Nifty, Sensex open lower as selling pressure continues; global cues, FPI flows, and Q3 earnings in focus

Jan 06, 2026

Mumbai (Maharashtra) [India], January 6 : The selling spree in the domestic stock markets continued on Tuesday, with both benchmark indices opening in the red amid weak sentiment and caution among investors.

The Nifty 50 index opened at 26,189.70, down by 60.60 points or 0.23 per cent, while the BSE Sensex began the session at 85,331.14, declining by 108.48 points or 0.13 per cent. The weak opening followed a negative close on Monday, as selling pressure persisted in select heavyweight stocks.

Market experts noted that Monday's session saw the indices touch intraday highs but fail to sustain gains.

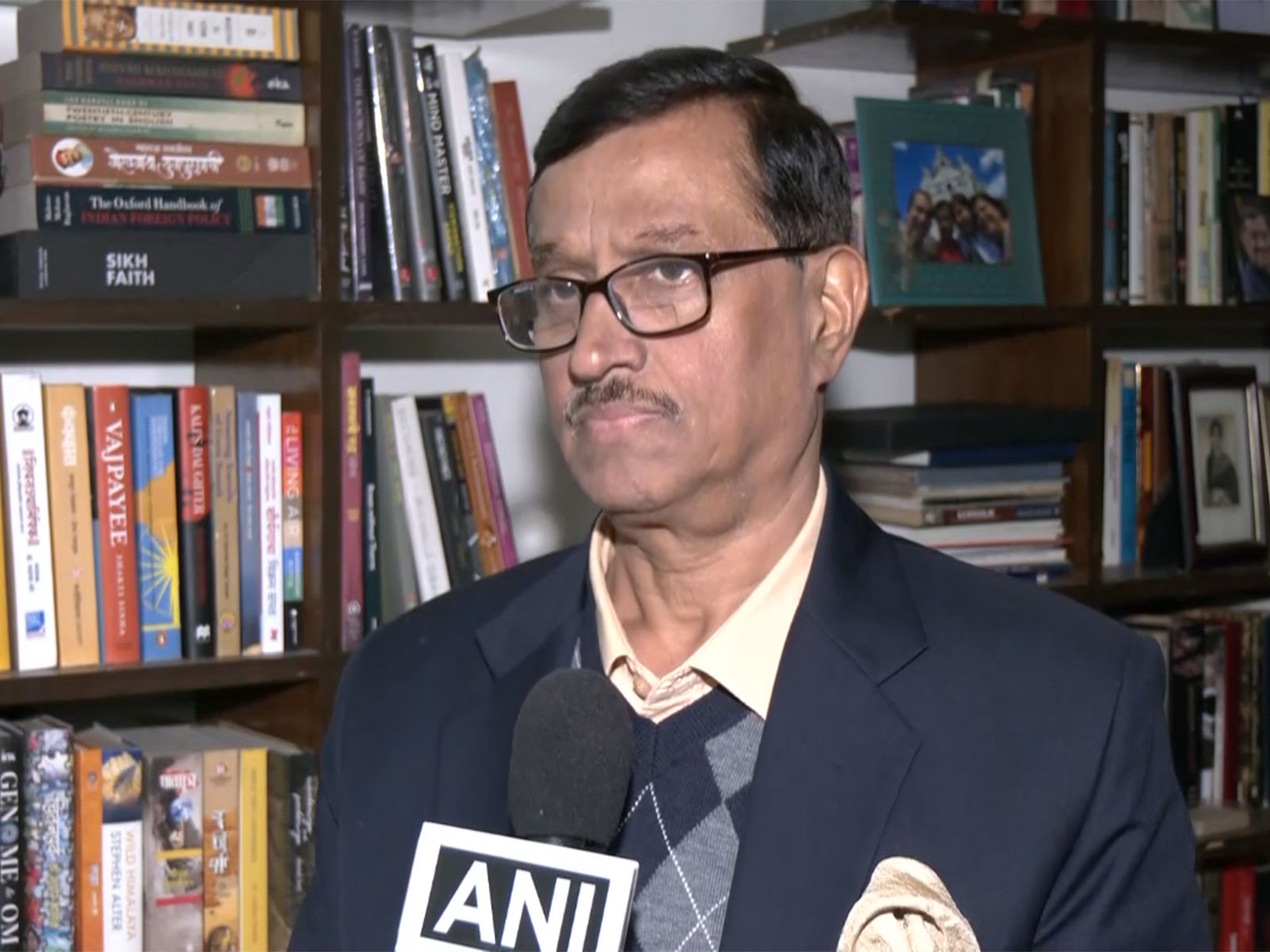

Ajay Bagga, Banking and Market Expert, told ANI, "Indian markets marked an intraday high but could not hold onto the gains as selling in IT and oil and gas stocks as well as index heavyweights, led to a negative day on Monday. This morning, the pointer is towards a positive start, but a lot will depend on FPI flows, which have been volatile in the New Year as well. FPI positioning has improved slightly from a net short of 91 per cent to a net short of 89 per cent, but it needs to improve a lot more before this rally gets stabilized".

Globally, market cues were mixed but largely supportive. Most Asian markets were trading higher in early hours, led by gains in defence and technology stocks. US stock futures were also in positive territory.

At the same time, gold and silver continued to rise, indicating sustained interest in safe-haven assets. Oil prices remained in the red, while the US dollar was slightly weaker following poor US economic data.

In the broader markets, a mixed trend was observed on the NSE. Midcap and smallcap stocks were trading in green, while the Nifty 100 index was in the red, indicating selling pressure in large-cap stocks.

Sectorally, Nifty IT and Oil and Gas indices opened in the red. Other sectors showed gains, with Nifty Auto up by 0.10 per cent, FMCG rising 0.18 per cent, PSU Bank gaining 0.25 per cent, Nifty Realty up 0.30 per cent and Nifty Metal advancing 0.37 per cent.

Ponmudi R, CEO of Enrich Money, said, "Market attention is expected to centre on weekly options expiry-related flows and evolving expectations around the upcoming Q3 earnings season. Nifty 50 remains in a short-term consolidation phase above its key moving averages, maintaining a constructive structure. The 26,000-26,050 support cluster, aligned with the 20-day EMA and recent higher lows, continues to act as a strong base on declines. Immediate support in the 26,150-26,200 zone is helping sustain the upside bias."

Meanwhile, US economic data is expected to take centre stage later this week, with jobs and unemployment numbers likely to influence expectations around future Fed rate cuts.

Global markets witnessed unusual price action on Monday following the Venezuela geopolitical event, with both risk assets and safe havens rising. After positive Asian and European markets, US indices also ended higher, with the Dow Jones hitting a record high. Gold and silver were sharply up, oil fluctuated but ended higher, and the US dollar also saw some safe-haven buying.