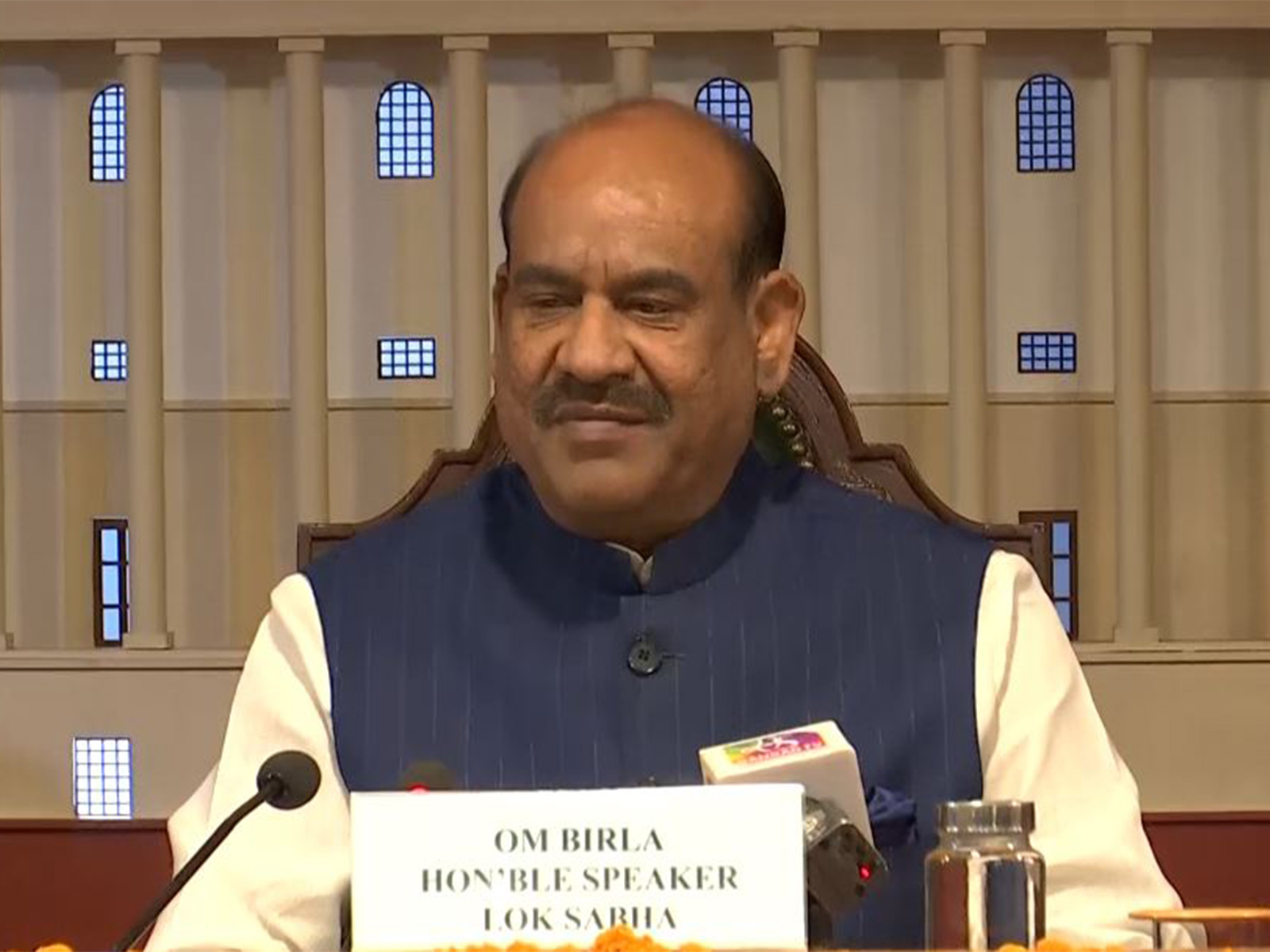

One Nation, One Tax made tax structure across nation simpler and more transparent: Lok Sabha Speaker Om Birla

Nov 27, 2025

New Delhi [India], November 27 : Lok Sabha Speaker Om Birla on Thursday observed that reforms in direct and indirect taxes, along with the 'One Nation, One Tax' GST framework, have made the nation's tax structure simpler and more transparent, contributing to India's growth and prosperity.

He said that it is the responsibility of revenue service officers to maintain and strengthen this transparent system.

Lok Sabha Speaker made these remarks while addressing Officer Trainees (OTs) of the 76th Batch of the Indian Revenue Service (IRS-C&IT), who are attending an Appreciation Course in Parliamentary Processes and Procedures organised by the Parliamentary Research and Training Institute for Democracies (PRIDE) in the Parliament House Complex.

Expressing joy at the rising numbers of women officers in various Central and All India Services, Birla noted that increasing numbers of women officers reflect India's growth and aspirations.

Birla also praised the technical skills and knowledge of today's youth, who are at the forefront of leveraging advanced technology, research, and innovation for nation-building.

He noted that the bold, confident, and fresh perspectives of young Officer Trainees will help India progress toward global leadership. He further stated that their contributions will significantly support the goal of Viksit Bharat as envisioned by Prime Minister Narendra Modi.

Speaking on the occasion, Birla emphasised that the Parliament of India is the centre of the nation's democratic process and policymaking. He added that IRS officers will become key pillars of India's economic strength in the years ahead.

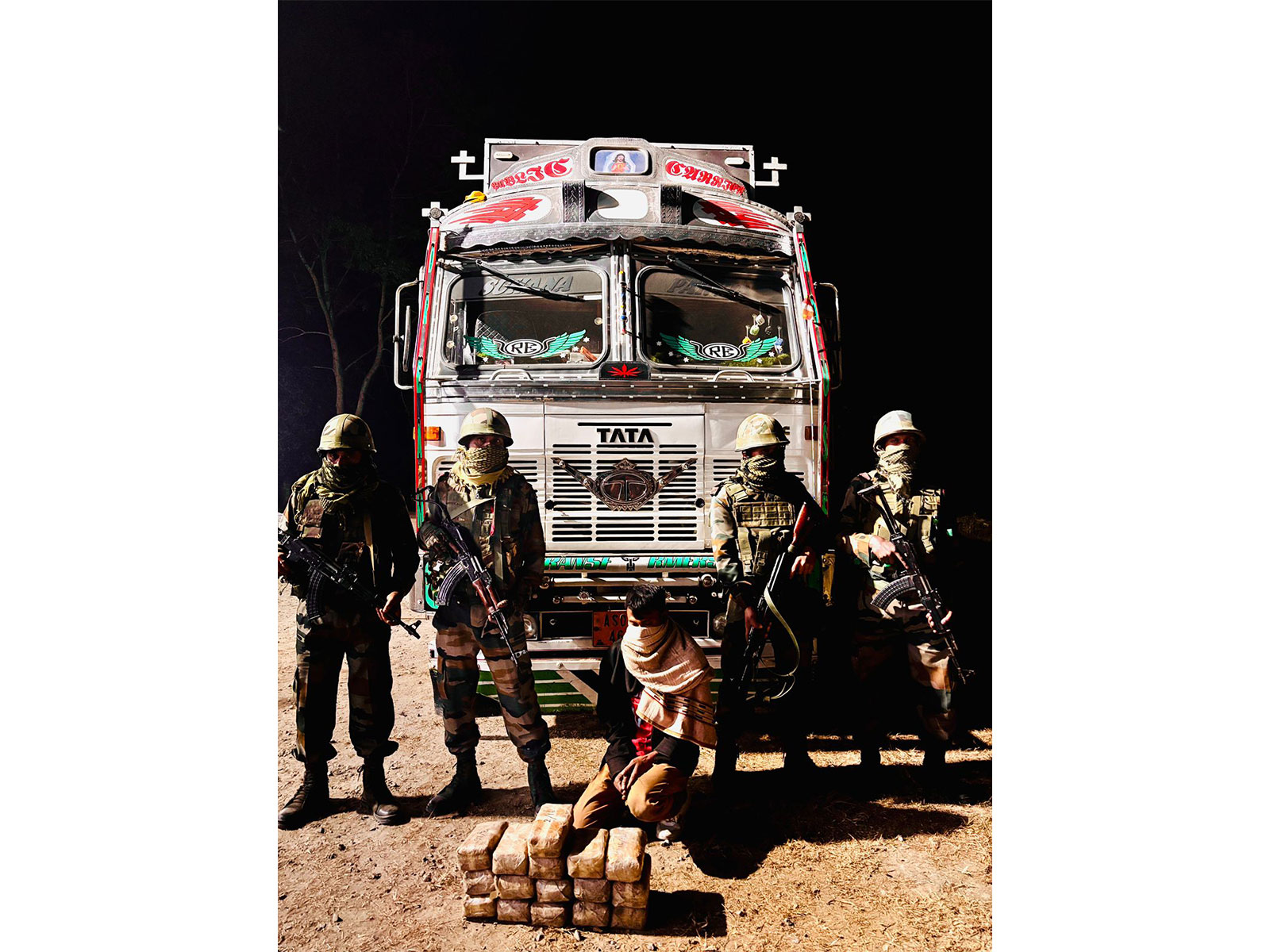

Birla underlined that IRS officers not only collect taxes but also play major roles in respecting honest taxpayers, facilitating business, preventing illegal trade and money laundering, and maintaining financial discipline.

He reiterated that the government aims to simplify and ease the taxation system so that citizens feel connected to the nation's growth and prosperity. The larger goal is to ensure transparency and accountability, and to establish a system where taxes are collected strictly in accordance with the law. Significant progress has been made in this regard in recent years, he observed.

Birla noted that modern tools such as digital tax systems, AI-based assessments, and data analytics further enhance transparency and fairness in taxation. He called upon the young OTs to contribute through their hard work, ability, and innovation.

He encouraged the OTs to undertake a deep study of taxation laws, parliamentary debates, and recent legislation to understand the letter and spirit of the law.

He expressed confidence that the batch of young IRS officers, with their dedication, capability, and technical expertise, will further strengthen India's tax administration and play an important role in the country's economic progress.

The 76th Batch of the IRS-C&IT comprises 79 OTs, including 5 from Bhutan. Women constitute 40 per cent of the batch; 32 per cent of the OTs come from rural backgrounds. The average age of the batch is 28 years, and 51 OTs have prior work experience.