Policy rate cut to stimulate credit offtake, reduce borrowing costs: FICCI President

Dec 05, 2025

New Delhi [India], December 5 : Anant Goenka, President, of industry chamber FICCI welcomed the RBI's decision to reduce the repo rate by 25 basis points, asserting that this calibrated easing will help stimulate credit offtake.

The FICCI President said the reduction in the policy rate will also reduce borrowing costs for industry and consumers, and reinforce the current growth momentum.

"FICCI welcomes the RBI's decision to reduce the repo rate by 25 basis points. This calibrated easing will help stimulate credit offtake, reduce borrowing costs for industry and consumers, and reinforce the current growth momentum," Goenka said in a brief statement.

The upward revision, as announced in the policy today, of estimated GDP growth for current fiscal to 7.3% from 6.8%, combined with a stable and benign inflation outlook, reflects the continued resilience of the Indian economy and the positive impact of sustained policy and reform measures -- including the rationalisation of GST, Goenka noted.

"The additional liquidity measures announced, such as the forex swap facility, will meaningfully strengthen market confidence and support investment flows," Goenka added.

He further noted, "Today's monetary policy sends a clear and reassuring signal -- that policy instruments are being actively deployed to safeguard India's growth trajectory and support economic expansion amid a challenging global environment."

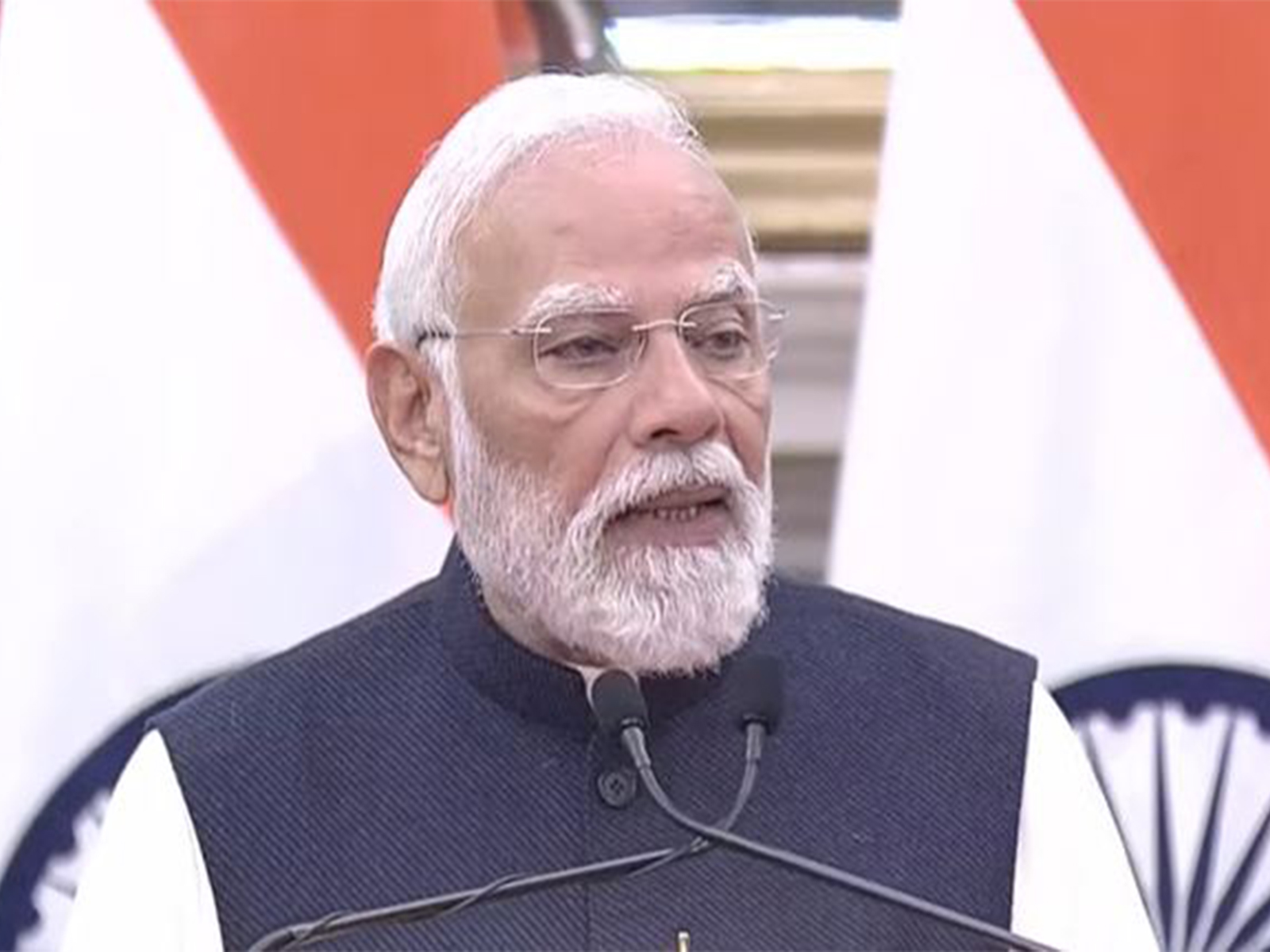

RBI Governor Sanjay Malhotra on Friday characterised India's current macroeconomic moment as a "rare goldilocks period", that currently marks high economic growth and exceptionally low inflation.

The remarks came as the Reserve Bank announced its latest monetary policy decision, cutting the repo rate by 25 basis points to 5.25 per cent, after the three-day review meeting that concluded today.

Opening his statement, Malhotra said the economy had navigated an "eventful and challenging" 2025 with resilience.

"The economy witnessed robust growth and benign inflation...We approach the new year with hope, vigour and determination to further support the economy and accelerate progress," he said.

The Governor added that inflation is likely to remain softer than earlier projected, supported by higher kharif output, healthy rabi sowing, and favourable commodity trends.

The RBI revised its CPI inflation forecast for 2025-26 to just 2.0 per cent, down from previous estimates.

Even as inflation cooled dramatically, economic growth surged.

India's real GDP expanded 8.2 per cent in Q2 2025-26, fuelled by robust consumption and aided by the GST rate rationalisation exercise of September 2025.

Taking all factors into account, the RBI raised its GDP growth projection to 7.3 per cent for the full year, up by half a percentage point.

Given the favourable growth-inflation balance, the MPC unanimously voted for a 25-bps rate cut, maintaining a neutral stance.

To aid liquidity, the RBI announced Rs 1 lakh crore of OMO purchases and a 3-year USD 5 billion buy-sell swap this month, measures that will "ensure adequate durable liquidity in the system and further facilitate monetary transmission."