Net direct tax collections spike by 9.40% in FY26

Feb 11, 2026

New Delhi [India], February 11 : India's net direct tax collections for the financial year 2025-26 have recorded a robust growth of 9.40 per cent, reaching Rs 19,43,743.97 crore as of February 10, 2026, compared to Rs 17,76,728.11 crore in the corresponding period of the previous fiscal, data released by the Income Tax Department said on Wednesday.

According to official data, gross direct tax collections stood at Rs 22,78,068.60 crore, marking a 4.09 per cent increase over Rs 21,88,554.86 crore collected during the same period last year.

Refunds issued during the period declined by 18.82 per cent to Rs 3,34,324.63 crore, compared to Rs 4,11,826.75 crore in the previous financial year.

Corporate tax collections (net) rose to Rs 8,89,752.90 crore in FY26 (as on February 10), up from Rs 7,77,047.63 crore in the same period last year.

Non-corporate tax collections, which include taxes paid by individuals, HUFs, firms and other entities, increased to Rs 10,03,385.52 crore from Rs 9,47,477.30 crore a year earlier.

Securities Transaction Tax (STT) collections remained broadly stable at Rs 50,279.17 crore, compared with Rs 49,201.40 crore in the previous fiscal.

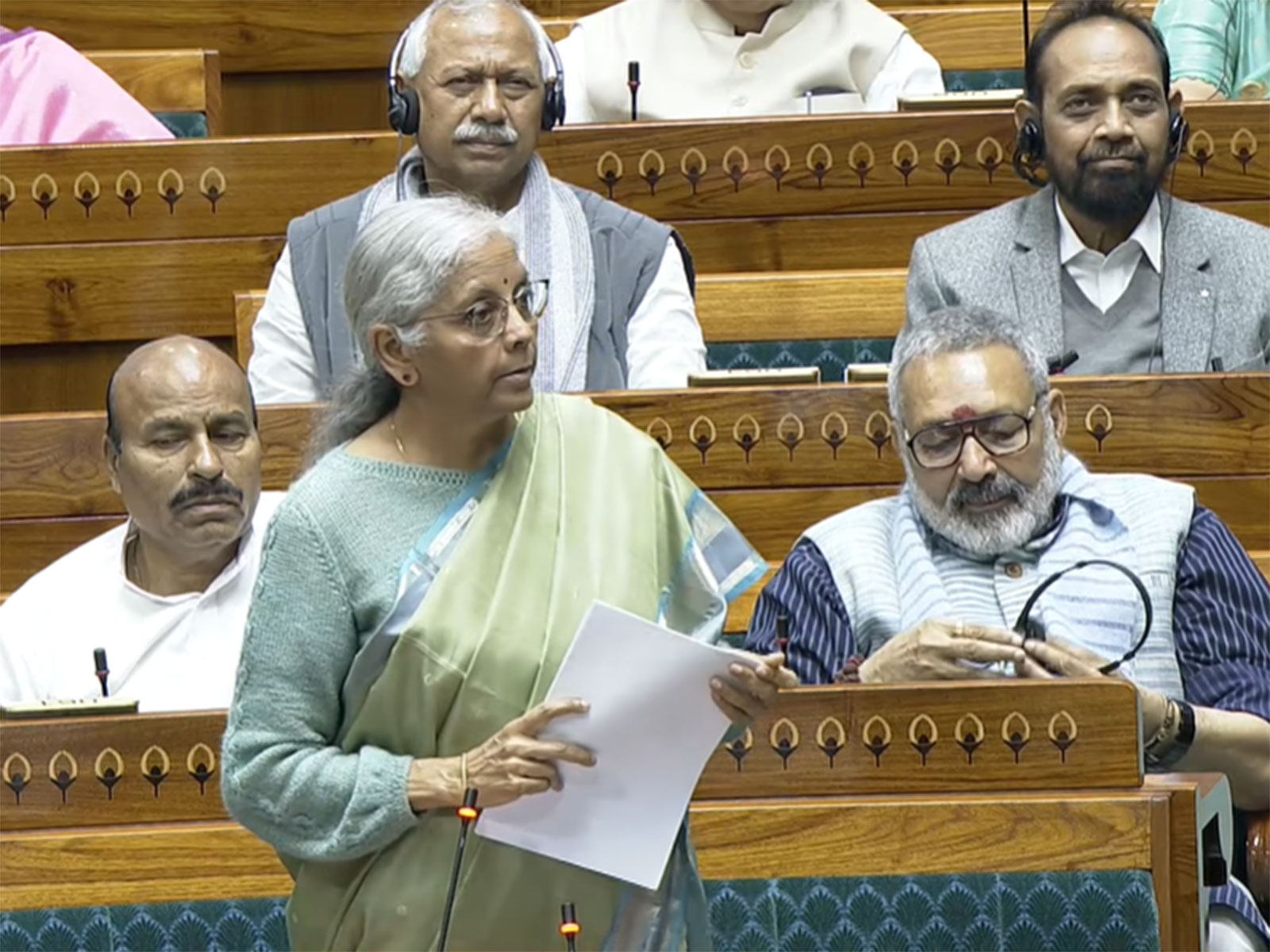

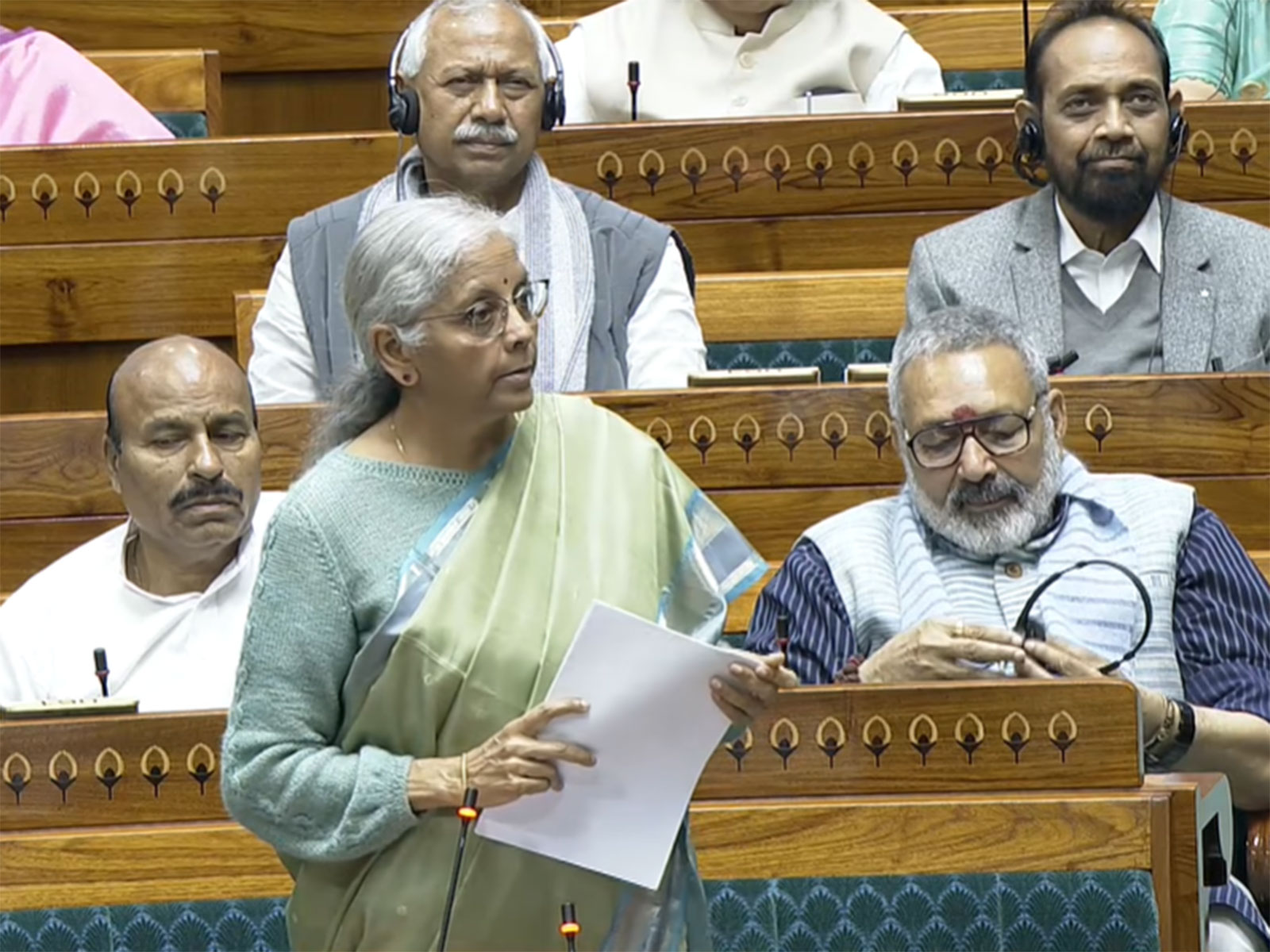

Replying to the debate in the Lok Sabha on the Union Budget 2026-27, Union Finance Minister Nirmala Sitharaman assured that a 41% share of taxes is devolved to the States. "We have transferred 41% of the divisible pool to the states. No state's share has been reduced."

"In the coming year, the States' share is estimated at Rs 25.44 lakh crore, which is devolved to them, an increase of Rs 2.7 lakh crore from last year," she said.

She cited the 16th Finance Commission and said it had analysed the devolution of funds from 2018 to 2023 and concluded that the Centre's transfers to states during each of those years matched the Commission's recommendations.