New Income Tax Bill a step toward simplified, fair tax system: LJP MP Arun Bharti

Jul 23, 2025

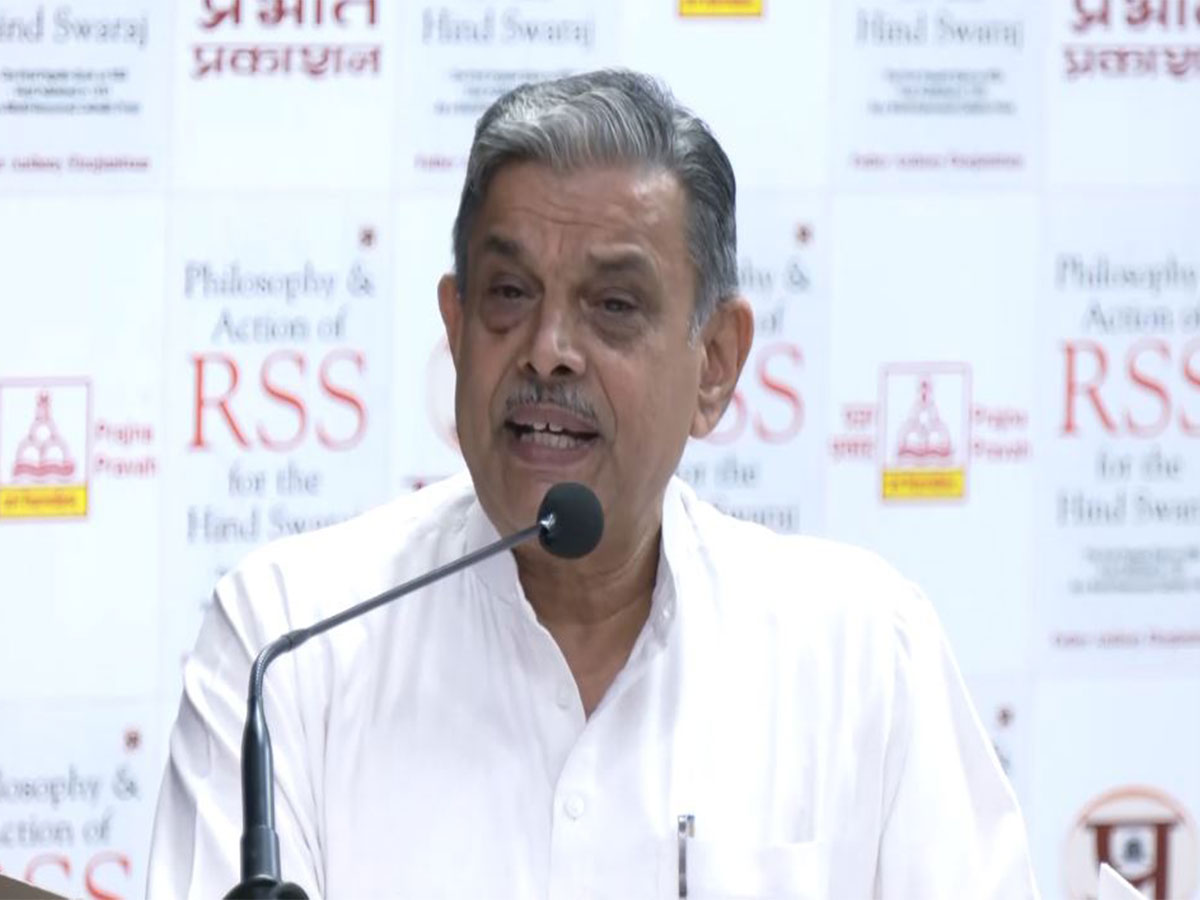

Gaya (Bihar) [India], July 23 : Lok Janshakti Party MP Arun Bharti on Wednesday welcomed the presentation of the Income Tax Standing Committee report on the Income Tax Bill, 2025 in the Lok Sabha, describing the proposed legislation as a "historic initiative" aimed at streamlining and modernising India's tax framework.

MP Bharti said that the bill brings sweeping structural changes to the tax code by simplifying provisions and enhancing transparency.

He said, "The Income Tax Bill, 2025, is a historic initiative aimed at making India's tax system simpler, more transparent, and just. Compared to the old laws, it introduces substantial structural reforms. The number of chapters has been reduced from 47 to 23. The number of sections has been brought down from around 819 to 536, and the total word count has been nearly halved. This means less confusion and more clarity -- that's the first key point."

The LJP MP pointed out that one of the primary objectives of the new bill is to reduce "ambiguity" in which led to "disputes and court cases."

"The new bill ensures clarity and reduces litigation. In the 1961 Act, the language was complex, the sections were lengthy, and the provisions were full of ambiguities, which consistently led to disputes and court cases. In contrast, the new bill uses simple, straightforward language, follows a table-based (tabular) format, and eliminates scope for confusion through well-defined and integrated tax year provisions," Bharti said.

Highlighting the impact of the bill on small businesses and emerging enterprises, Bharti said the legislation offers "significant relief" to startups and MSMEs.

He said, "The second key point is the significant relief provided to startups and MSMEs. There will be a faceless assessment process. The time limit for updating returns has been increased from two years to four. The threshold for TDS (Tax Deducted at Source) has been raised, reducing the compliance burden on small businesses. The hassles of receiving notices, responding to them, and paperwork will be greatly reduced."

He further emphasised that the new bill would tackle several long-standing taxpayer grievances, including delays in refunds, harsh TDS rules on late filings, and the repetitive nature of tax notices.

He said, "The third key point is the reduction in the compliance burden. Practical and timely solutions will be provided for issues such as delays in refunds, harsh and unclear TDS rules on late filings, and repeated notices. This is not just a tax reform -- it lays a new foundation for respecting and protecting honest taxpayers. Let us take a firm step toward a transparent and simplified tax system."

Earlier on July 21, Select Committee on Income Tax Bill Chairperson and Bharatiya Janata Party MP Baijyant Panda presented the Report of the Select Committee on the Income-Tax Bill, 2025 in the Lok Sabha.

Under Panda's leadership as Chairperson, the Committee undertook a thorough and inclusive review process. It conducted stakeholder consultations, meeting with industry leaders, mid-level tax practitioners, legal experts, MSME bodies, Non Profit Organisations, economists, and civil society representatives to gather diverse perspectives, according to an official statement.

The 31 member committee had unanimously adopted the report during the meeting.

"Extensive sittings with the Ministry of Finance for a clause-by-clause examination of the Bill were held. Over a period of five months, the Committee met consistently, held 36 sittings without a single adjournment, and have been able to accomplish their stated mandate within the stipulated time," the statement added.

After comprehensive deliberations, the Committee submitted 285 recommendations focused on simplifying the tax regime and making the Income Tax legislation simplified and lucid.