC) of Dun & Bradstreet supporting global technology delivery using cutting-edge technology. Located at Hyderabad, the GCC has a highly skilled workforce of over 500 employees, and focuses on enhanced productivity, economies of scale, consistent delivery processes and lower operating expenses.

Visit www.dnb.co.in for more information.

Click here for all Dun & Bradstreet India press releases

Logo: https://mma.prnewswire.com/media/2314099/5466458/DB_Logo.jpg

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PRNewswire. ANI will not be responsible in any way for the content of the same)