Rupee breaches 90-mark, but CEA says no alarm: "I am not losing my sleep over It"

Dec 03, 2025

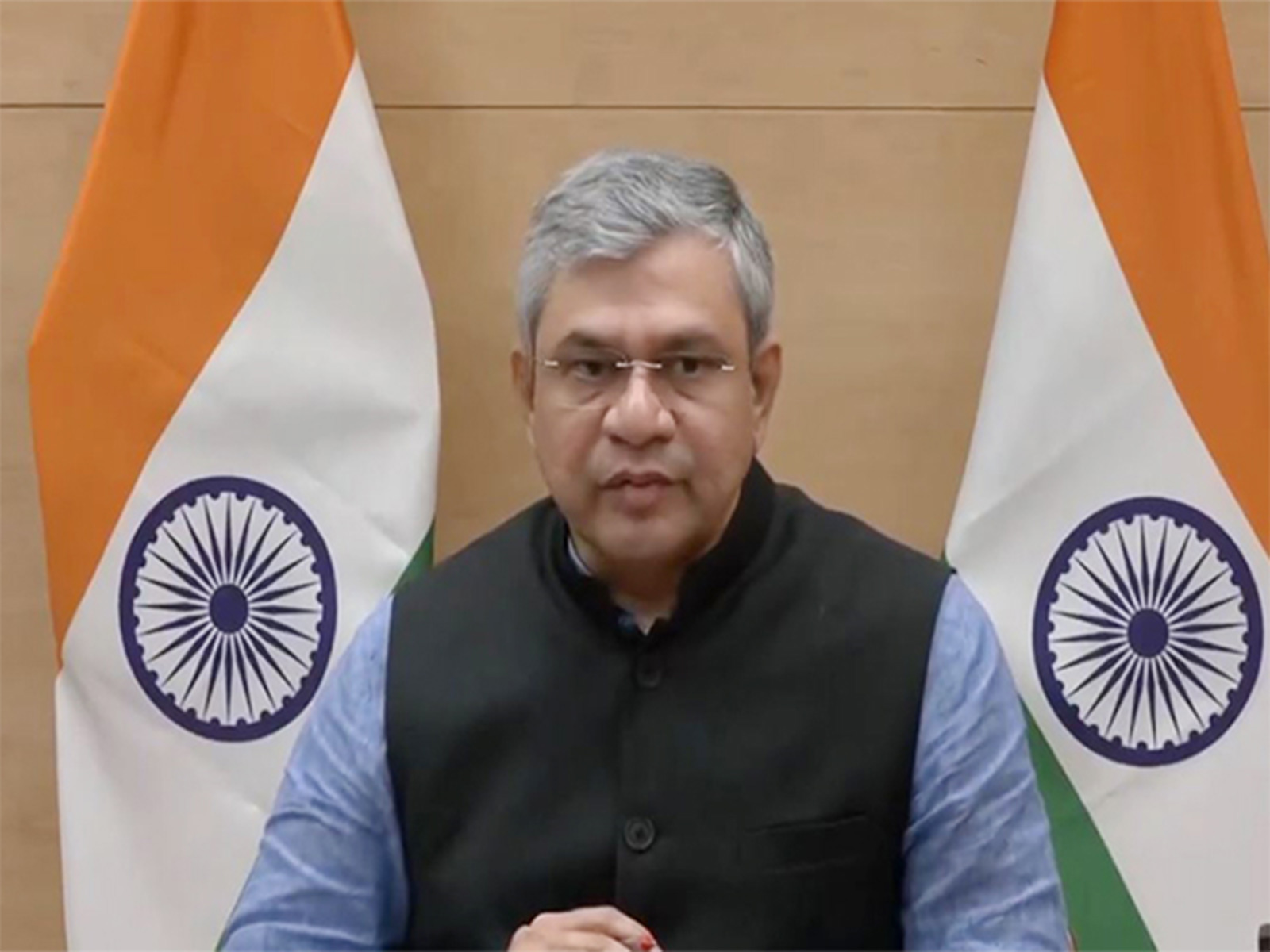

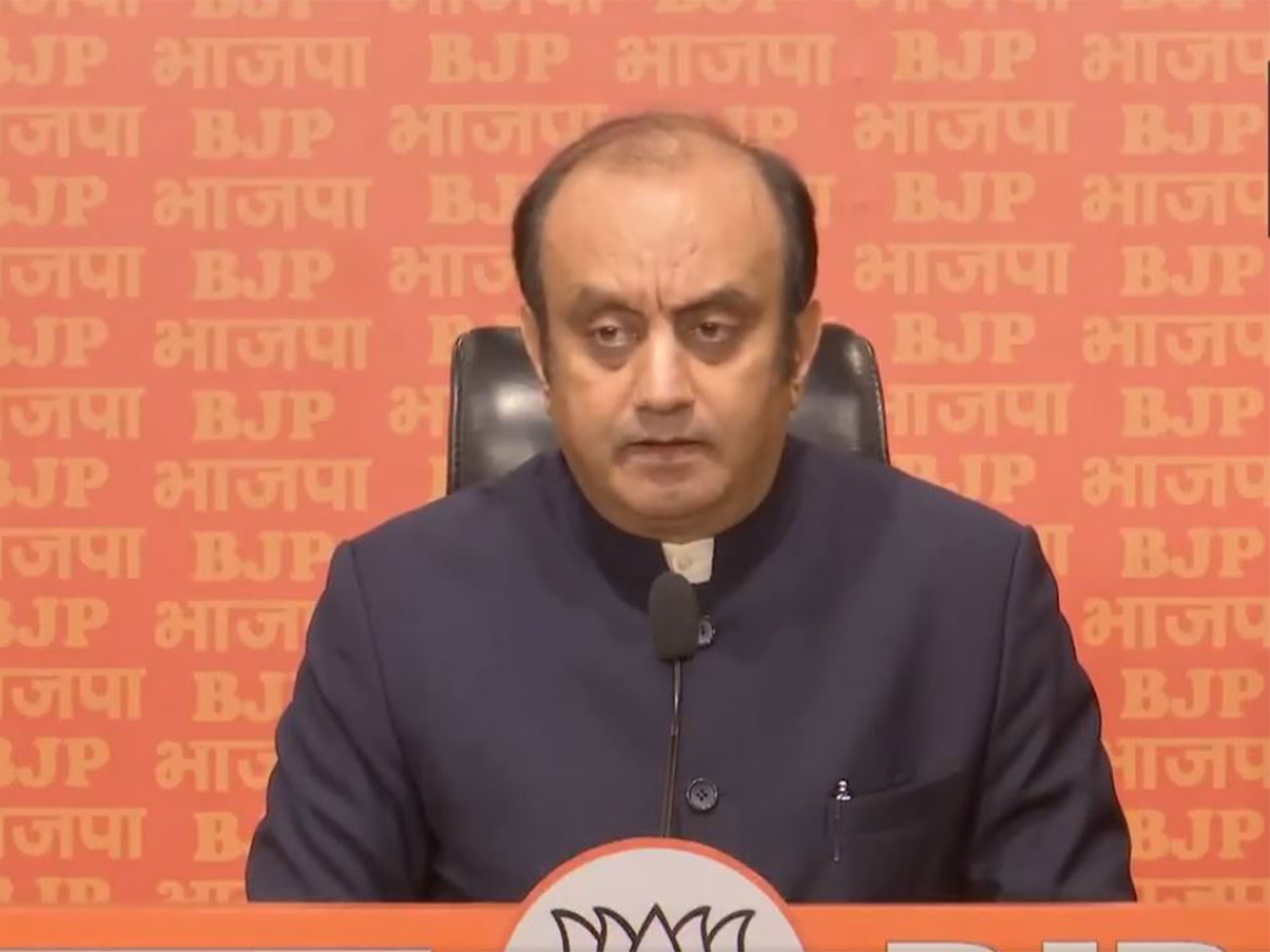

New Delhi [India] December 3 : India's Chief Economic Advisor V Anantha Nageswaran on Wednesday, downplayed concerns over the rupee weakening past 90 against the US dollar, asserting that the currency's movement remains within manageable limits and has not created macroeconomic stress.

"I am not losing my sleep over it," he told reporters on the sidelines of a CII summit, emphasising that the current level of depreciation has neither stoked inflationary pressures nor undermined India's export momentum. "Right now it's not hurting our exports or inflation," he said.

The rupee has slipped about 4-5 percent since April amid sustained dollar strength, patchy foreign inflows and steady demand for the greenback from importers. The currency opened at a fresh record low on Wednesday, weighed down by persistent equity outflows and uncertainty around the India-US trade negotiations.

Nageswaran, speaking on the sidelines of the summit in the national capital, maintained that the timing of the depreciation was not necessarily adverse for the economy. "If it (the rupee) has to depreciate now probably is the right time," he remarked. He also expressed confidence in a possible reversal in the next financial year, noting, "It will come back next year," signalling expectations of more favourable global financial conditions.

The Reserve Bank of India has allowed the currency to largely follow market dynamics, intervening only to curb excessive volatility. Policymakers have consistently underscored that the central bank does not pursue a fixed exchange-rate target.

The Monetary Policy Committee, met earlier in the day ahead of its December 5 rate decision, likely to prioritise its inflation mandate while highlighting the role of a flexible exchange rate in cushioning external shocks.

Economists note that the rupee's movement remains broadly aligned with trends across Asian currencies, many of which have come under pressure due to elevated US yields and cautious investor sentiment. India's strong growth prospects, however, have helped limit the scale of depreciation compared to some regional peers.

Nageswaran also participated in a session titled Building a Resilient Macroeconomic Framework - Fiscal Discipline, Privatisation and Statistics, where panelists discussed how shifting global headwinds are prompting countries to reinforce the foundations of macroeconomic stability.

The discussion examined the importance of prudent fiscal management, deeper privatisation efforts and robust statistical systems in sustaining long-term growth. It aimed to identify institutional reforms and policy pathways that could strengthen economic resilience and improve policy effectiveness.