Lok Sabha passes new Income Tax Bill without debate amid opposition protests

Aug 11, 2025

New Delhi [India], August 11 : Lok Sabha on Monday passed the new Income Tax Bill without debate, hours after it was introduced in the House by Finance Minister Nirmala Sitharaman.

The Income Tax (No.2) Bill, 2025, which was introduced on Monday afternoon after the government on Friday last withdrew the Income Tax Bill, 2025 in the Lok Sabha, incorporates almost all recommendations of the Select Committee, which examined the legislation.

The Government had said in the budget in July 2024 that a time-bound comprehensive review of the Income-tax Act, 1961 would be undertaken to make the Act concise, lucid, and easy to read and understand.

The new Income Tax Bill was passed without debate amid opposition protests over their demand for debate on Special Intensive Revision (SIR) of electoral rolls in Bihar. Both Lok Sabha and Rajya Sabha have witnessed continuous disruptions since the beginning of the monsoon session of Parliament over the opposition's demand.

The Government had introduced the Income Tax Bill, 2025 in the Lok Sabha on February 13, 2025, and it was referred to the Select Committee for examination.

The Select Committee laid its report in the Lok Sabha on July 21, 2025. The new and amended bill also incorporates suggestions from stakeholders about changes that would convey the proposed legal meaning more accurately.

There were corrections in the nature of drafting, alignment of phrases, consequential changes and cross-referencing and the government decided to withdraw the Income-tax Bill, 2025 and bring the Income Tax (No. 2) Bill, 2025.

The new bill replaces the Income-tax Act, 1961, which has been subjected to numerous amendments since its passage more than sixty-four years ago.

As a result of these amendments, the basic structure of the Income-tax Act had been overburdened and language has become complex, "increasing compliance for taxpayers and hampering efficiency of tax administration".

The Objects and Reasons of the bill states that taxpayers, practitioners and tax administrators had also raised concerns about the complicated provisions and structure of the Income-tax Act 1961.

The new Income-Tax Bill was passed without debate amid opposition protests over their demand for debate on Special Intensive Revision (SIR) of electoral rolls in Bihar. Both Lok Sabha and Rajya Sabha have witnessed continuous disruptions since the beginning of the monsoon session of Parliament over the opposition demand.

The Lok Sabha also passed the Taxation Laws (Amendment) Bill, 2025 without debate.

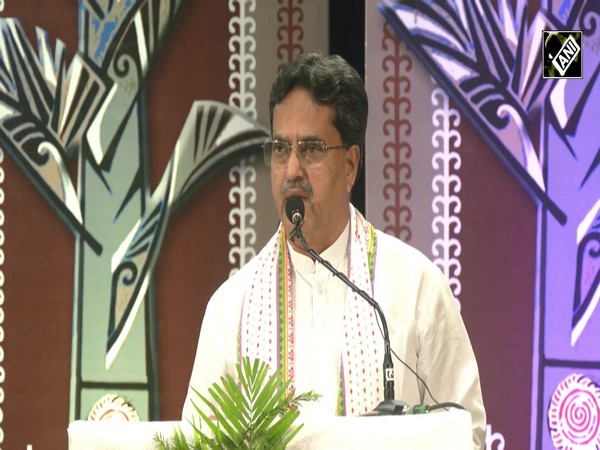

The BJP MP Baijayant Panda-headed 31-member Select Committee had suggested a few changes to the legislation.

In its report, the panel has suggested important changes to tighten definitions, remove ambiguities, and align the new law with existing frameworks.

The Committee, in its 4,584-page report, had identified several drafting corrections based on stakeholder suggestions, which they believed were essential for clarity and unambiguous interpretation of the new bill. The parliamentary panel had made a total of 566 suggestions and recommendations in its report.

To give significant relief to taxpayers, the committee had suggested changing the provision which disallows refunds if income tax returns are filed beyond the due date.

Other recommendations of the committee included aligning the definition of micro and small enterprises with the MSME Act.

For non-profit organisations, the committee asked for clarification over the terms 'income' vs 'receipts', anonymous donations, and the removal of the deemed application concept. The panel asked for these to be fixed to avoid legal disputes.

The report also recommended amendments in the bill for clarity on advance ruling fees, TDS on provident funds, low-tax certificates, and penalty powers.