New Income Tax Bill to promote MSMEs; enable youth to start new businesses: BJP's Dinesh Sharma

Jul 23, 2025

New Delhi [India], July 23 : The proposed Income Tax Bill 2025 will enable the youth the start their own small businesses, allow Micro, Small and Medium Enterprises (MSMEs) to flourish further, and address any economic inequality across states, member of Parliamentary Select Committee on the proposed IT bill, Dinesh Sharma said on Wednesday.

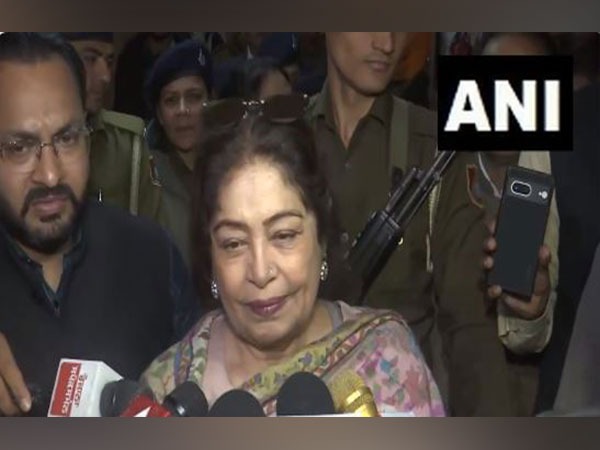

"The impact of simplifying the Income Tax Act will be on youth who want to start new businesses, small businesses, MSMEs, or states where inequalities have arisen for some reason, so that there can be equality in that. There are multiple things, some small changes to revolutionary changes to make our economy grow," Rajya Sabha MP Dinesh Sharma told ANI outside Parliament.

The new IT Bill has been hailed for simplifying the provisions in the six-decade old Income Tax Act of 1961. The RS MP, while detailing the discussions which took place on the bill, told ANI, "The government has either amended or simplified the old bills. The issue of simplifying the provisions of Income tax has been talked about from the beginning."

Praising the 2025 budget which was introduced in February of this year, Sharma hailed the government managing to lift 2.5 crore out of poverty through various schemes and initiatives.

"Right now, many things have been reduced in the budget, but how can we bring changes so that small scale industries can be promoted so that Manipur or everything else can be brought under the purview of GST. You must have seen before that more than twenty five million people have come out from poverty."

Another member of the Select Committee, BJP RS MP Sanjay Seth also highlighted how the new Income Tax Return (ITR) forms will be easier to comprehend for the common man, without one needing to go to a Chartered Accountant to file their returns.

"The bill was quite old, and there was a need to change some things in it. Nowadays as people have tax liabilities or other things, to organise those we brought this. Then there was the thing that when one files a return, the common person could not understand the clauses themselves and had to go to a CA. With the new bill, a common man can easily read and fill the new forms," Seth told ANI.

Earlier on July 21, Select Committee on Income Tax Bill Chairperson and Bharatiya Janata Party MP Baijyant Panda presented the Report of the Select Committee on the Income-Tax Bill, 2025 in the Lok Sabha.

Under Panda's leadership as Chairperson, the Committee undertook a thorough and inclusive review process. It conducted stakeholder consultations, meeting with industry leaders, mid-level tax practitioners, legal experts, MSME bodies, Non Profit Organisations, economists, and civil society representatives to gather diverse perspectives, according to an official statement.

The 31 member committee had unanimously adopted the report during the meeting.

"Extensive sittings with the Ministry of Finance for a clause-by-clause examination of the Bill were held. Over a period of five months, the Committee met consistently, held 36 sittings without a single adjournment, and have been able to accomplish their stated mandate within the stipulated time," the statement added.

After comprehensive deliberations, the Committee submitted 285 recommendations focused on simplifying the tax regime and making the Income Tax legislation simplified and lucid.