Manipur GST amendments taken up for consideration and passing in Lok Sabha

Dec 01, 2025

New Delhi [India], December 1 : The Lower House of the Parliament took up the Manipur Goods and Services Tax (Second Amendment) Bill, 2025 for consideration and passing on Monday.

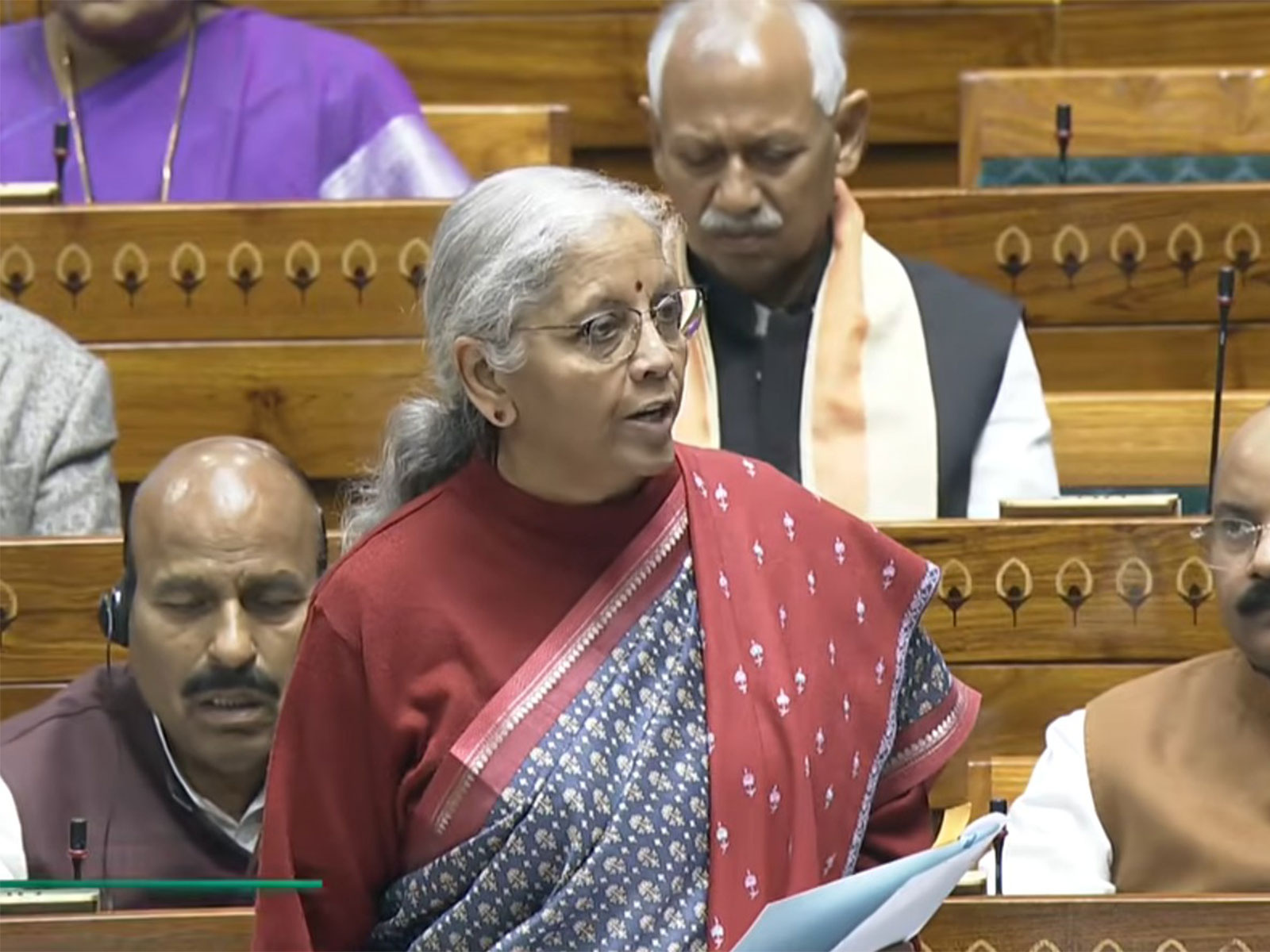

Union Finance Minister Nirmala Sitharaman introduced the bill on the floor of the house for consideration and passing.

"The Central government amended the Central Goods and Services Act of 2017, particularly section 121 to 134 of the finance Act 2025. This was passed by Parliament and enacted in 2024. These changes also came into effect on October 2025 after more than half of the states updated their GST. But unfortunately Manipur GST could not happen in time as the state assembly was in a suspended mode," the Union Finance Minister said on the floor amid repeated sloganeering.

BJP's Deoria MP Shashank Mani also spoke in support of the Manipur GST amendments.

"In the last 8 years, under the leadership of Prime Minister, we changed a lot in GST, in that we introduced uniformity in the GST, and because of that production has increased. Under leadership of PM Modi and Nirmala ma'am, this year itself we introduced new reforms, which is known as GST 2.0," the BJP MP said.

"The Manipur Goods and Services Tax Act, 2017 was enacted pursuant to enactment of the Central Goods and Services Tax Act, 2017 to make provision for levy and collection of tax on intra-State supply of goods or services or both by the State of Manipur and for matters connected therewith or incidental thereto," according to the bills' "objects and reasons."

The provisions of the Central Goods and Services Tax Act, 2017 were amended through sections 121 to 134 of the Finance Act, 2025 and similar amendments were required to be carried out in the Manipur Goods and Services Tax Act, 2017 at the earliest, as per the decision of the 56th GST Council, to avoid repugnancy with the said Central Act.

Since the proclamation issued by the President under article 356 of the Constitution is in force in the State of Manipur since the 13th February, 2025 and as Parliament was not in session and circumstances existed which rendered it necessary to take immediate action to have continuance of the Manipur Goods and Services Tax Act, 2017 in line with the Central Goods and Services Tax Act, 2017, the President promulgated the Manipur Goods and Services Tax (Second Amendment) Ordinance, 2025 on the October, 2025.

The Manipur Goods and Services Tax (Second Amendment) Ordinance, 2025 is to be replaced by an Act of Parliament and for the said purpose, it is proposed to introduce the Manipur Goods and Services Tax (Second Amendment) Bill, 2025 in Parliament.

While the bill was allocated 3 hours for discussion, the Lok Sabha was adjourned nearly 20 minutes after convening at 2 PM.

Earlier, the Union Finance Minister also introduced the Health Security se National Security Cess Bill, 2025, for augment the resources for meeting expenditure on national security and for public health, and to levy a cess for this on the machines installed or other processes undertaken by which specified goods are manufactured and for matters connected therewith or incidental thereto.