Maharashtra Revenue Department lifts jurisdictional restriction on document adjudication in Mumbai

Oct 14, 2025

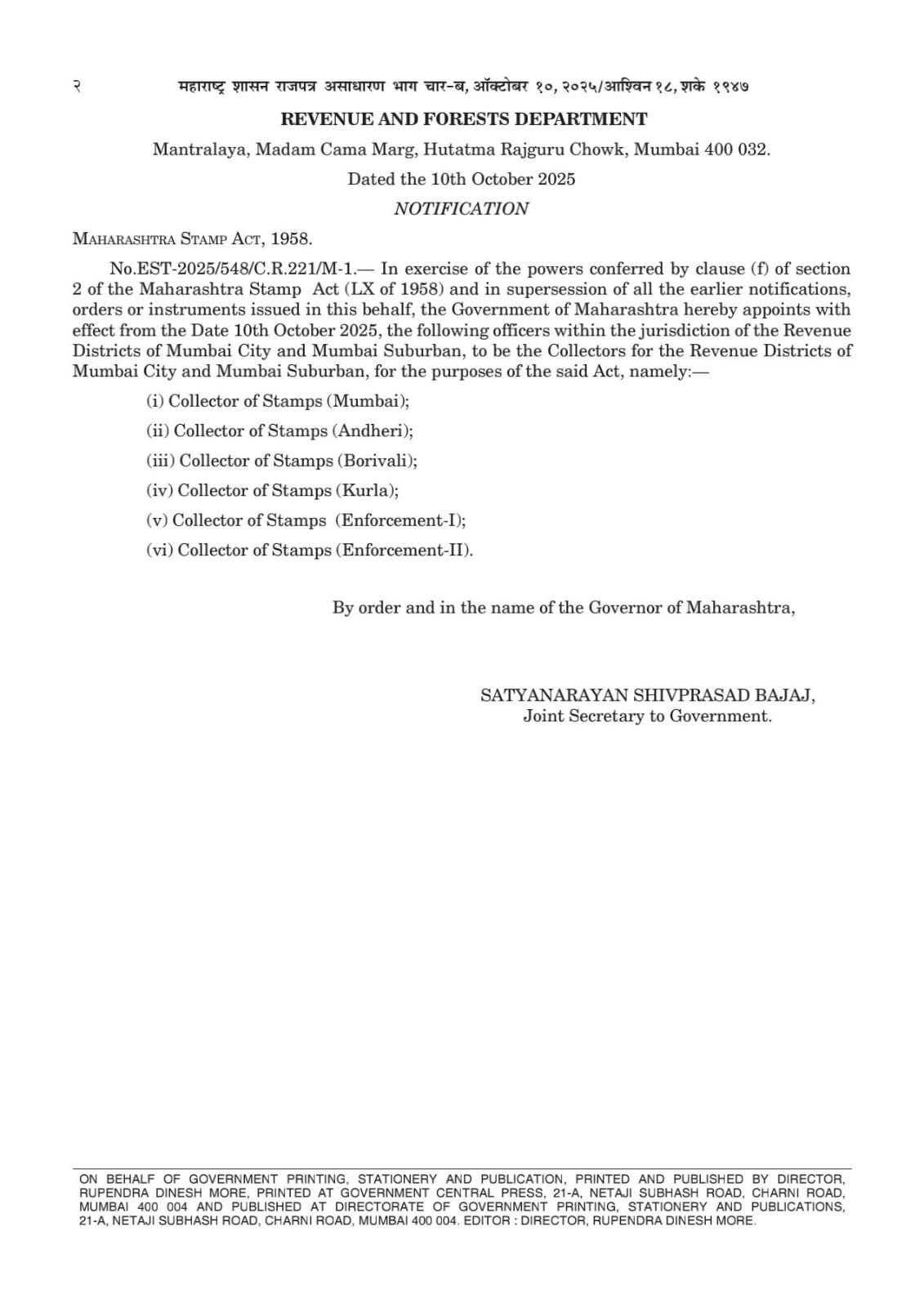

Mumbai (Maharashtra) [India], October 14 : In what is seen as a relief for citizens, businesses and company owners, the Maharashtra Revenue Department has announced that document adjudication can now be done at any stamp office in Mumbai, with earlier jurisdictional restrictions being removed.

Maharashtra Revenue Minister Chandrashekhar Bawankule made an announcement in this regard on Tuesday.

Under the new rule, citizens are no longer required to adjudicate documents only in the area where they reside or conduct business.

"Citizens, businesses, and company owners in Mumbai and its suburbs can now register documents (Adjudication of Documents) at any of the six stamp offices in Mumbai, irrespective of their location. The earlier requirement to register documents only at the stamp office within the respective area of residence or business has now been eliminated," Bawankule said.

The change allows the adjudication of property agreements, lease deeds, inheritance deeds, and other related documents at any stamp office across Mumbai, offering significant relief to Mumbaikars.

"Now, residents of Mumbai city and its suburbs can complete the document registration process for property agreements, lease agreements, inheritance deeds, and other important documents at any stamp office, including Borivali, Kurla, Andheri, Mumbai City, and the main stamp office near the Old Custom House (Stamp District Collector, Enforcement 1 and 2)," Chandrashekhar Bawankule wrote in a post on X.

Meanwhile, Uttar Pradesh Chief Minister Yogi Adityanath on Sunday said that Prime Minister Narendra Modi has given the nation and Uttar Pradesh a historic Diwali gift through GST reforms, providing relief on essentials while imposing higher taxes on drugs and wasteful spending.

On September 3, the 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates. The 5 per cent slab consists of essential goods and services, including food and kitchen items like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agriculture equipment; handicrafts and small industries; and medical equipment and diagnostic kits.

The 18 per cent slab comprises a standard rate for most goods and services, including automobiles (such as small cars and motorcycles up to 350cc), consumer goods (like electronic items), household goods, and certain professional services. A uniform 18 per cent rate applies to all auto parts.

Additionally, there is a 40 per cent slab for luxury and sin goods, including tobacco and pan Masala, products such as cigarettes, bidis, and aerated sugary beverages, as well as luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.