MediTrust Health Shares Insights at Hong Kong Fintech Week: AI Pragmatically Reshaping Cross-Border Healthcare Payments in the Greater Bay Area

Nov 06, 2025

PRNewswire

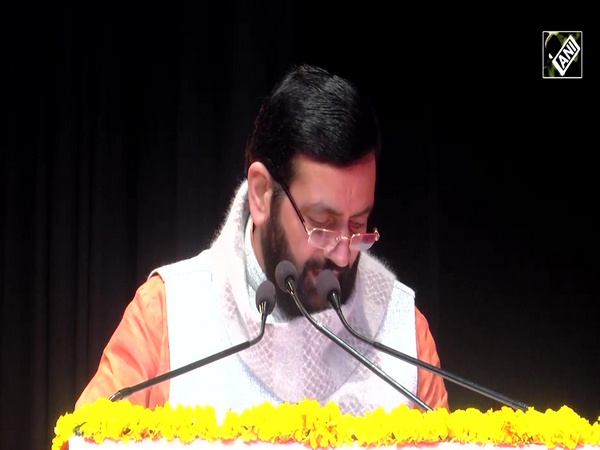

Hong Kong, November 6: MediTrust Health, the largest innovative healthcare payor platform in China, delivered key insights recently at the HealthTech Forum of "Hong Kong FinTech Week 2025." Seth Zhang, Founder and CEO of MediTrust Health, stated that Artificial Intelligence (AI) is bringing disruptive innovation to the traditional insurance sector, with cross-border services emerging as a new industry trend. He emphasized that the company would leverage Hong Kong as a hub for expansion into overseas markets, highlighting its successful use cases in the Greater Bay Area (GBA) as a valuable reference for the industry.

https://www.youtube.com/watch?v=dgVxyMhWWgY

During a panel discussion titled, "AI Reality Check: What's Powering Insurance and Healthcare Today," Seth shared profound insights on AI's transition from concept to large-scale implementation. He noted the polarized expectations for AI in the industry: one side is overly optimistic, believing AI can completely replace human roles, while the other fears errors in high-precision scenarios. MediTrust Health, he explained, focuses on specific, critical sub-domains to pragmatically achieve true disruptive innovation rather than mere incremental improvement.

AI Drives Core Operations to Achieve a "What You See is What You Pay" Seamless Experience

Discussing AI's measurable impact, Seth noted that in its eight years since establishment, MediTrust Health has cumulatively processed nearly 400 million claims data entries using its proprietary AI platform (AI Hub mind42.ai) and has collaborated deeply with leading reinsurers.

He emphasized that MediTrust Health's core strategy is to empower an end-to-end, intelligent closed-loop--spanning from insurance product design, precise pricing, and risk management to claims processing. Citing its flagship application, Care2Pay (Yi Ma Zhi Fu ), as a prime example, he explained that the service generates an exclusive, AI-powered QR code in real-time. When a user pays a medical bill, the system automatically matches their insurance policy and completes the settlement. "This transforms a complex backend claims process into a seamless, front-end 'what you see is what you pay' user experience," he stated.

"The AI model's capability is the entry ticket, but industry value is the pass," Seth added. "The future competitiveness of AI enterprises will depend on their irreplaceability within the 'efficiency improvement--cost optimization--ecosystem win-win' value chain."

Simulating Expert Decisions to Overcome Data and System Challenges

The panel also delved into the real-world challenges of scaling AI applications. Seth identified that a primary challenge is fostering deep system transformation among partners. He noted that in the 2B market, guiding numerous insurance companies to migrate from legacy IT systems to AI-driven workflows is an extremely time-consuming, resource-intensive, and capital-intensive process.

Furthermore, data governance and standardization present another major obstacle. He analyzed that even in a data-rich market like China, information structurization requires significant improvement. This challenge is amplified in other markets, such as Southeast Asia, where data is highly fragmented and unstructured. To overcome these data limitations, MediTrust Health's solution is the deployment of AI agents. Seth stated that these AI agents function as domain experts. Even in imperfect data environments, they can simulate professional decision-making processes, thereby ensuring a high-quality service experience.

Leveraging the Hong Kong Hub for New Cross-Border Medical Opportunities in Asia

Regarding strategic positioning, Seth stressed that Hong Kong is the core node for the medical integration of the Guangdong-Hong Kong-Macao Greater Bay Area and serves as MediTrust Health's business base. "Hong Kong's status as an international hub for capital and talent, backed by the Greater Bay Area, provides an irreplaceable strategic advantage," he said.

MediTrust Health submitted its prospectus to the Hong Kong Stock Exchange mid-year for a planned Main Board listing, with Goldman Sachs, CICC, and HSBC as joint sponsors. The company is supported by top-tier institutions including GIC, HSBC, and Ant Group, giving it robust capital strength and international credibility. The company's strategy is to integrate the dual advantages of "Hong Kong + GBA," using the city as a critical springboard for expansion into overseas markets.

Looking ahead, Seth observed a new regional mobility trend among the middle class, with frequent travel between Hong Kong SAR, Singapore, and Japan creating immense demand for integrated healthcare services. MediTrust Health aims to precisely serve this cross-border consumer group by connecting medical resources across Chinese Mainland and Hong Kong, providing efficient healthcare payment solutions that eliminate the need for out-of-pocket payments and fulfill the cross-border healthcare connectivity needs of Hong Kong insurance users.

About MediTrust Health

MediTrust Health, as an innovative healthcare payor platform in China, is committed to transforming China's healthcare payment system by addressing funding and payment challenges faced by patients, health insurers and pharmaceutical companies. With our AI-empowered technologies, we have augmented the healthcare payment ecosystem and realized triple wins for all three stakeholders. With a focus on the needs of patients, insurers and pharmaceutical companies, we have developed two main offerings: Smart Pharma Solution provides pharmaceutical companies with a comprehensive suite of commercialization solutions across the product lifecycle; Smart Insurance Solution enables health insurance innovation by offering end-to-end support to health insurers through our proprietary AI-empowered technologies and access to quality medical resources. Additionally, we have also launched Care2Pay, an all-in-one user platform, that allows users to discover more payment solutions and complete direct billing transactions, ultimately delivering more comprehensive, quality and accessible healthcare to patients and their families. As of December 31, 2024, we had serviced approximately 393 million commercial health insurance policies, of which our City Supplementary Insurance projects covered 160 cities, and achieved cumulative savings of RMB 6.7 billion in out-of-pocket costs for patients.

More information can be found on the official website: https://www.meditrusthealth.com/en

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PRNewswire. ANI will not be responsible in any way for the content of the same.)