New Income Tax Act likely to broaden tax base on simpler compliance

Nov 25, 2025

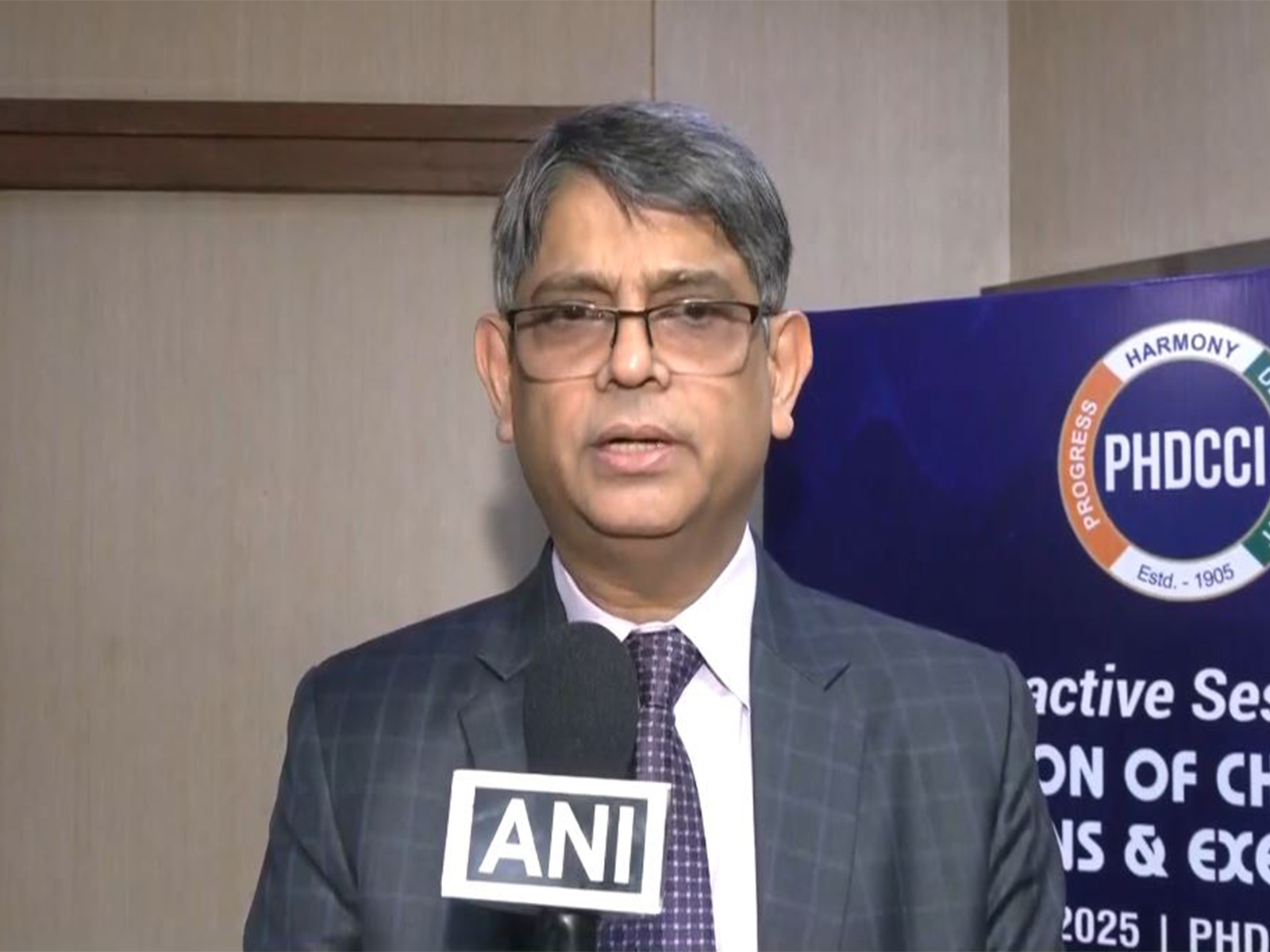

New Delhi [India], November 25 : The new Income Tax Act is expected to expand India's tax base by making compliance simpler and more accessible for individuals, institutions and exempt entities, Debjyoti Das, Principal Chief Commissioner of Income Tax (Exemption) told ANI today.

"As far as exemptions are concerned, even though revenue is foregone when it comes to exemptions, what I do understand is it is easier for many tax regimes to become part of this process so that they can file the return easily," he said in an interview on the sidelines of an interactive session on Taxation of Charitable Institutions and Exempt Entities at PHDCCI.

Das said the new framework is designed to draw more people into formal filing.

Income Tax Act, 2025 to be effective from April 1, 2026. The Act simplifies language, removes obsolete provisions and consolidates and restructures provisions. It Introduces concept of 'Tax Year' replacing 'Assessment Year' and 'Previous Year'.

To modernize and simplify India's outdated tax laws, the government announced a comprehensive review of the Income-tax Act, 1961.

This led to the introduction of the Income-tax Bill, 2025, which was referred to a Select Committee of Parliament for detailed examination.

This updated Bill incorporated most of the committee's inputs along with improvements in legal clarity and drafting. It was passed by both Houses of Parliament in the monsoon session and now forms the foundation of India's new tax framework.

Das added that the simple form of digital integration was accelerating the shift. "Use of UPI is another example, every vendor is using UPI. Things are coming into the mainstream and people want to come mainstream."

Das said a major factor expected to boost compliance is the design philosophy of the new Act itself.

He said the new Act is a major improvement over the Act that has been in force. He pointed out that the current law had grown "a little unwieldy" due to multiple amendments, making simplification necessary. According to him, the Finance Minister had clearly stated that she wanted an Act that is "concise, lucid and easy to understand," aligning with the government's broader effort to make laws easier for the common person to navigate.

Das said the new Act is built with clarity in mind. "It is very concise, it is beautifully written. It's in a flow and tabular forms are there and formulas are used. The language was difficult to understand earlier. It makes life easier for everybody," he said, adding that the new structure would reduce complexity and lead to "better compliance" across sectors, including exempt institutions and NGOs.

He also addressed the ongoing registration cycles for charitable and non-profit entities--a core operational issue for the exemption ecosystem. Since April 2021, new non-profit organisations receive automatic provisional registration, enabling them to begin operations without delay. These entities must return for regularisation, at which point the department examines their activities and compliance records.

Das said this ensures both facilitation and accountability. Organisations registered before April 2021, which were automatically renewed during the transition, are now coming up for revalidation. He acknowledged the high volume of applications but said that for "old trusts, if they are genuine, and there are genuine activities, it will be made as streamlined and easy for them as possible."

Addressing concerns around CSR spending, Das said that while most companies follow proper processes, there are instances of misuse. "Some CSRs are not very accurate but this is not a regular practice. But as in everything else, there will be outliers... where we have seen CSR expenditure not being spent in the right way as it was supposed to be," he said, urging tax practitioners and corporate representatives to remain vigilant.