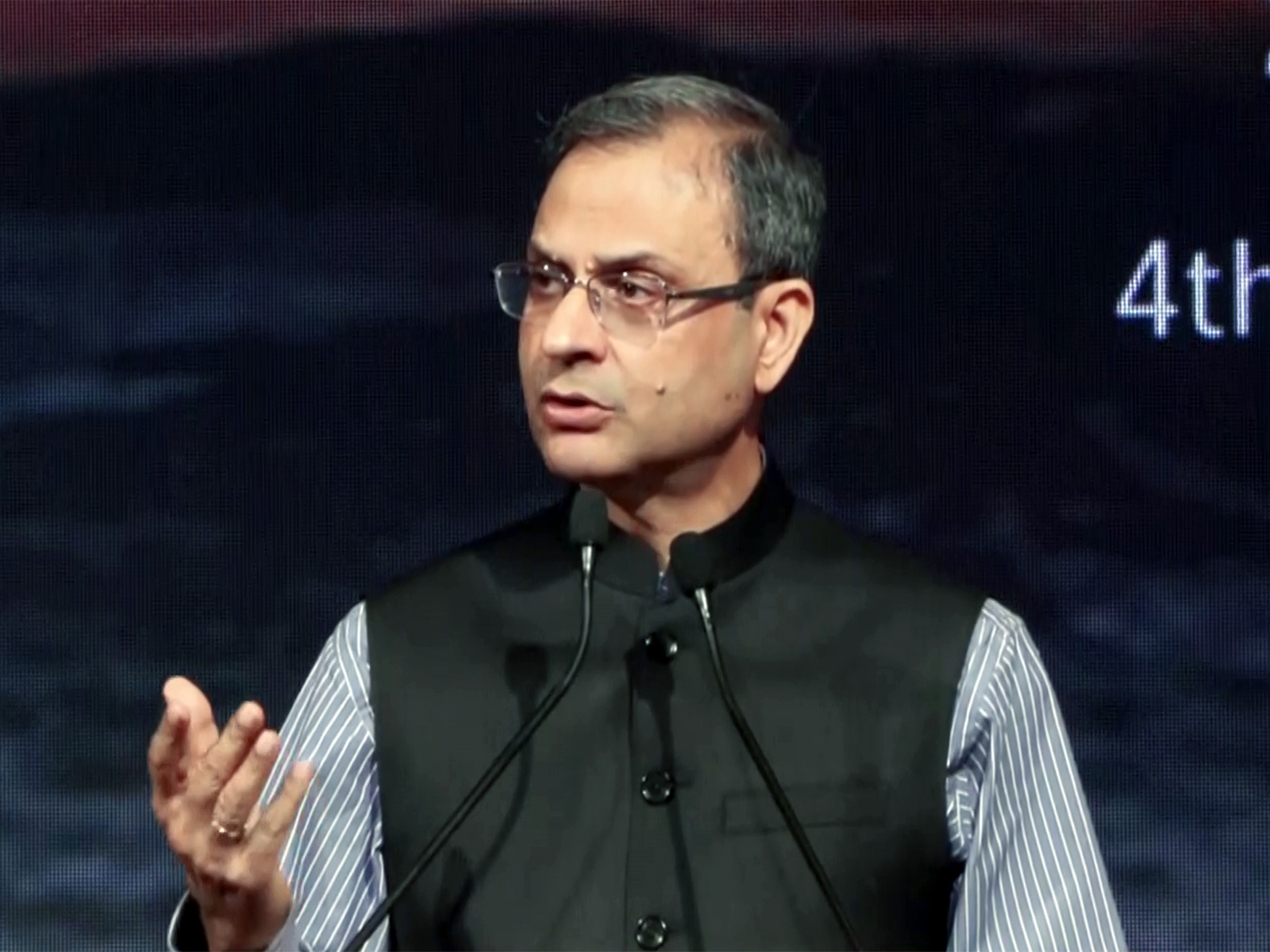

Regulation works best when banks see supervisors as partners, not inspectors: RBI Governor

Jan 09, 2026

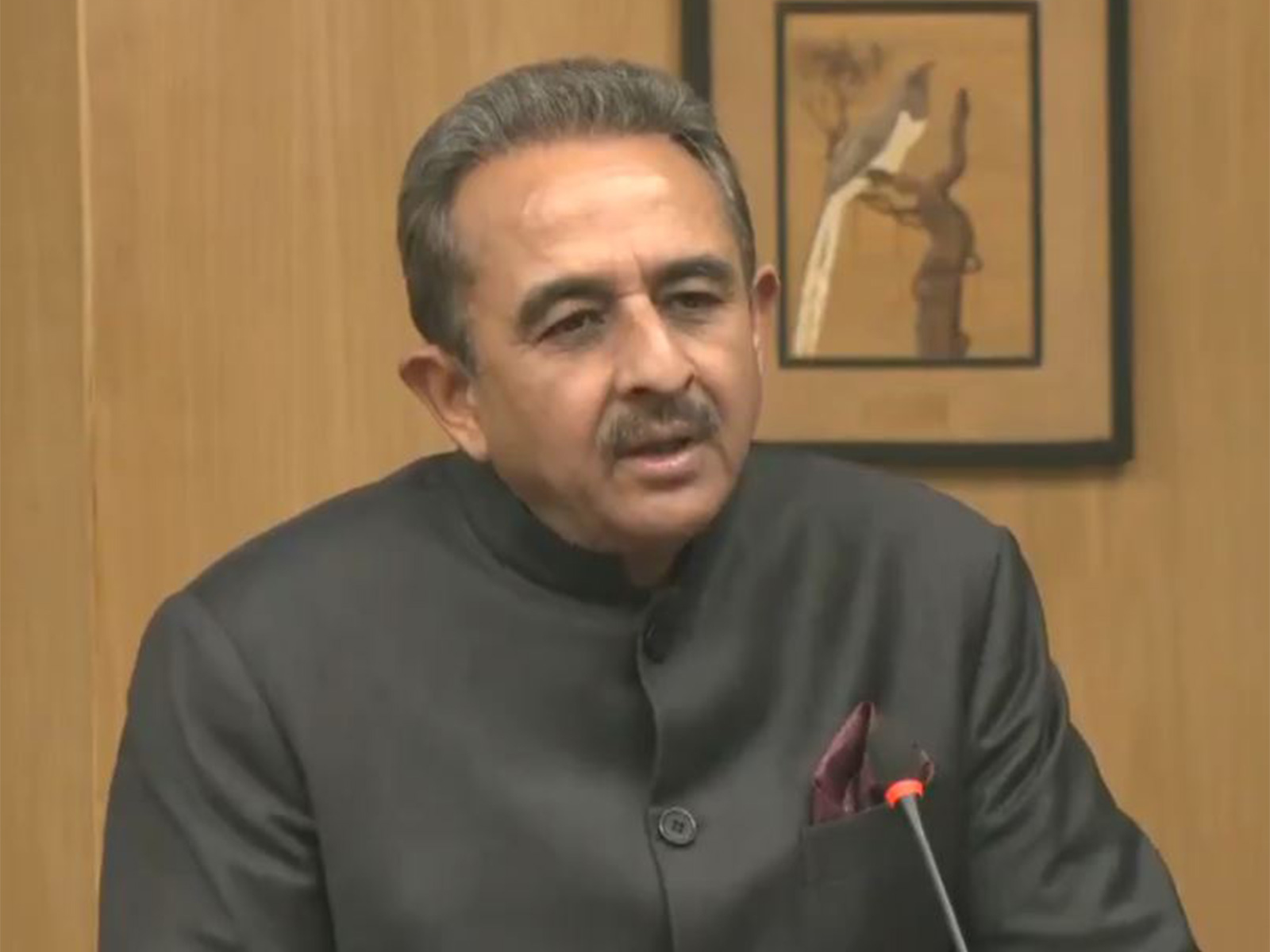

Mumbai (Maharashtra) [India], January 9 : The Reserve Bank of India (RBI) Governor on Friday said the regulation works best when banks and other regulated entities view supervisors not as fault-finding inspectors, but as partners in resilience.

While speaking at the Third Annual Global Conference of the College of Supervisors in Mumbai, Governor Malhotra said, "For a country like India, where banks play a critical role in financial intermediation and inclusive growth, this collaborative approach is not just desirable, it is essential."

Talking about the RBI's actions on banks and other regulated entities, the governor said the purpose of enforcement actions undertaken by the Reserve Bank is generally not punitive.

"The intent is largely to correct. They serve two purposes which are signal to those against whom such measures have been initiated; and make others aware of our acceptable standards of conduct and expectations," he highlighted.

He said the supervision should not only enforce existing regulations, but also help refine them by flagging regulatory gaps and inconsistencies observed during supervisory engagements.

"The amendments to the co-lending directions and lending against gold & silver jewellery last year were few recent examples," he said.

"We in RBI view our regulatory and supervisory roles vis-a-vis the regulated entities as collaborative and not adversarial. We measure our success as a regulator not only in terms of stability but also the dynamism and vibrancy in the financial sector. Similarly, for the regulated entities to succeed in the long term, stability is essential," RBI Governor said.

"Essentially, the objectives and purposes of the regulator and the regulated are the same viz. to ensure the long term growth, advancement, stability, integrity, and credibility of the financial system. The regulators and the regulated are in the same team and not opposite camps. We are partners in the nation's development. Therefore, we have to work together to strike the right balance between growth and systemic stability on the one hand and between responsible innovation and consumer protection on the other hand," he added.

The RBI Governor noted that the supervisory action and enforcement are often viewed as the most visible aspect of regulation and supervision. "It is therefore important to clarify that such actions by the Reserve Bank must be seen as part of a continuum of supervisory tools, not as a standalone response," he said.

Giving a message to the regulated entities, Governor Malhotra said they need to better understand regulatory expectations and requirements, particularly in the areas where models, partners, data, and digital delivery create new forms of risk. "They need to imbibe the essence of regulation and follow the spirit of it and not merely follow a tick-box based compliance culture."