Road construction execution declines 12% YoY; Toll sector maintains stability: ICRA

Jan 02, 2026

New Delhi [India], January 2 : India's road construction execution witnessed a 12 per cent year-on-year decline during the first seven months of Financial Year (FY) 2026, even as the outlook for the operational toll road sector remains stable. According to a recent report by ICRA, the Ministry of Road Transport and Highways (MoRTH) completed 3,468 km of road construction between April and October 2025, down from 3,920 km in the same period the previous year.

For the full fiscal year 2026, execution is expected to moderate to a range of 9,000-9,500 km. This projected figure is marginally lower than the 10,660 km achieved in FY2025, which had already seen a 14 per cent contraction from the 12,349 km recorded in FY2024.

The National Highways Authority of India (NHAI) recorded a 16 per cent drop in execution in FY2025. Despite this slowdown in construction, the operational toll road segment benefits from steady traffic and controlled inflation.

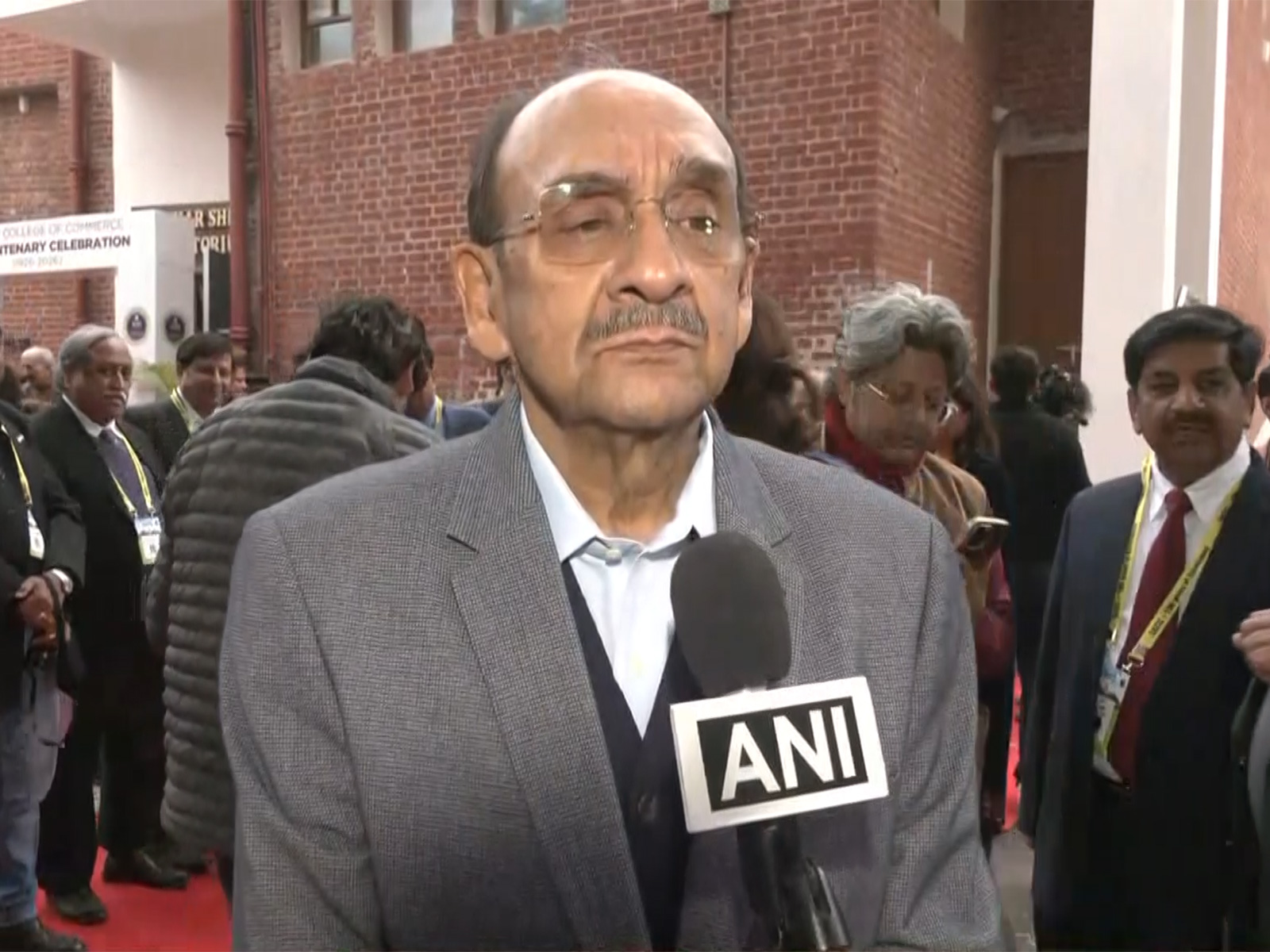

M Rajashekar Reddy, Assistant Vice President & Sector Head, ICRA Ltd, said, "The outlook on the toll road sector remains stable, paving the way for sustained growth. On the back of benign WPI inflation, the inflation-linked toll rate hike is projected at around 3.2% for newer projects and 1.6%-2.0% for older projects in FY2027."

He further added that "Resultantly, toll collection growth is expected to improve to 5-9% in FY2026e and moderate to 5-8% in FY2027p, compared to around 6% in FY2025. On the back of healthy toll collections and benign O&M costs, the debt coverage metrics for BOT toll road projects are expected to remain adequate."

The report notes that project awarding activity remains muted, which impacts future revenue visibility for construction firms. ICRA anticipates road awards to reach between 8,500-9,000 km in FY2026, slightly higher than the estimated 7,500-8,000 km in FY2025, yet still below the levels seen between FY2021 and FY2023.

A meaningful pick-up in order awards is considered vital to ease competitive intensity, which remains high despite tighter bidding norms for Hybrid Annuity Model (HAM) and Engineering, Procurement, and Construction (EPC) projects.

On the funding front, NHAI's asset monetisation surpassed the Rs 1 lakh crore milestone, reaching Rs 1,04,990 crore since inception through the end of the first nine months of FY2026. During this nine-month period, the authority raised Rs 12,357 crore via Toll-Operate-Transfer (TOT) monetisation. With additional bundles in the pipeline, total monetisation proceeds are expected to reach approximately Rs 1.3 lakh crore by the end of FY2026.

While road-focused entities face near-term challenges, ICRA maintains a stable outlook for the broader construction sector with a projected revenue growth of 8-10 per cent for FY2027. This growth is expected to be driven by players diversified into urban infrastructure, irrigation, and energy segments. However, the Construction Gross Value Added (GVA) growth is projected to moderate to 6.5-7.5 per cent in FY2026, down from 9.4 per cent in FY2025.