Real estate investors shift focus beyond metros as tier 2 & 3 cities show strong growth: RISE Infraventures COO

Sep 14, 2025

New Delhi [India], September 14 : Real estate investors are increasingly diversifying beyond metro cities, as Tier 2 and Tier 3 hubs demonstrate strong growth potential on the back of rapid infrastructure development.

Improving connectivity, rising urban migration, and government-led initiatives are making these emerging markets more attractive for both residential and commercial investments.

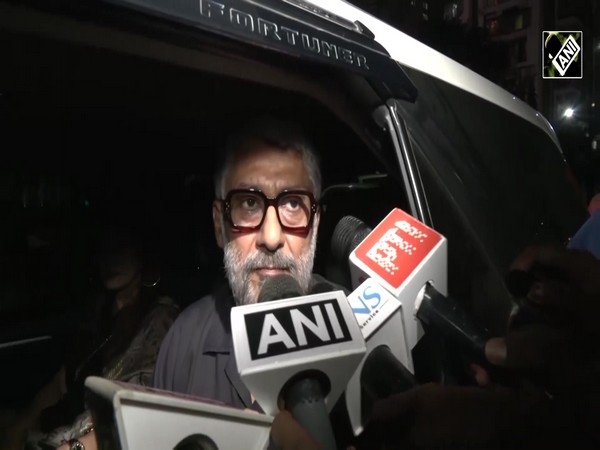

Observing current trends, Bhupindra Singh, COO of RISE Infraventures, noted that investors from Tier 1 cities are increasingly eyeing Tier 2 and 3 towns in pursuit of higher growth and potential double-digit returns.

He added that this shift reflects a growing risk appetite among investors who see strong upside in emerging real estate markets beyond the metros. However, he emphasised that "metros will continue to dominate overall investments."

The COO of RISE Infraventures, which recently announced its strategic foray into the leasing verticals, said, "Tier 2 cities are attracting growing interest from investors, largely driven by infrastructure development. This trend is expected to continue and gather momentum in the coming years."

"Tier 2 and Tier 3 cities will see increasing traction and stronger numbers. While they may still represent a smaller share compared to metros, the growth in investor activity in these cities is undeniable," he added.

Interestingly, he pointed out that investors from Tier 2 and Tier 3 cities are preferring Tier 1 markets due to the stable income, even if the returns are lower.

"So, it's essentially a function of need--Tier 1 investors seek aggressive returns, while Tier 2 and Tier 3 investors prioritize stability," he added.

Singh added that current investor-friendly policies, favourable interest rates, and an overall positive sentiment will push the sector into full flight and are expected to continue for the next 10-15 years. With its foray into the leasing segment, RISE also channel investments from UHNIs and family offices into pre-leased and income-generating assets.

India's real estate market witnessed robust performance under office demand as well as residential sales, driven by economic stability and positive market sentiment. The demand for real estate is emerging not only in tier 1 and tier 2 cities but across the country due to the expansion of metro networks, enhancements to road networks, and improvements in connectivity.

According to the Finance Ministry, housing demand in India is expected to touch 93 million units by 2036.

The Indian real estate sector has attracted nearly USD 80 billion in institutional investments over the past 15 years, since 2010, as per the latest report by Colliers-CREDAI. Foreign capital continues to dominate, contributing 57 per cent of total inflows during these years.

Interestingly, domestic capital has been emerging as a key driver post-pandemic, indicating a substantial shift in the investment landscape across asset classes.

India's real estate sector has evolved significantly, from a largely fragmented and unorganised sector in the 1990s to a more transparent and accountable growth driver today.

Over the years, its contribution to India's Gross Domestic Product (GDP) has steadily increased from less than 5 per cent before 2010 to around 6-8 per cent in recent years.

The sector contributed nearly USD 0.3 trillion in terms of value added to the Indian economy in 2025.