Pension funds hail NPS reforms, call new framework a game-changer for sector

Oct 02, 2025

New Delhi [India], October 2 : The National Pension System (NPS) has received strong support from industry experts, who said that the reforms introduced by the Pension Fund Regulatory and Development Authority (PFRDA) are progressive and will help expand the reach of retirement savings in India.

On the occasion of NPS Diwas, which coincides with the International Day for Older Persons, the Multiple Scheme Framework (MSF) was formally launched.

Experts highlighted that the new framework gives pension funds the freedom to create their own schemes, thereby offering more flexibility and options for subscribers.

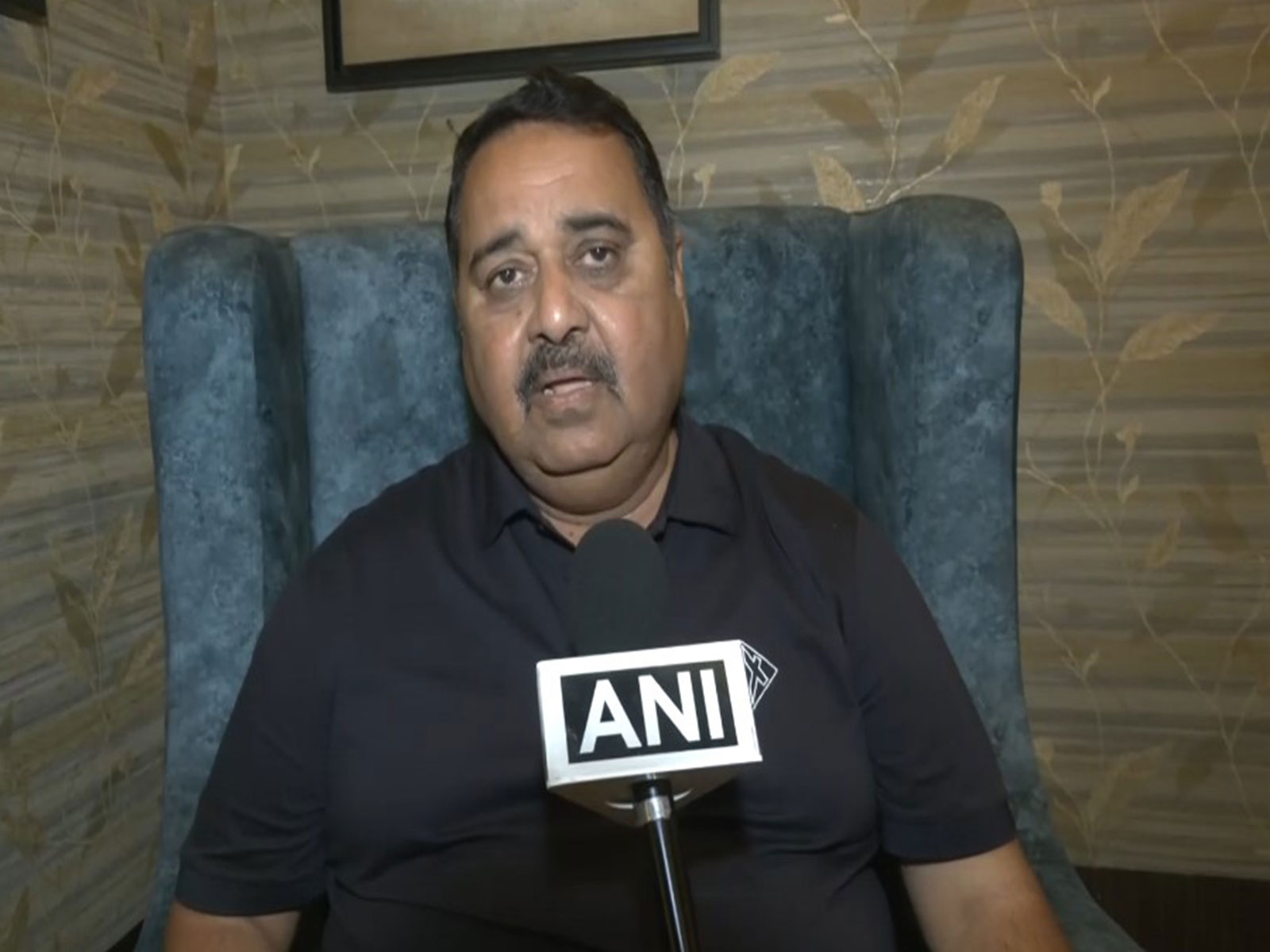

Speaking to ANI, Axis Pension Fund CEO Sumit Shukla described the day as a "big day for NPS" and underlined that the MSF scheme marks a major milestone for the sector.

"Today is NPS Diwas, and we are launching this MSF scheme, which allows all pension funds to create their own schemes. As Axis, we are also launching a new scheme for the subscriber. This is the first time pension funds have been allowed to launch a scheme. It will provide significant value to the customer," he said.

Shukla explained that the new scheme permits 100 per cent equity allocation for the first time, with a 15-year lock-in period, offering subscribers greater flexibility and long-term benefits.

"The pension industry is poised to grow significantly from here and become a much larger industry than it is today. The new products that have arrived will help us expand and attract new customers," he added.

He also noted that customisation of products for children, women, and big workers will now be possible. While praising PFRDA for "changing the landscape completely," he emphasized the need for additional tax incentives.

"If we can get 50,000 rupees as a tax benefit in the new tax regime, it will be great," he said.

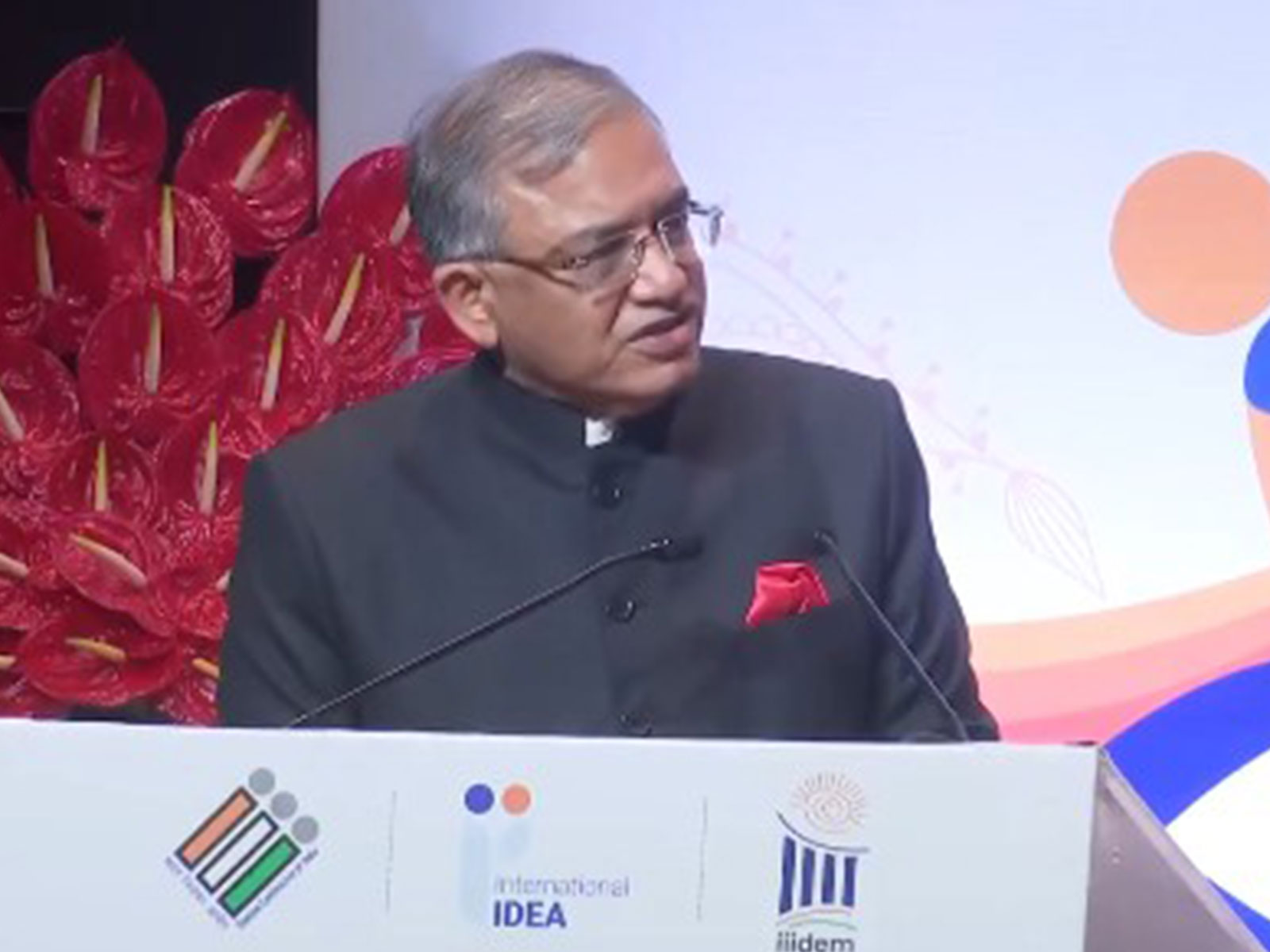

Echoing similar sentiments, HDFC Pension MD & CEO Sriram Iyer said that the launch of the Multiple Scheme Framework was a momentous development for the sector.

He stressed that the progressive steps taken by PFRDA would help expand the reach of NPS to wider segments of the population.

"HDFC Pension, as the largest private sector pension fund manager and also the largest corporate NPS point of presence, is very excited to bring about a set of schemes that will help expand the reach of NPS 2. We are focused on two broad product segments and will launch more products. We are also coming up with a product which is going to have a 100 per cent exposure to equity, best suited for individuals of the younger age group or those with a high risk appetite," he said.

Experts believe that with the new reforms, NPS is set to become a stronger and more inclusive system, offering Indians more options for a secure and happy retirement.