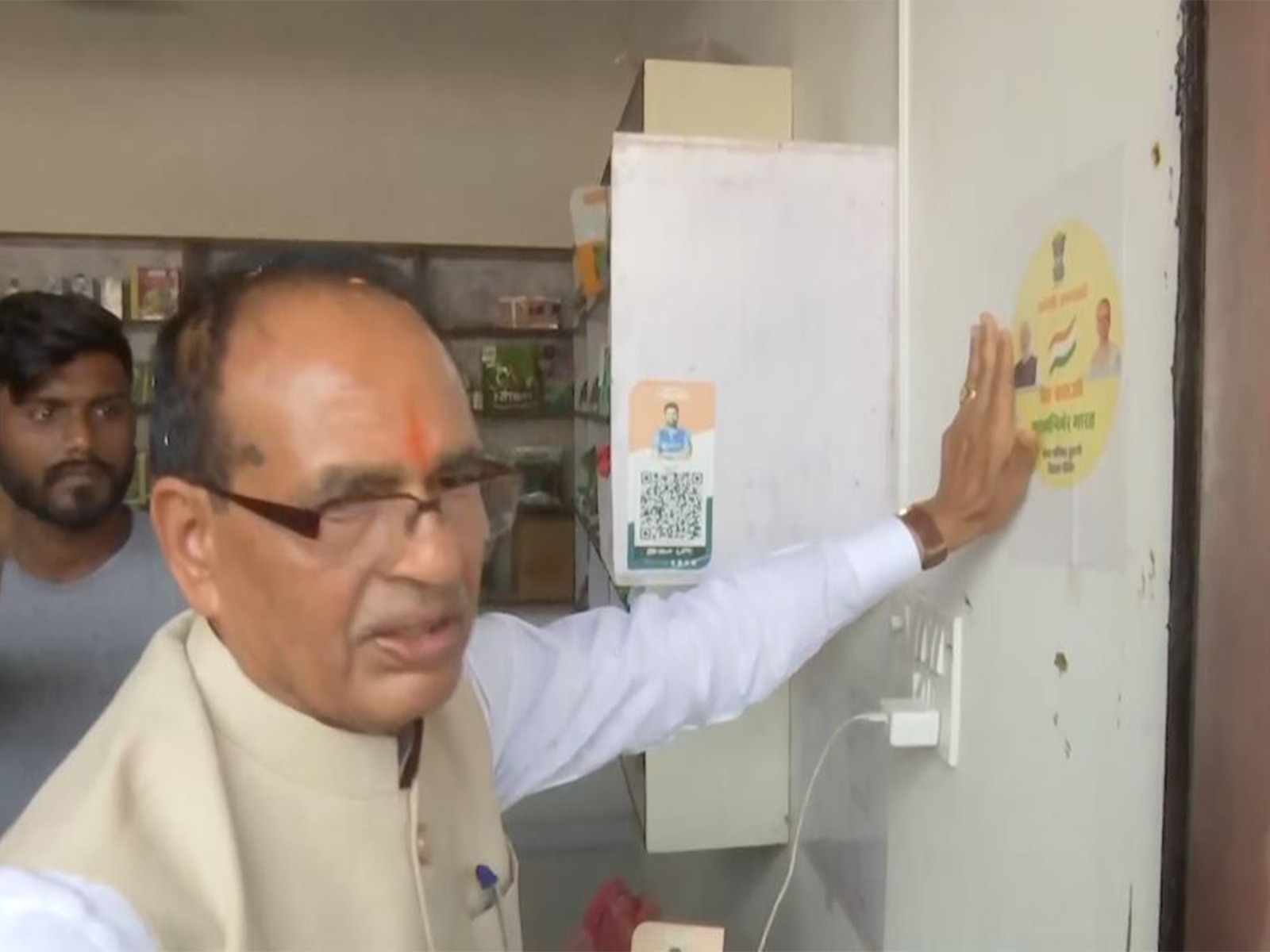

MP: Union Minister Shivraj Chouhan meets shopkeepers, promotes Swadeshi products

Sep 29, 2025

Sehore (Madhya Pradesh) [India], September 29 : Union Minister Shivraj Singh Chouhan on Monday interacted with local shopkeepers in a public outreach initiative aimed at promoting Swadeshi products and raising awareness about the revised GST (Goods and Services Tax) rates.

The campaign aims to promote the use of locally produced goods while keeping traders and consumers informed about the latest tax updates.

Earlier, Chouhan hailed the implementation of the Goods and Services Tax (GST) reforms, calling it a "Bachat Utsav" for the people.

The union minister said that the changes had made daily-use items, agricultural equipment, and clothing more affordable, directly benefiting the common man.

While speaking to ANI, Chouhan said, "The Goddess is showering her blessings in Navratri. But Modi Government has showered gifts. Daily-use products used by the common man are affordable starting today. Agri products are affordable. Edible products are affordable. Clothes are less expensive. This is 'Bachat Utsav'. People will save money and utilise it somewhere else."

The minister highlighted that the new GST rates would bring major savings for farmers, and up to Rs 23,000 would be saved on small tractors, Rs 63,000 on big tractors, and Rs 1.87 lakh on combine harvesters.

Chouhan congratulated the people on the benefits of the reform and stressed that awareness was crucial.

"Congratulations to the people... All our MLAs, MPs and workers will go to the markets to create awareness on GST rates so that the benefit reaches people and doesn't stop midway," he said.

Emphasising Prime Minister Narendra Modi's message, Chouhan urged citizens and traders to support Indian products. "Also, as per the message of PM Modi, we should purchase 'Swadeshi'... Traders should sell 'Swadeshi'," he said.

The Goods and Services Tax (GST) reforms, approved by the Union Government on September 4, came into effect on September 22.

GST 2.0 features two main tax slabs, 5% and 18%, with a 40% compensation cess for luxury and sin goods.

The new framework is expected to ease compliance, reduce consumer prices, boost manufacturing, and support a wide range of industries, from agriculture to automobiles and from FMCG to renewable energy, and is intended to lower the cost of living, strengthen MSMEs, widen the tax base, and drive inclusive growth.